- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:ZD

Is Ziff Davis’s Exploration of Strategic Alternatives Reshaping the Investment Case for ZD?

Reviewed by Sasha Jovanovic

- In November and December 2025, Ziff Davis announced its participation in several major investor conferences and revealed that it is exploring value-creating opportunities, including possible divestitures or a sale in response to a perceived disconnect between intrinsic value and current share price.

- This news also highlighted strong growth in the company’s health and wellness segment and a focus on integrating AI technologies to enhance its digital platform and advertising capabilities.

- We'll now examine how Ziff Davis's exploration of strategic alternatives could reshape core assumptions in its investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ziff Davis Investment Narrative Recap

The core thesis for holding Ziff Davis centers on belief in its ability to create value through a mix of organic growth, operational improvements, and disciplined portfolio management. The recent announcement that the company is exploring value-creating opportunities, including potential divestitures or a sale, is important, but for now does not materially change the company's immediate catalyst, improved digital platform performance, or its key risk: ongoing reliance on acquisitions to sustain long-term growth and margins.

Among the recent news items, Ziff Davis’s active participation in upcoming technology and AI investor conferences stands out as the most relevant. These appearances place strong emphasis on its push toward integrating AI technology into digital products and ad solutions, which is essential as the company seeks to offset structural advertising headwinds and diversify revenue streams beyond M&A-fueled expansion.

On the other hand, investors should be aware that heavy dependence on acquisitions leaves Ziff Davis exposed if...

Read the full narrative on Ziff Davis (it's free!)

Ziff Davis' outlook projects $1.6 billion in revenue and $235.9 million in earnings by 2028. This scenario assumes a 3.9% annual revenue growth rate and a $169.8 million earnings increase from current earnings of $66.1 million.

Uncover how Ziff Davis' forecasts yield a $43.14 fair value, a 36% upside to its current price.

Exploring Other Perspectives

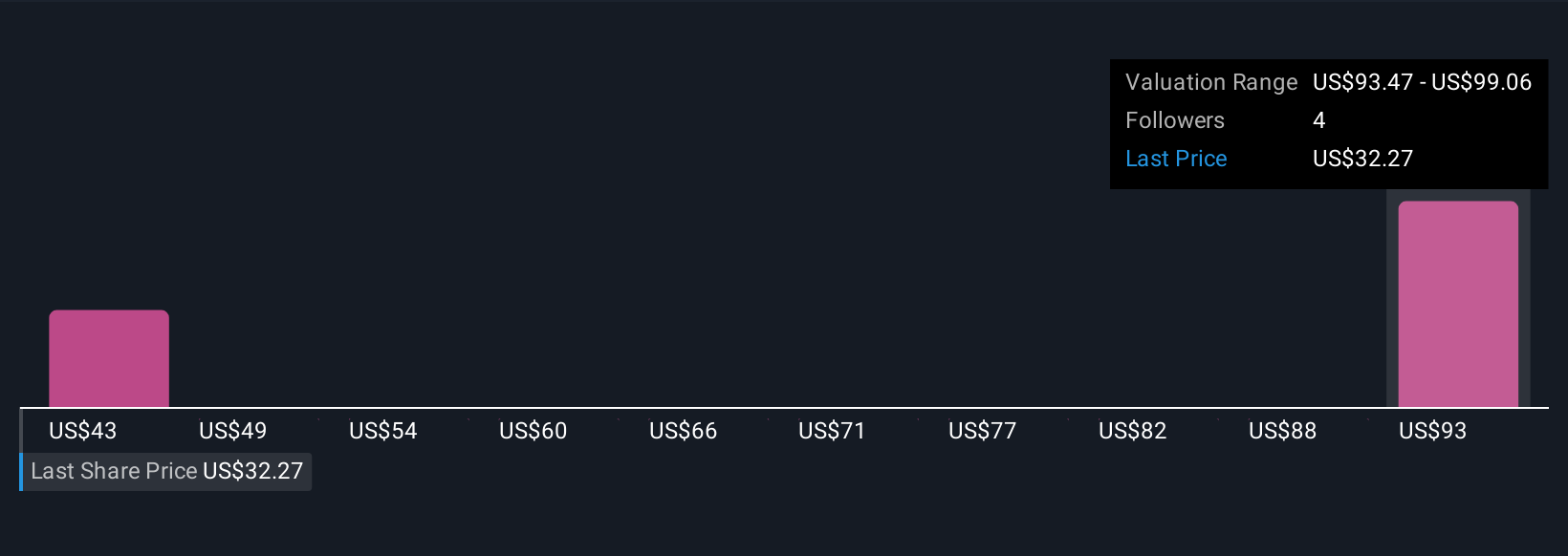

Fair value estimates from the Simply Wall St Community range from US$43.14 to US$98.91 based on two detailed viewpoints. With persistent concerns about acquisition-driven growth, readers can compare these sharply different perspectives on Ziff Davis’s trajectory.

Explore 2 other fair value estimates on Ziff Davis - why the stock might be worth over 3x more than the current price!

Build Your Own Ziff Davis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ziff Davis research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Ziff Davis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ziff Davis' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ziff Davis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZD

Ziff Davis

Operates as a digital media and internet company in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives