- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney (DIS) Valuation: Analyst Optimism Grows as Streaming Division Delivers Strong Earnings Momentum

Reviewed by Simply Wall St

Walt Disney (DIS) found itself in the spotlight after Bernstein SocGen Group reaffirmed a positive view on the stock. The recent earnings report presented a mixed bag of results. The real focus was on the company’s streaming division, which posted standout growth and a jump in operating income. This sparked renewed investor interest despite some headwinds elsewhere.

See our latest analysis for Walt Disney.

Disney’s share price has seen some ups and downs lately, climbing over 4% in the past week after the streaming division’s strong showing. However, short-term momentum is still muted, with a -9.7% return over the past three months and a 1-year total shareholder return of -8%. Broader worries about the entertainment business have weighed on performance, but confidence in the company’s long-term ability to generate growth remains, especially as earnings forecasts move higher and its streaming arm gains traction.

If the positive surprise from Disney’s streaming growth got your attention, you might want to widen your search and discover fast growing stocks with high insider ownership

With analyst optimism and improving forecasts driving renewed attention to Disney, the key question for investors is whether its current share price still offers value or if the market has already accounted for its growth potential.

Most Popular Narrative: 18.8% Undervalued

According to the most-followed narrative by Cashflow_Queen, Walt Disney's fair value estimate sits notably above its recent market close. This narrative spotlights the powerful tailwinds of Disney's expanding streaming business, robust Experiences division, and potential sports-driven growth. This raises the question of whether the market is keeping up with these transformative catalysts.

“The next five years are poised to be transformative. ESPN’s NFL-driven streaming dominance, streaming scaling into multibillion-dollar profits, parks and cruises expanding globally, and blockbuster releases fueling the IP machine. Disney could see sustained double-digit EPS growth and a re-rating of the stock as sports transforms from a cable anchor into a digital rocket booster.”

Want to know how bold projections around cash flow, sports streaming, and blockbuster releases feed this high valuation? Which underlying assumptions make this estimate so compelling? Dive in to uncover the logic behind the bullish fair value and see what could send Disney’s stock surging beyond what the market expects.

Result: Fair Value of $131.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating sports rights costs or heightened streaming competition could challenge ESPN’s margins and potentially disrupt Disney’s positive growth trajectory.

Find out about the key risks to this Walt Disney narrative.

Another View: What Does Our DCF Model Say?

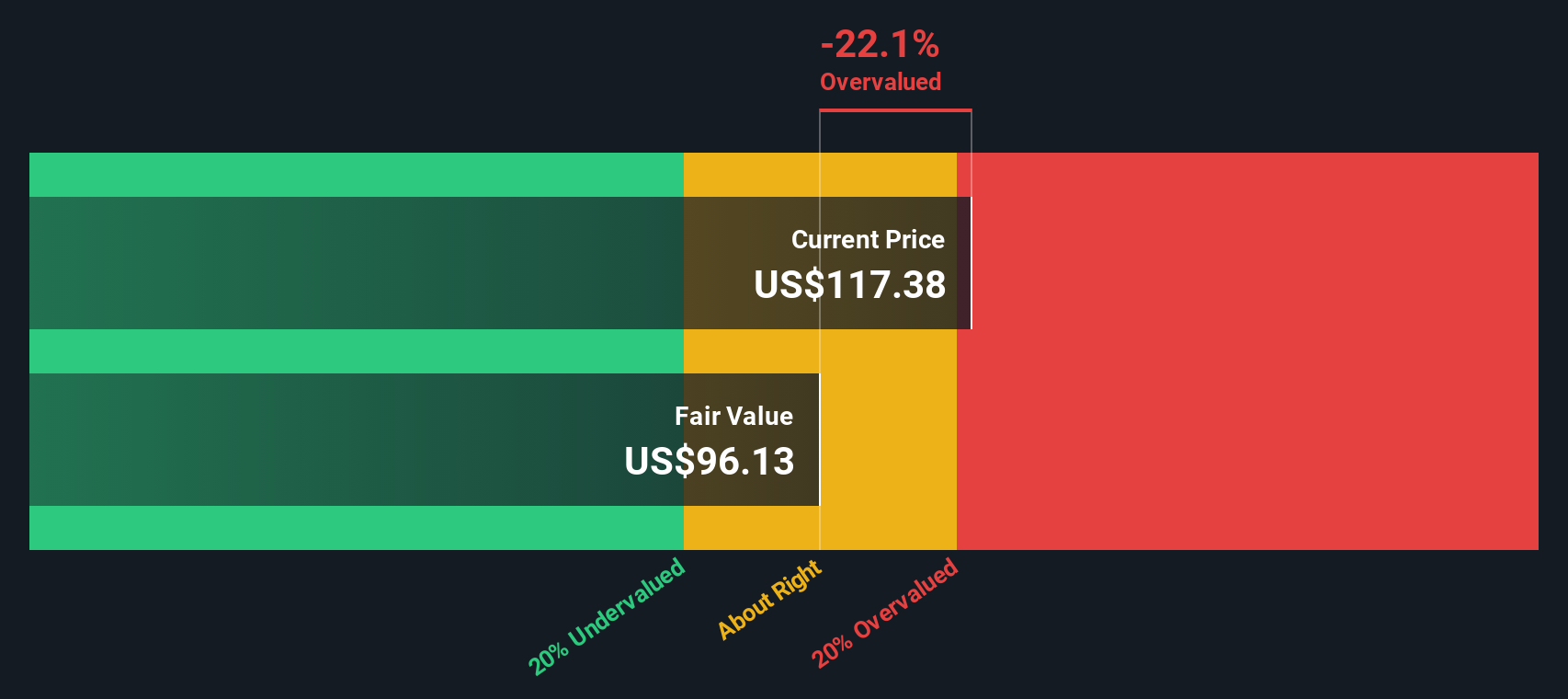

Taking a step back from narratives and multiples, the SWS DCF model suggests Walt Disney's current share price of $106.77 is just above our calculated fair value of $105.35. This means, by this method, Disney appears slightly overvalued. Does this challenge the optimism of other approaches, or does it highlight hidden risks not fully priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you want to dig deeper or build a perspective that’s all your own, you can craft your personalized Disney story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Walt Disney.

Looking for more investment ideas?

Great opportunities won't wait around. Take your portfolio up a notch by exploring proven strategies from expert-curated lists on Simply Wall Street.

- Uncover hidden potential among market newcomers by checking out these 3566 penny stocks with strong financials poised for rapid growth and strong fundamentals.

- Target steady income streams and stronger returns by reviewing these 14 dividend stocks with yields > 3% featuring impressive yields and a history of rewarding shareholders.

- Capitalize on the artificial intelligence trend and gain an edge with these 25 AI penny stocks that showcase cutting-edge innovation and rapid scalability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in Americas, Europe, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026