- United States

- /

- Entertainment

- /

- NYSE:IMAX

What the Recent 34% IMAX Rally and New Global Partnerships Mean for Investors in 2025

Reviewed by Bailey Pemberton

- Ever wondered if IMAX stock is actually a bargain right now or if you might be catching it after the main show? Let's break down what's really behind the numbers to help you decide if it's worth a spot in your portfolio.

- IMAX has posted an impressive 29.5% year-to-date return and is up 34.1% over the last year, even with minor dips of -0.7% in the past week and -3.5% over the past month.

- Part of this momentum has been fueled by renewed excitement around blockbuster releases and growing demand for premium cinema experiences. News of new global partnerships and expansion into additional international markets has also kept investors’ eyes fixed on IMAX’s growth story.

- When looking at valuation, IMAX scores a 3 out of 6 on our value checks, which you can learn more about here. Next, we will walk through those valuation methods in more detail. Also, we will share an even more insightful way to gauge IMAX’s true worth before you make your move.

Find out why IMAX's 34.1% return over the last year is lagging behind its peers.

Approach 1: IMAX Discounted Cash Flow (DCF) Analysis

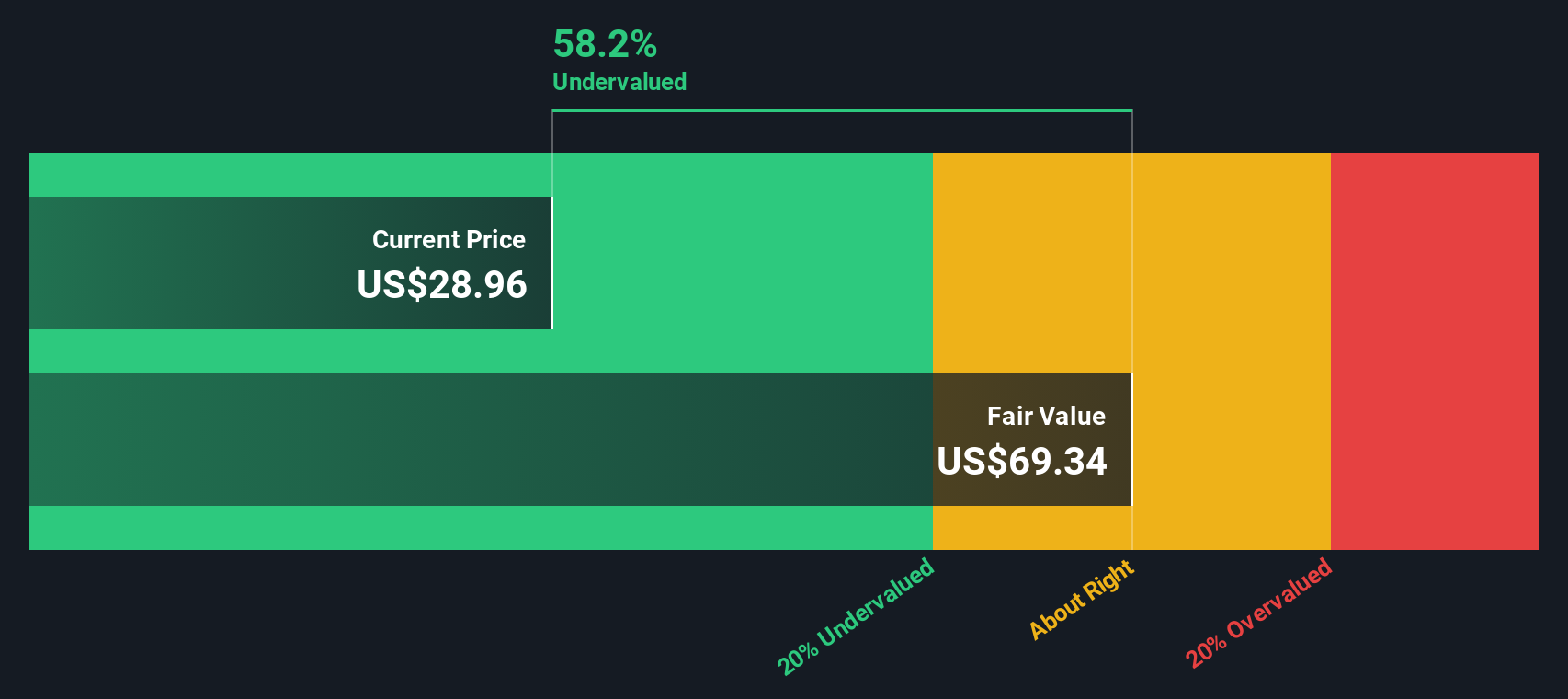

A Discounted Cash Flow (DCF) model estimates a company's total value by projecting its future cash flows and then discounting them back to today's value. This approach helps investors determine what a business is truly worth, regardless of short-term market movements.

For IMAX, recent data shows the company generated $68.9 Million in Free Cash Flow (FCF) over the last twelve months. Analyst forecasts predict steady growth in these figures, with FCF expected to reach $175.0 Million by 2029. These projections combine analyst estimates for the next five years. After this period, Simply Wall St extends the growth outlook based on recent trends and industry assumptions.

Using this method, the estimated intrinsic value of IMAX is $59.20 per share. When compared to the current share price, the DCF methodology suggests the stock is trading at a 45.0% discount to its true value. This indicates significant upside potential from current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IMAX is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: IMAX Price vs Earnings

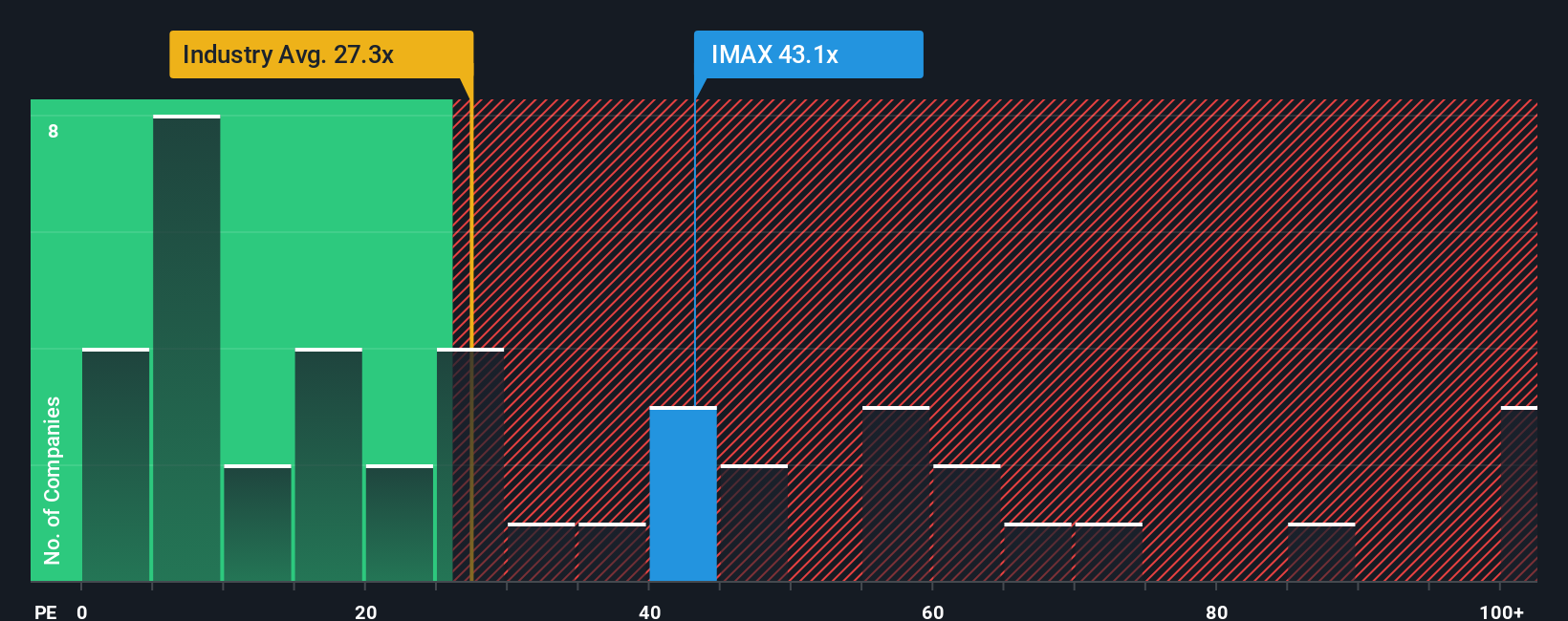

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies because it provides a quick way to gauge how much investors are willing to pay for each dollar of earnings. It is especially useful when comparing companies with consistent profitability, as it reflects both their earnings power and the market’s confidence in future growth.

Growth expectations and risk play a big role in what’s considered a “normal” or “fair” PE ratio. Higher growth companies usually command a premium, while riskier businesses may be priced more cautiously. For IMAX, the current PE ratio stands at 44x. This is higher than the Entertainment industry average of 25x and somewhat lower than the peer group average of 74x. This signals that investors have priced in a stronger earnings outlook than most competitors in the sector but are not as aggressive as the top performers.

Simply Wall St’s Fair Ratio for IMAX is 18x. This proprietary metric estimates what a reasonable PE ratio should be, taking into account the company’s earnings growth, profit margins, market cap, risks, and the industry’s characteristics. Unlike raw peer or industry comparisons, the Fair Ratio gives a more tailored perspective by weighing IMAX’s own fundamentals. Since the current PE is well above the Fair Ratio, the stock looks likely to be overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IMAX Narrative

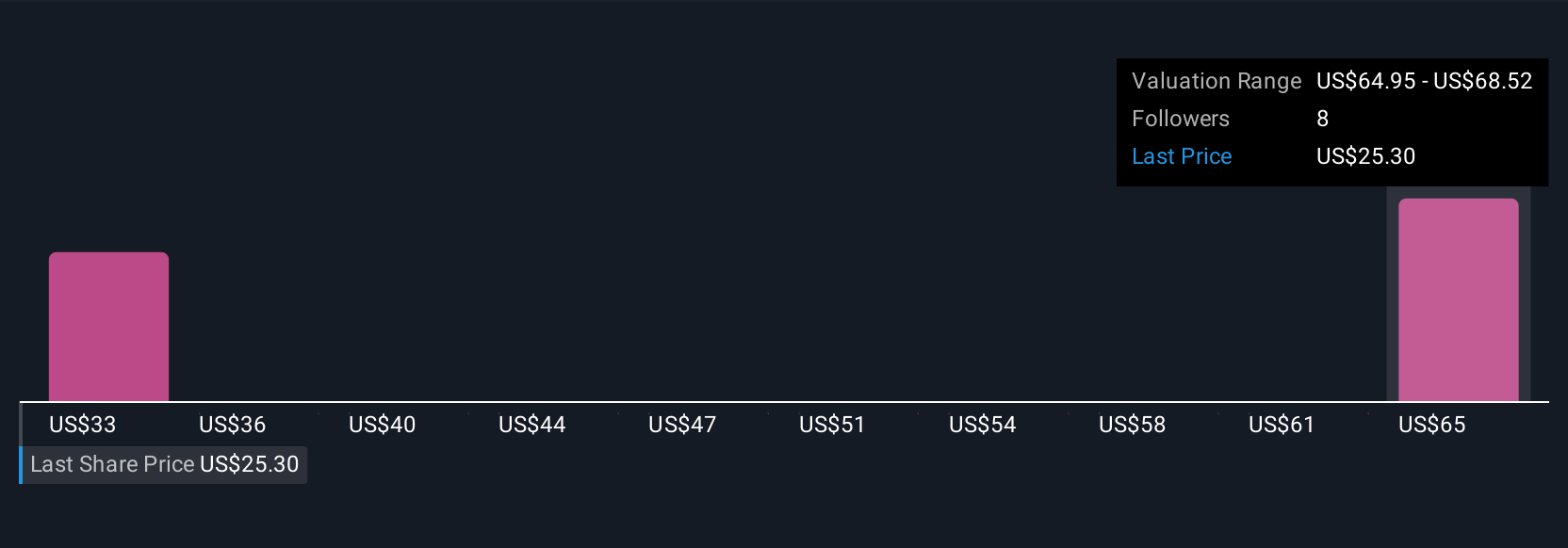

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise, personalized "story" that lets you connect your own perspective on a company, such as what you think is driving its future growth, margins, or risks, to a clear financial forecast and ultimately a fair value. Rather than just crunching numbers, Narratives help you structure your investment thesis and see exactly how your assumptions about revenue, earnings, or the industry shape what you consider to be a fair price for IMAX.

On Simply Wall St's Community page, Narratives are used by millions of investors because they are easy to create, update dynamically with new information such as news or earnings releases, and let you compare your Fair Value directly against the current share price to decide when to buy or sell. They bridge market headlines, your independent research, and traditional valuation methods, helping you act with more clarity and confidence.

For example, one IMAX Narrative assumes robust box office momentum and successful expansion, forecasting a potential upside and a Fair Value of $38.00 per share. A more cautious Narrative, wary of industry risks and shifting consumer habits, sees Fair Value closer to just $18.00 per share.

Do you think there's more to the story for IMAX? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives