- United States

- /

- Entertainment

- /

- NYSE:LYV

Live Nation (LYV): Exploring Valuation After Recent Shifts in Live Entertainment Trends

Reviewed by Simply Wall St

Live Nation Entertainment (LYV) shares have recently been reacting to shifting trends within the live music and events industry. Investors are watching how the company is navigating a changing landscape for concerts and ticket sales in the months ahead.

See our latest analysis for Live Nation Entertainment.

The recent dip in Live Nation’s 7-day and 30-day share price returns comes after a strong run since the start of the year, with total shareholder returns over one, three, and five years all standing well above the market. While there has been some short-term volatility, the long-term momentum points to persistent investor confidence and potential for further growth as the live entertainment industry continues to rebound.

If the latest industry shifts have you thinking beyond the big names, now is a great time to discover fast growing stocks with high insider ownership

With strong historical returns but some recent short-term weakness, investors now face a critical question: is Live Nation undervalued at current levels, or has the market already factored in all of the future growth potential?

Most Popular Narrative: 16% Undervalued

Live Nation Entertainment’s most widely followed valuation narrative suggests fair value sits well above the latest closing price, hinting at upside potential. This is based on analyst expectations for rapid growth and improving profitability, setting the stage for a closer look at the drivers behind this view.

Live Nation is in the early stages of expanding its presence across high-growth international markets such as Latin America (notably Mexico and Brazil) and APAC (notably Japan), leveraging surging demand for live events among younger, increasingly affluent urban populations globally. This is poised to materially drive revenue growth through increased ticket sales, new venues, and event launches.

How are analysts arriving at an above-market price target? Their thesis weaves together projections for double-digit growth, higher margins, and international momentum. All of these factors converge into a premium future earnings multiple. The full story holds some surprising numbers and bold assumptions. Curious to see them all?

Result: Fair Value of $171 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory scrutiny and stronger competition in ticketing could limit Live Nation’s pricing power or growth trajectory in the coming years.

Find out about the key risks to this Live Nation Entertainment narrative.

Another View: Market Ratios Tell a Different Story

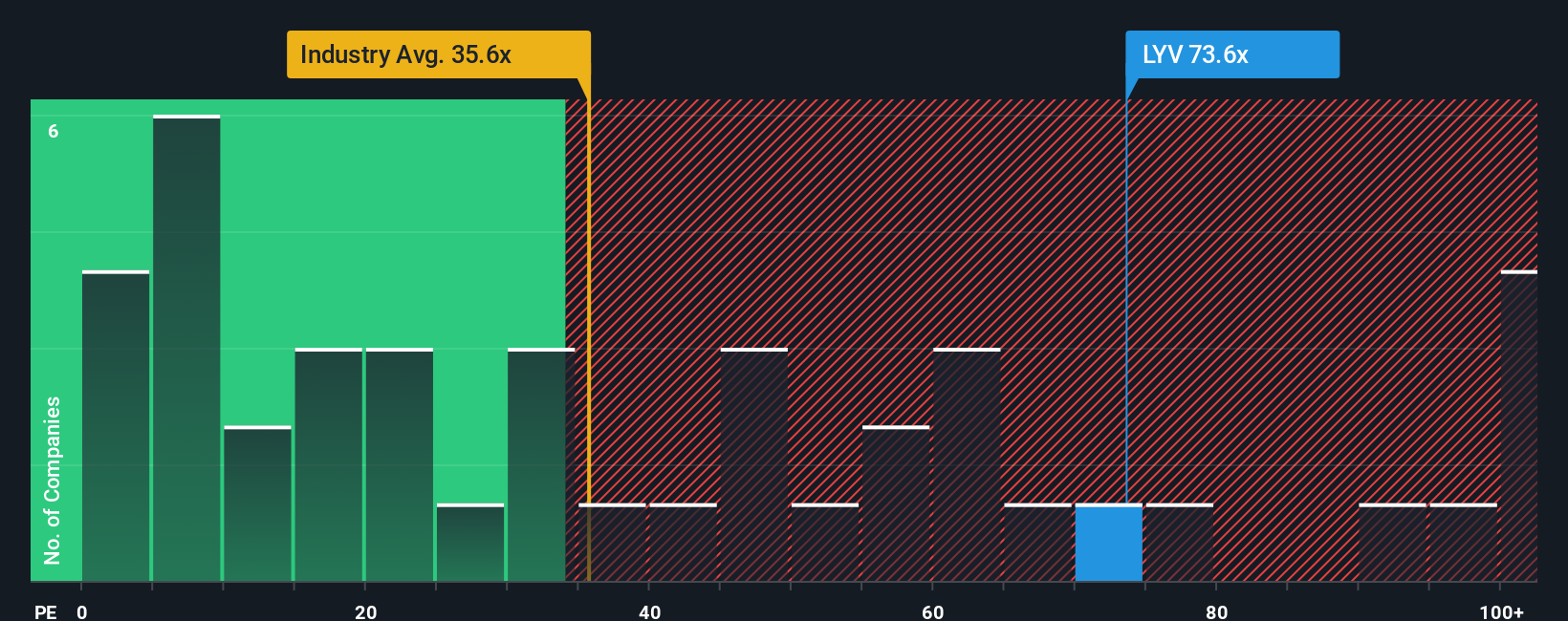

While analyst forecasts point to future upside, the company’s current market price is over 100 times earnings, which is vastly above both the US Entertainment industry average and its peer group. The fair ratio, at less than half this level, signals significant valuation risk if sentiment changes. What would justify paying such a rich premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Nation Entertainment Narrative

If you’d rather dig into the numbers yourself and challenge these conclusions, you can create a personalized take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Live Nation Entertainment.

Looking for More Smart Investment Ideas?

Give yourself an edge and stay a step ahead of the market by uncovering unique opportunities handpicked for investors ready to take action now.

- Jump on emerging trends and see which companies are harnessing artificial intelligence by checking out these 24 AI penny stocks, making waves in the industry.

- Grow your portfolio’s income potential by targeting these 16 dividend stocks with yields > 3% to lock in attractive yields above 3%.

- Tap into untapped opportunities and track these 3575 penny stocks with strong financials with powerful financials before they hit the mainstream radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives