- United States

- /

- Entertainment

- /

- NYSE:AMC

How Investors Are Reacting To AMC (AMC) Launching Popcorn Pass for Loyalty Members Across All Locations

Reviewed by Sasha Jovanovic

- On November 25, 2025, AMC Theatres® announced the launch of the AMC Popcorn Pass, an annual $29.99+tax benefit available to AMC Stubs members, offering 50% off a large AMC Perfectly Popcorn every day at U.S. AMC locations beginning December 1, 2025.

- This initiative replaces the AMC Annual Bucket and extends popcorn discounts to all AMC locations, adding a fresh value proposition to the theater experience for loyalty members.

- We'll examine how the AMC Popcorn Pass, aimed at boosting in-theater spending, may influence AMC's investment outlook and growth plans.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

AMC Entertainment Holdings Investment Narrative Recap

To be an AMC Entertainment shareholder today, you need confidence that moviegoing demand will rebound meaningfully and support premium pricing strategies, despite continued industry headwinds. The new AMC Popcorn Pass offers incremental value to loyalty members and could modestly aid in-theater spending, but is unlikely to meaningfully affect the primary near-term catalysts, such as blockbuster releases, or outweigh big-picture concerns around box office recovery and persistent structural risks.

Of the recent announcements, the summer launch of XL at AMC auditoriums, bringing wall-to-wall screens and enhanced projection technology, aligns most closely with the major catalyst for AMC: attracting audiences through improved premium experiences that drive both admissions and food and beverage revenue. This investment in cinematic upgrades directly targets higher-margin attendance growth, which is crucial given the focus on out-of-home entertainment that can't be replicated with streaming services.

But, it's important to keep in mind that while these enhancements may strengthen AMC's value proposition, investors should also be aware of the risk posed if moviegoing habits...

Read the full narrative on AMC Entertainment Holdings (it's free!)

AMC Entertainment Holdings' narrative projects $5.7 billion in revenue and $541.4 million in earnings by 2028. This requires 5.3% yearly revenue growth and a $904.5 million increase in earnings from the current level of -$363.1 million.

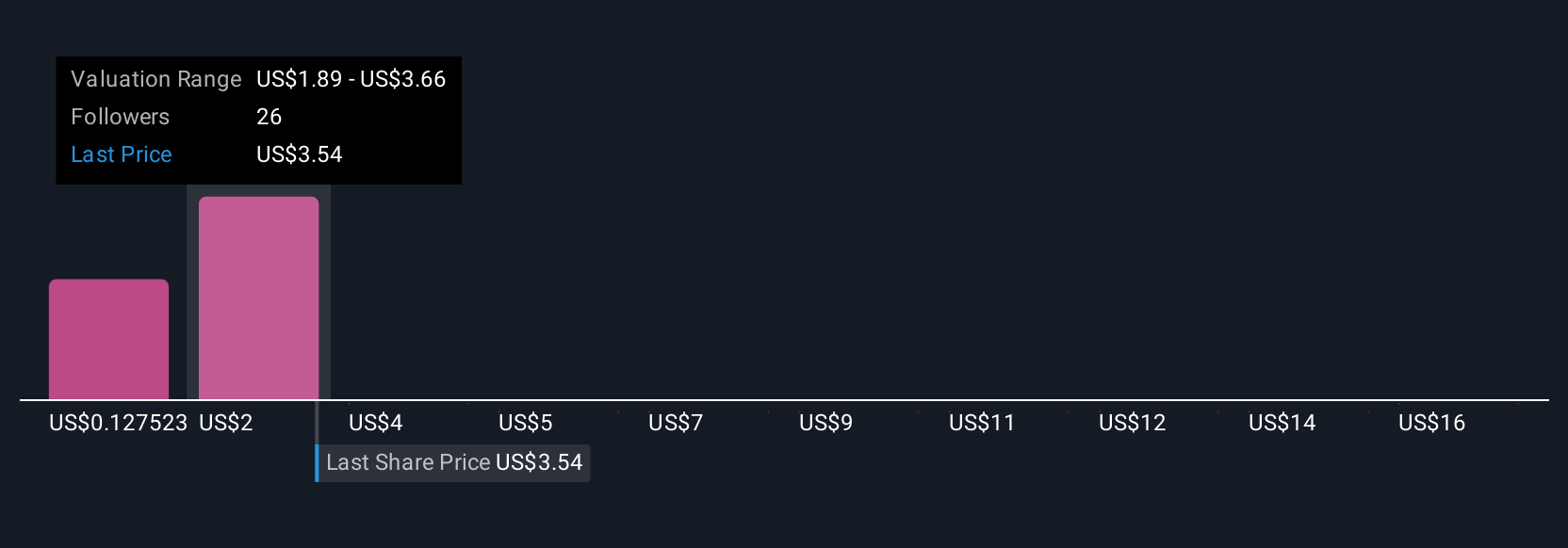

Uncover how AMC Entertainment Holdings' forecasts yield a $3.34 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community assessed a wide fair value range for AMC, with estimates spanning US$3.21 to US$33.23 per share. Given persistent weakness in movie theater attendance, these viewpoints signal just how differently you can weigh AMC's opportunities and risks.

Explore 7 other fair value estimates on AMC Entertainment Holdings - why the stock might be a potential multi-bagger!

Build Your Own AMC Entertainment Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMC Entertainment Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free AMC Entertainment Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMC Entertainment Holdings' overall financial health at a glance.

No Opportunity In AMC Entertainment Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMC

AMC Entertainment Holdings

Through its subsidiaries, engages in the theatrical exhibition business in the United States and Europe.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success