- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

A Fresh Look at fuboTV (FUBO) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

fuboTV (FUBO) has seen its stock price move upward recently, leading investors to wonder what is driving the action. Over the past month, shares have gained about 5% and are tracking higher for the year.

See our latest analysis for fuboTV.

Momentum has clearly been building for fuboTV, with the share price returning over 175% so far this year and a solid 8% gain in the last three months. These moves suggest changing sentiment around the company’s growth trajectory. Factoring in both share price and dividends, the one-year total shareholder return sits at 173%. While that long-term figure is impressive, it comes after several years of challenging performance. This underscores the importance of watching how this renewed momentum plays out.

If the recent run-up in fuboTV has you thinking about fresh opportunities, it might be a great time to broaden your search and discover fast growing stocks with high insider ownership

With fuboTV’s recent rally, investors are now left to consider whether the stock remains undervalued or if these gains have already factored in all the optimism. This raises the question of whether there is still a buying opportunity.

Most Popular Narrative: 13.8% Undervalued

With fuboTV’s last close at $3.88 and the most popular narrative setting fair value at $4.50, expectations are one step ahead of the market price. The difference is attracting attention and suggests optimism surrounding fuboTV’s turnaround potential.

Improved ad technology, operational efficiency, and international expansion support margin gains and position the company for sustainable long-term profitability.

Curious what’s fueling analyst confidence? The fair value depends on key assumptions about margin recovery and long-term earnings strength. There is one crucial number in their forecast that could surprise you. Ready to see what it is?

Result: Fair Value of $4.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining subscribers and ongoing losses underline the risk that structural challenges, such as competition and content rights, could quickly dampen this bullish outlook.

Find out about the key risks to this fuboTV narrative.

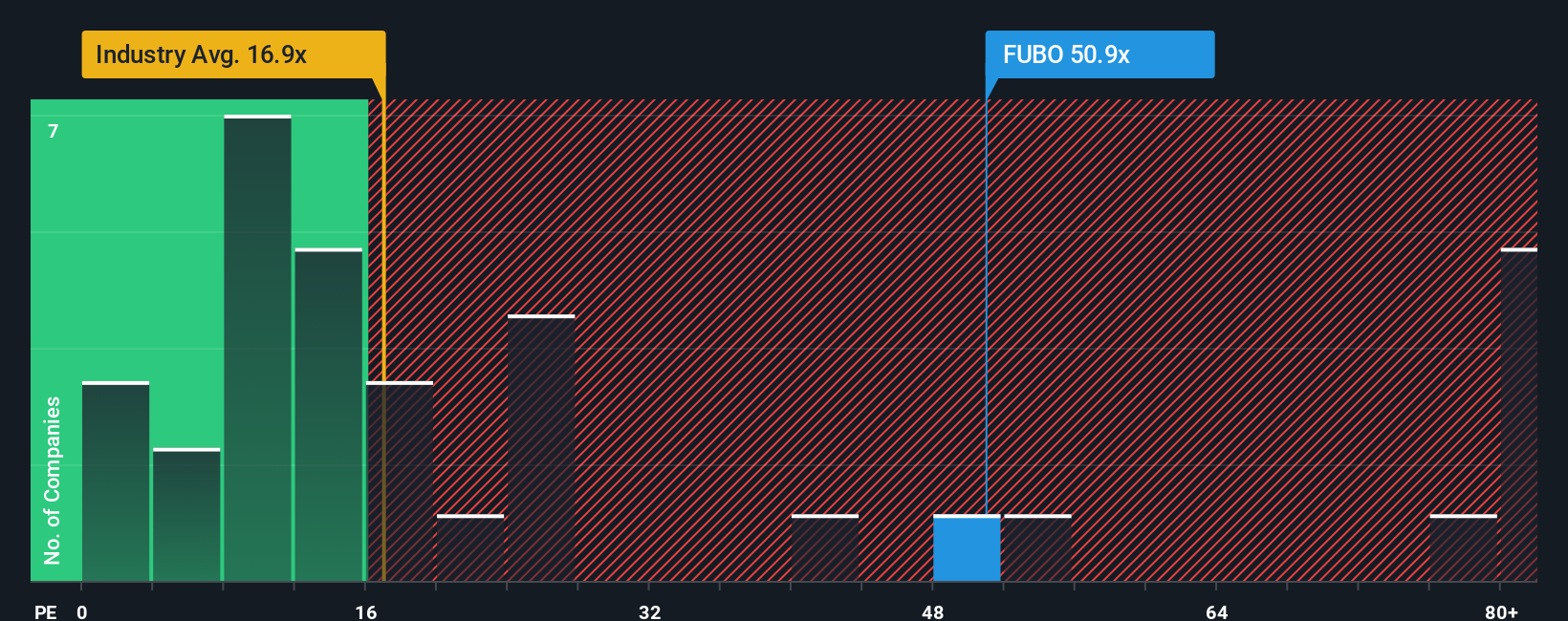

Another View: Multiples Signal Overvaluation Risk

While the fair value narrative points to fuboTV being undervalued, a closer look at how the market prices similar businesses reveals a different story. fuboTV trades at a price-to-earnings ratio of 40.7x, far higher than the industry average of 17x, and even further above the fair ratio of 5.8x that the market could revert to. This steep premium may signal higher valuation risk compared to both its peers and what fair value models suggest. Could the market be too optimistic about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own fuboTV Narrative

If you want to dig into the data and build a story that fits your own analysis, you can easily craft your own view in just a few minutes. Do it your way

A great starting point for your fuboTV research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge by branching out into fresh possibilities, guided by handpicked stock ideas designed for investors like you on Simply Wall Street.

- Boost your income potential by checking out these 16 dividend stocks with yields > 3% with especially attractive yields over 3% to fortify your portfolio.

- Capitalize on disruptive innovation by targeting these 25 AI penny stocks, accelerating the rise of artificial intelligence across industries.

- Start your search for the strongest value with these 874 undervalued stocks based on cash flows, standing out based on compelling cash flow fundamentals and upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives