- United States

- /

- Media

- /

- NYSE:IPG

Is Interpublic Group (IPG) Undervalued? A Fresh Look at Valuation After Recent Share Price Move

Reviewed by Simply Wall St

See our latest analysis for Interpublic Group of Companies.

While Interpublic Group of Companies has seen a mild uptick today, the bigger story is its momentum fading over the past year. The share price is down nearly 9.5% year-to-date and the 12-month total shareholder return sits at -10.4%, pointing to ongoing caution despite healthy earnings growth. Looking further back, the five-year total shareholder return of nearly 47% shows the business has proven itself long-term. However, recent trends suggest investors are waiting for a fresh catalyst before jumping back in.

If you’re rethinking your watchlist after today’s move, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading noticeably below analysts’ price targets amid solid earnings growth, the question remains: is Interpublic’s recent dip a value opportunity, or is the market already factoring in its future prospects?

Most Popular Narrative: 23% Undervalued

With Interpublic Group of Companies closing at $25.46 against a widely followed fair value of $33.20, the gap suggests significant upside remains if current forecasts play out. The market appears cautious despite healthy underlying business signals, setting up the stage for differing views on what drives IPG’s value.

The company's accelerated integration of AI and data-driven platforms (such as Interact and the new ASC for commerce) is expanding high-margin, tech-enabled service offerings and unlocking new revenue streams (e.g., SaaS fees, performance-based compensation), with adoption rates increasing across the organization. This is likely to support future revenue growth and margin expansion.

Curious what's fueling this valuation? The story centers around ambitious margin gains, bold revenue growth forecasts, and a future profitability leap that could rival leaders in digital media. Ever wondered what controversial financial assumptions have emboldened analysts to mark IPG as a hidden opportunity? Explore the full narrative and challenge your expectations.

Result: Fair Value of $33.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent organic revenue declines and execution challenges with the Omnicom merger could quickly undermine analysts’ optimistic forecasts and upside expectations for Interpublic.

Find out about the key risks to this Interpublic Group of Companies narrative.

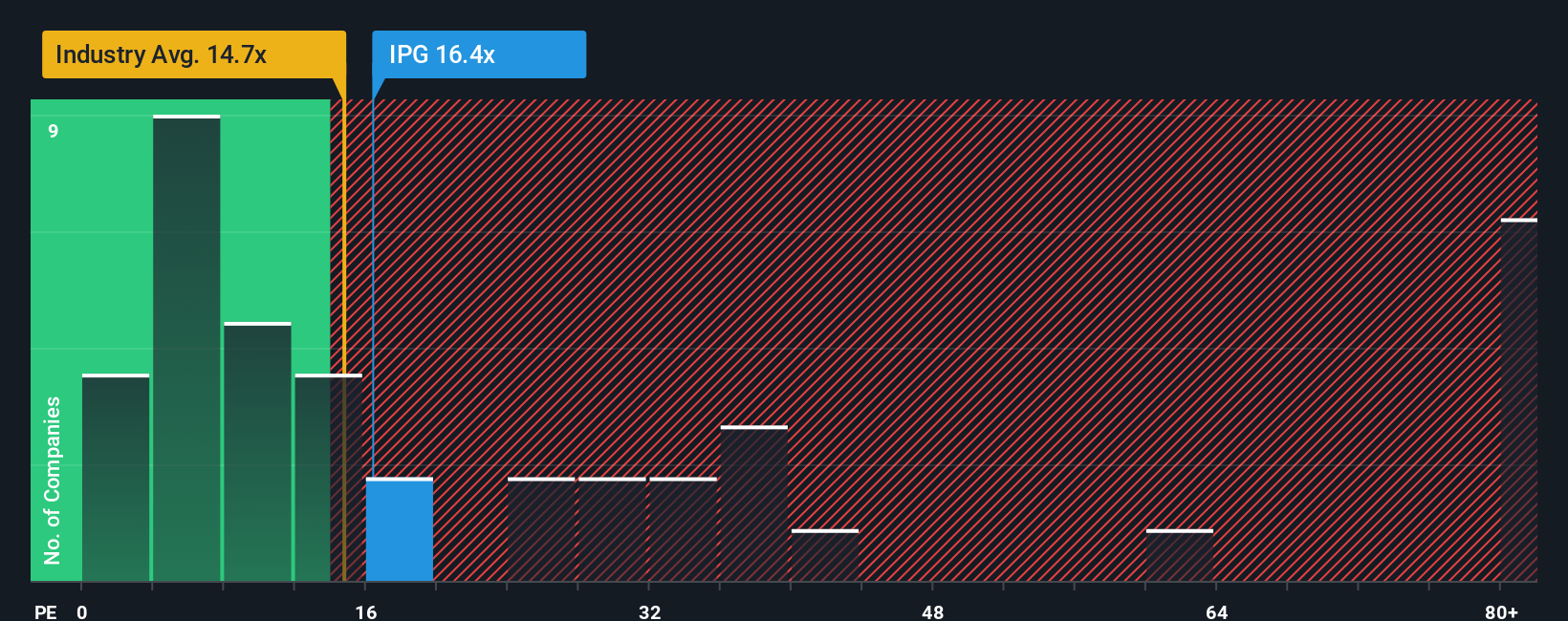

Another View: Multiples Raise Questions

While the fair value estimate highlights potential upside, the current price-to-earnings ratio of 21.1 times is higher than the US Media industry average of 16.6 times. Compared to peers, IPG actually looks attractive. However, versus the fair ratio of 21.4 times, it sits close to expectations. Does this suggest limited valuation risk, or is the upside already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Interpublic Group of Companies Narrative

If the numbers or perspectives above don't match your view, dive into the data and piece together your own story in under three minutes. Do it your way.

A great starting point for your Interpublic Group of Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on the next big market moves by targeting opportunities built for today’s economy. Don’t miss your chance to find winning investments ahead of the crowd.

- Boost your passive income potential and secure steady returns by tapping into these 16 dividend stocks with yields > 3% with above-average yields and proven reliability.

- Tap emerging market themes and enjoy exciting growth by chasing innovation leaders among these 25 AI penny stocks at the forefront of artificial intelligence.

- Capture hidden value in overlooked sectors by checking out these 877 undervalued stocks based on cash flows that are poised to rebound and may reward early investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IPG

Interpublic Group of Companies

Provides advertising and marketing services worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives