- United States

- /

- Media

- /

- NYSE:EVC

Entravision (EVC) Losses Worsen, Undermining Market Optimism on Profit Turnaround

Reviewed by Simply Wall St

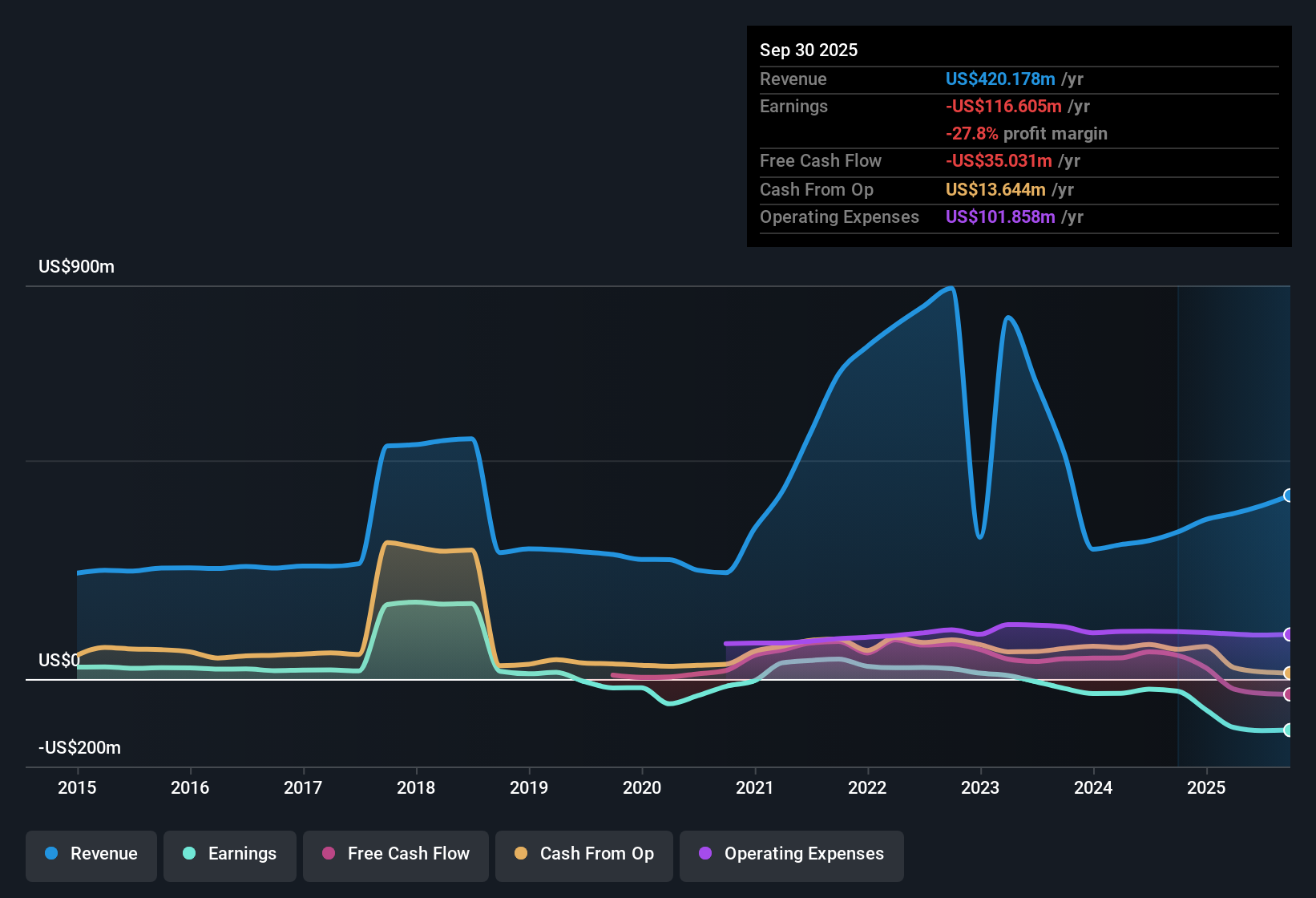

Entravision Communications (EVC) continues to struggle with profitability, posting net losses that have widened over the past five years at an annual rate of 69.7%. The company’s net profit margin shows no sign of improvement while it remains unprofitable, and recent earnings trends do not offer any evidence that profit growth has picked up. The data highlights mounting risks for investors, with high and rising losses overshadowing any potential rewards at this stage.

See our full analysis for Entravision Communications.Next, we will see how these headline results measure up against the dominant narratives shaping Entravision’s outlook. Some themes may get confirmed, while others face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Discount Signals Peer Mismatch

- Entravision trades at a Price-to-Sales ratio of 0.7x, which is below the US media industry average of 1x, but well above the closest peer average of 0.2x.

- Analysts and investors often see a below-average sector multiple as a value play. In this case, however, the stalled net profit margins and persistent unprofitability limit the argument that Entravision is overlooked or misunderstood.

- While the company sits at a discount compared to the wider media sector, the fact that it trades at a premium to peers invites questions about whether its digital and Hispanic media focus justifies higher pricing despite ongoing losses.

- Some may anticipate multiple expansion if digital growth triggers a turnaround. However, until margins recover, the valuation gap versus peers appears more a warning signal than a hidden upside.

DCF Indicates 57% Premium to Intrinsic Value

- At $2.85, Entravision’s current share price stands more than double its DCF fair value of $1.22, flagging a potential overvaluation from a discounted cash flow perspective.

- Bulls have pointed to the company’s unique demographic reach and digital push as catalysts for higher future earnings, but this premium looks difficult to justify without clear improvement in profit or cash generation.

- The recent net losses, increasing at a 69.7% annual rate, directly contradict the idea that Entravision is on the verge of deploying its audience base for turnaround-level profits.

- Until there is documented profit momentum or cash flow reversal, the share price premium raises the risk for new investors hoping for a quick rerating.

No Dividend Uplift Amid Negative Growth Outlook

- Entravision's filings cast doubt on dividend sustainability, with a persistent net loss and a negative outlook for both revenue and earnings growth overriding any potential for capital returns.

- Bears argue that, absent a turnaround in the underlying business, the combination of rising losses and sector headwinds makes any future dividend payout more a risk than a benefit.

- Ongoing lack of earnings growth, paired with an unfavorable financial position, challenges any bullish hope that dividend streams or cash returns will be restored in the near term.

- The narrative for a stable or increasing payout is not supported by the recent trends in profits and margins.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Entravision Communications's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Entravision’s widening losses, persistent unprofitability, and premium valuation compared to intrinsic value point to concerning risks for shareholders seeking returns.

If you want alternatives with better value upside and less overvaluation risk, check out these 839 undervalued stocks based on cash flows that highlight companies trading below their fair worth with healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entravision Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVC

Entravision Communications

Owns and operates television and radio stations in the United States and internationally.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives