- United States

- /

- Entertainment

- /

- NYSE:CNK

Does Cinemark (CNK) See Shareholder Returns as the Key to Its Post-Earnings Strategy?

Reviewed by Sasha Jovanovic

- Cinemark Holdings, Inc. recently reported its third-quarter 2025 earnings, revealing a year-over-year revenue decrease to US$857.5 million and a decline in net income to US$49.5 million, while announcing a US$300 million share repurchase program and a 12.5% dividend increase.

- In partnership news, IMAX Corporation and Cinemark announced an agreement to expand premium IMAX experiences across 17 Cinemark locations, including new IMAX with Laser systems and upgrades throughout the United States and South America.

- We'll assess how Cinemark's initiation of a substantial buyback program influences its investment outlook and shareholder return profile.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cinemark Holdings Investment Narrative Recap

To be a Cinemark shareholder right now, you’d need to believe that moviegoers will keep valuing the theatrical experience amid streaming headwinds, and that premium offerings and market share gains can offset near-term box office variability. The recent quarter’s dip in revenue and profits highlights just how dependent current results remain on the pace and mix of releases; while the new IMAX expansion brings long-term opportunity, it does not fundamentally shift the near-term risk from a weaker film slate or soft attendance.

The recently announced US$300 million share repurchase program stands out, as it aims to bolster shareholder returns and mitigate dilution, but it does not materially impact the most immediate catalysts or risks tied to operating cash flow and underlying demand. Improvements in technology and dividend growth offer positives, but cost structure and reliance on strong box office continue to be areas that warrant close monitoring.

By contrast, investors should also be mindful of persistent cost inflation and how rising expenses may compress profitability if attendance lags...

Read the full narrative on Cinemark Holdings (it's free!)

Cinemark Holdings' outlook anticipates $3.7 billion in revenue and $297.4 million in earnings by 2028. This implies a 5.0% annual revenue growth rate and a $8.6 million increase in earnings from the current $288.8 million.

Uncover how Cinemark Holdings' forecasts yield a $33.91 fair value, a 19% upside to its current price.

Exploring Other Perspectives

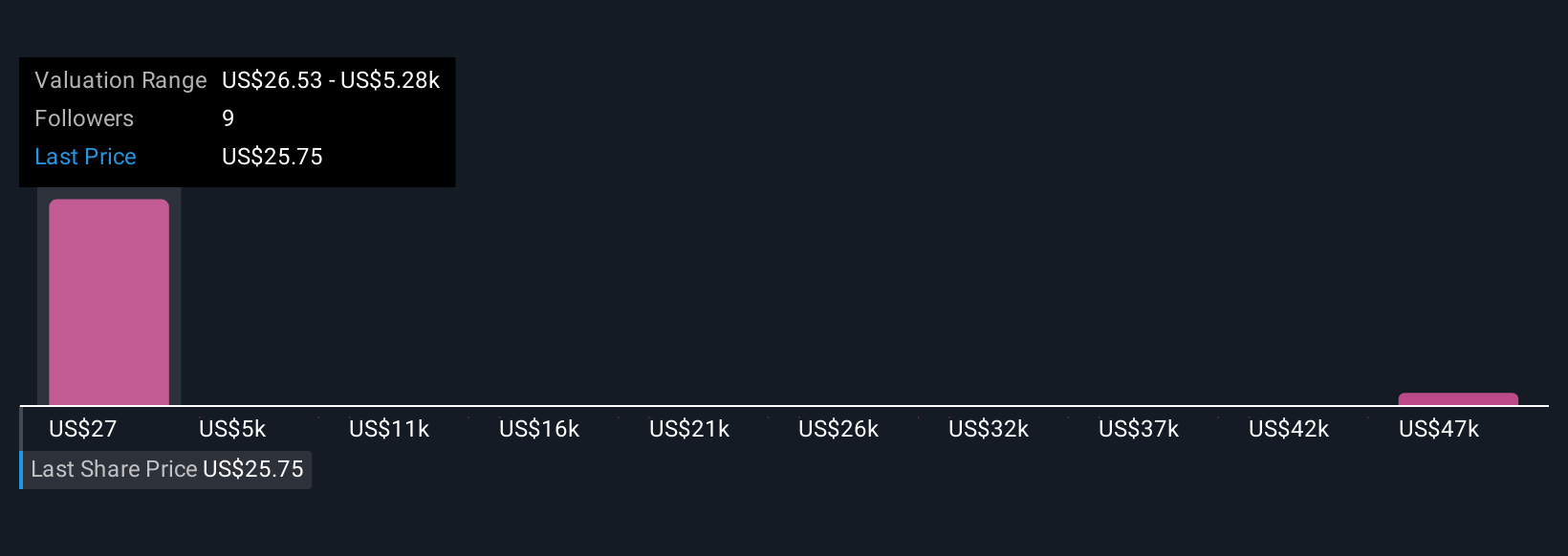

Four independent fair value estimates from the Simply Wall St Community range from US$26.53 to an outlier above US$52,600. With such wide disparities, consider how box office reliance and evolving consumer trends might shape Cinemark’s future and why opinions can differ so much on this stock.

Explore 4 other fair value estimates on Cinemark Holdings - why the stock might be a potential multi-bagger!

Build Your Own Cinemark Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cinemark Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cinemark Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cinemark Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNK

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives