- Indonesia

- /

- Basic Materials

- /

- IDX:SMGR

Exploring Three Undervalued Small Caps With Insider Actions In The Market

Reviewed by Simply Wall St

As global markets navigate through a relatively quiet phase with small-cap companies and tech stocks showing notable performance, investors are keenly watching the upcoming rebalancing of major indexes like the Russell 2000. In this context, understanding what constitutes an undervalued stock becomes crucial, especially when insider actions hint at unrecognized potential within the market's quieter segments.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cabka | NA | 0.5x | 28.02% | ★★★★★★ |

| Dundee Precious Metals | 8.3x | 2.8x | 45.28% | ★★★★★☆ |

| Tokmanni Group Oyj | 17.1x | 0.5x | 38.63% | ★★★★★☆ |

| Nexus Industrial REIT | 2.4x | 3.0x | 19.86% | ★★★★★☆ |

| THG | NA | 0.4x | 42.82% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.4x | 3.0x | 36.49% | ★★★★★☆ |

| Russel Metals | 9.0x | 0.5x | -5.67% | ★★★★☆☆ |

| Chatham Lodging Trust | NA | 1.3x | 18.79% | ★★★★☆☆ |

| Papa John's International | 19.8x | 0.7x | 36.84% | ★★★☆☆☆ |

| Freehold Royalties | 15.4x | 6.6x | 48.46% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

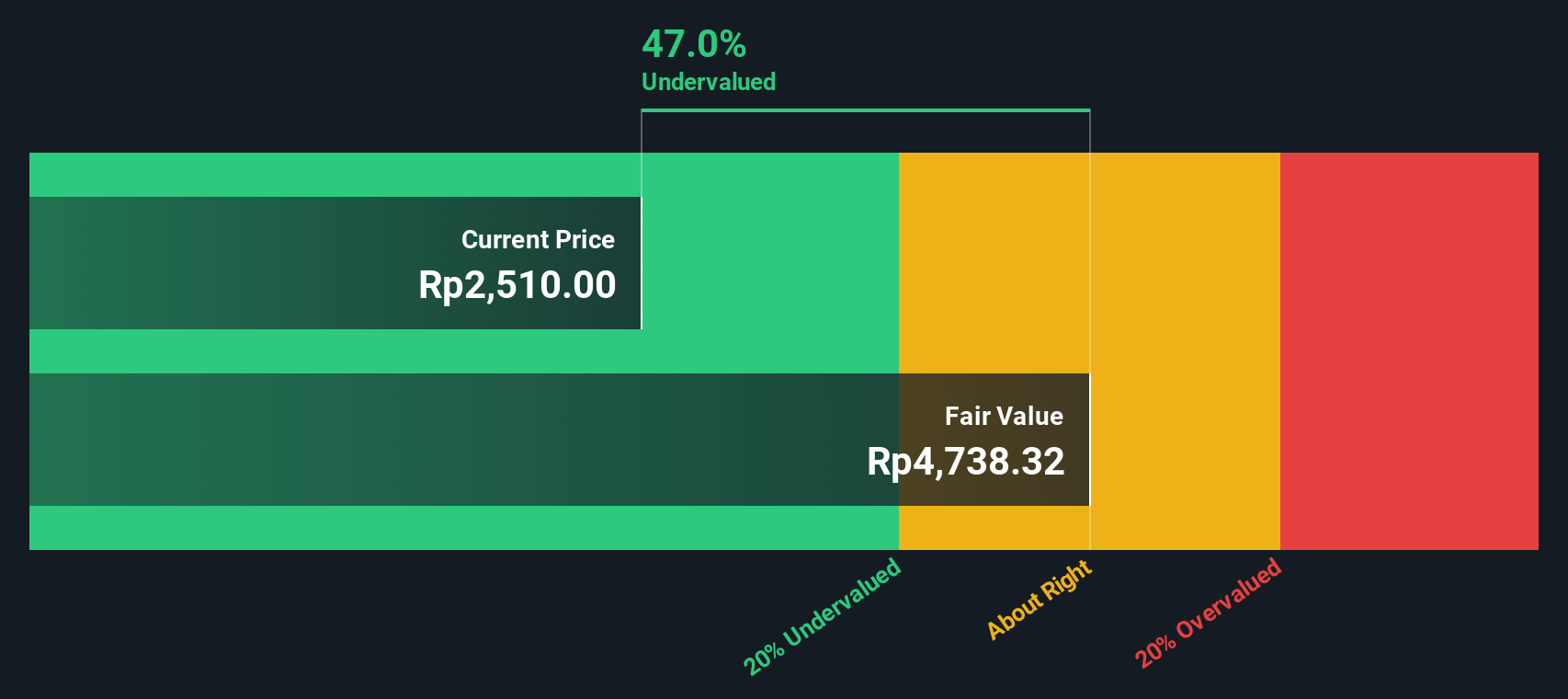

Semen Indonesia (Persero) (IDX:SMGR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Semen Indonesia is a company primarily engaged in cement and non-cement production, with a market capitalization of approximately IDR 53.24 billion.

Operations: Cement Production and Non-Cement Production are the primary revenue streams for SMGR, contributing IDR 34.11 billion and IDR 13.13 billion respectively. The company's Gross Profit Margin has shown variability over recent periods, with a notable figure of 25.72% as of the latest reporting date.

PE: 13.1x

Semen Indonesia has recently shown a dip in sales and net income as per the latest quarterly report, yet forecasts suggest a 13.5% annual growth in earnings. With all liabilities tied to external borrowing, financial structure leans towards higher risk. Insider confidence is evident from recent purchases on May 8, underscoring belief in the company's prospects despite current figures. This aligns with its presentation at an international conference, hinting at strategic positioning for recovery and growth.

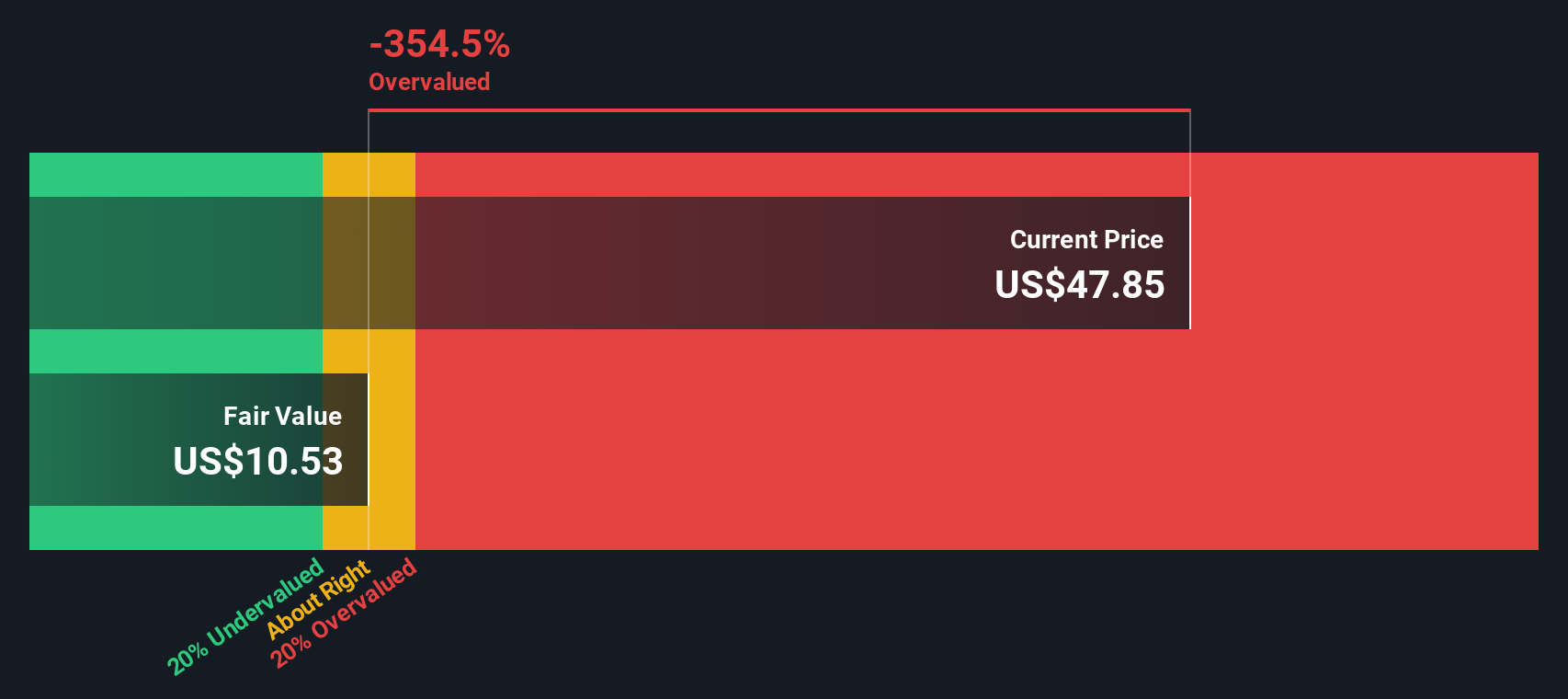

Ramaco Resources (NasdaqGS:METC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ramaco Resources is a company focused on the metals and mining sector, specifically in coal, with a market capitalization of approximately $699.84 million.

Operations: In the Metals & Mining - Coal sector, the company generated a revenue of $699.84 million, with a gross profit margin of 25.27% and net income of $56.32 million for the latest reported period. The cost of goods sold was $522.96 million, illustrating significant operational costs associated with production activities in this industry segment.

PE: 13.7x

Ramaco Resources, recently added to several Russell indexes, underscores its growth potential despite a shift in its index composition. With insider confidence demonstrated through recent share purchases, the company's commitment to strategic leadership changes and an expanded credit facility of US$275 million highlight its robust financial positioning. Despite lower profit margins year-over-year, Ramaco's proactive management and insider investments suggest a promising outlook for this evolving entity in the resource sector.

- Delve into the full analysis valuation report here for a deeper understanding of Ramaco Resources.

Examine Ramaco Resources' past performance report to understand how it has performed in the past.

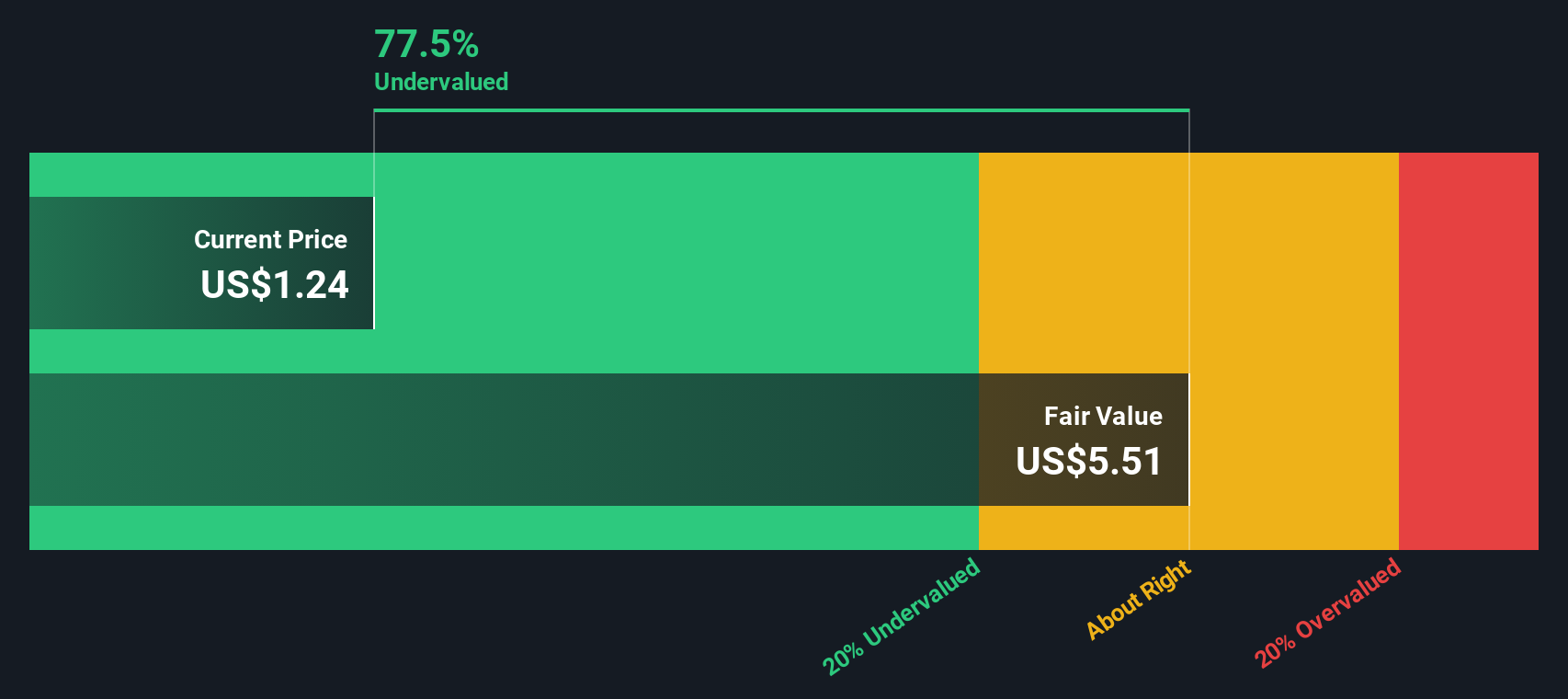

Clear Channel Outdoor Holdings (NYSE:CCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations across America and Europe, including airports, and has a market capitalization of approximately $0.54 billion.

Operations: The company generates a significant portion of its revenue from America (excluding airports), which contributed $1.11 billion, followed by Europe-north at $630.45 million, and Airports at $334.74 million. Over recent periods, the gross profit margin has shown fluctuations, with a notable figure of 47.43% in March 2016 and a decrease to 32.12% by March 2021, illustrating variability in profitability relative to sales over time.

PE: -4.9x

Recently, Clear Channel Outdoor Holdings demonstrated insider confidence with significant share purchases, signaling strong belief in the company's prospects despite its current unprofitability and reliance on higher-risk funding sources. Added to multiple Russell indexes on July 1, 2024, they highlight a growing recognition within the investment community. With first-quarter sales rising to US$481.75 million from US$437.42 million year-over-year but facing a widened net loss of US$89.67 million, their financial path showcases challenges yet potential for growth as projected revenues for 2024 are expected between US$2.2 billion and US$2.26 billion.

Summing It All Up

- Take a closer look at our Undervalued Small Caps With Insider Buying list of 227 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:SMGR

Semen Indonesia (Persero)

Manufactures, packs, and distributes cement in Indonesia and internationally.

Excellent balance sheet, good value and pays a dividend.