- United States

- /

- Media

- /

- NYSE:DV

DoubleVerify Holdings (DV): Assessing Valuation as Earnings Forecasts and Analyst Sentiment Shift Ahead of Results

Reviewed by Simply Wall St

See our latest analysis for DoubleVerify Holdings.

Despite improved analyst sentiment heading into the upcoming earnings release, DoubleVerify Holdings' momentum has been mixed. After a sharp decline, its share price has stabilized near $11.38. However, the year-to-date share price return remains down 40.9%, and its one-year total shareholder return sits at -33.7%, reflecting persistent investor caution compared to its past highs.

If DoubleVerify’s recent volatility has you thinking about your next move, it might be the perfect time to expand your watchlist and discover fast growing stocks with high insider ownership

With earnings expectations shifting and sentiment improving, investors now face a key question: is DoubleVerify Holdings undervalued at these levels, or is the market already factoring in the company’s future growth potential?

Most Popular Narrative: 38.5% Undervalued

DoubleVerify Holdings' most popular narrative values the company at $18.50 per share, a significant premium to its last close of $11.38. This substantial gap is fueling debate over whether the company’s fundamentals really support such a high fair value.

Ongoing product suite innovation (for example, Media AdVantage platform, DV Authentic AdVantage, AI-driven Scibids optimization) and deepened platform integrations with major players such as Meta, Google, and The Trade Desk are resulting in higher attach rates and cross-selling. This is raising average revenue per customer and enhancing operating leverage, which is likely to positively impact net margins and EBITDA.

Want to know what’s pushing this ambitious valuation? The real intrigue lies in aggressive margin expansion, bold international growth, and a revenue mix shift. Only the full narrative reveals which financial levers fuel this outlook and why future profitability is so hotly debated.

Result: Fair Value of $18.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing platform policy changes and advertiser budget volatility remain significant risks. These factors could undermine DoubleVerify’s projected growth and profitability improvements.

Find out about the key risks to this DoubleVerify Holdings narrative.

Another View: High Valuation Signals Caution

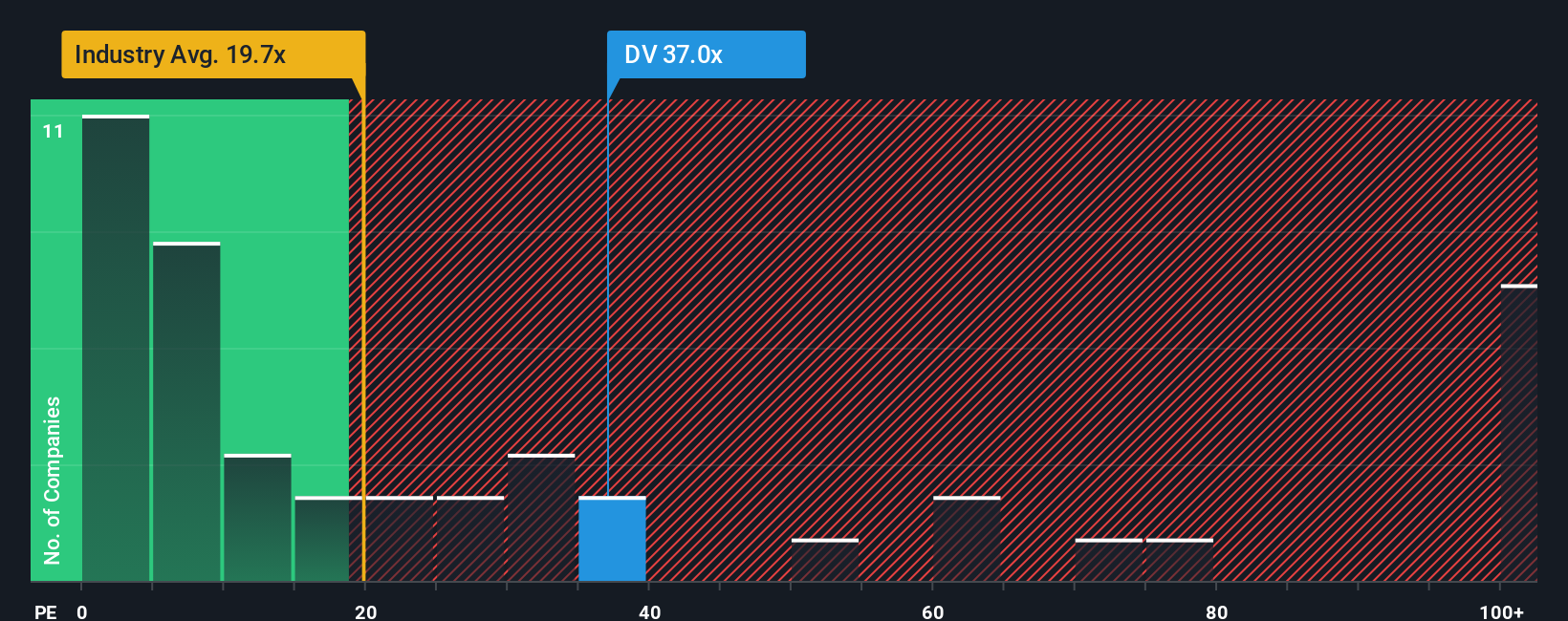

While the popular narrative pegs DoubleVerify Holdings as significantly undervalued, a look at its earnings multiple tells a different story. Shares trade at 35.3 times earnings, well above the US Media industry average of 18.9 and the fair ratio of 22.8. This premium suggests the market is already pricing in a lot of good news, which poses valuation risk if growth falls short. Are investors too optimistic, or is the upside just beginning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoubleVerify Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story in just a few minutes with Do it your way.

A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let your strategy stall on a single stock. Supercharge your watchlist with tomorrow’s opportunities by targeting themes and trends that are shaping the markets right now.

- Boost your returns with steady paychecks by checking out these 22 dividend stocks with yields > 3% yielding more than 3% from strong, income-generating companies.

- Leap ahead of mainstream trends and invest early in next-gen technology through these 28 quantum computing stocks, featuring pioneers in quantum computing innovation.

- Take advantage of market mispricing by targeting these 832 undervalued stocks based on cash flows to find promising stocks trading below their intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives