- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

WEBTOON Entertainment (WBTN): Exploring Valuation After Recent Run-Up and Disney Deal

Reviewed by Kshitija Bhandaru

See our latest analysis for WEBTOON Entertainment.

WEBTOON Entertainment’s share price has surged over the last quarter, adding more than 85% in the past 90 days, even after a recent 1-day dip and some short-term volatility. While the 1-year total shareholder return stands at an impressive 57%, momentum has cooled in the past month. This suggests the market may be pausing to reassess the company’s future growth prospects.

If you’re interested in spotting more dynamic movers with strong growth stories, now is the perfect moment to broaden your investing lens and discover fast growing stocks with high insider ownership

Yet with shares still trading below analyst targets and the company growing revenues despite losses, the key question remains: is WEBTOON Entertainment undervalued at today’s level, or has the market already priced in future gains?

Most Popular Narrative: 5.5% Undervalued

WEBTOON Entertainment’s fair value estimate in the most widely followed narrative stands at $19 per share, just above the last close of $17.95. With only a small gap between the current price and this target, it becomes critical to understand the rationale fueling this outlook.

The recently announced multi-year collaboration with Disney (encompassing Marvel, Star Wars, and 20th Century Studios IPs) is expected to accelerate new user acquisition and engagement, especially among younger, mobile-native demographics. This should drive strong top-line revenue and expand the monetizable user base in the mid to long term.

Want an inside peek into what powers this high valuation? The narrative only reveals a portion: ambitious growth in users, innovative partnerships, and a focus on breakthrough monetization. Curious about the bold financial leaps that get the fair value to that number? Find out what’s driving the optimism behind WEBTOON’s future.

Result: Fair Value of $19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as declining user growth in core markets and unpredictability in hit-driven content. These factors could challenge the optimism in this narrative.

Find out about the key risks to this WEBTOON Entertainment narrative.

Another View: Sales Multiple Paints a Mixed Picture

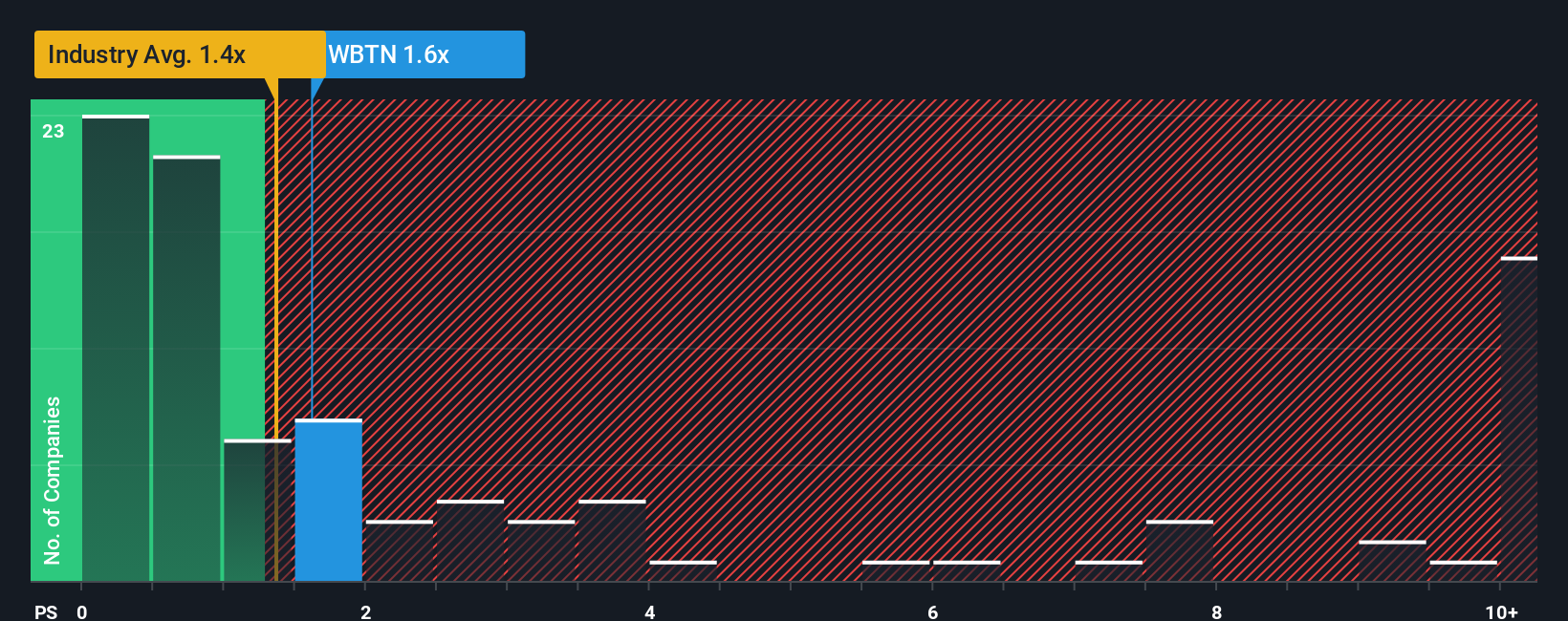

Looking at the price-to-sales ratio, WEBTOON Entertainment trades at 1.7x, which is higher than the US Interactive Media and Services industry average of 1.3x but far below the peer average of 8.2x. The fair ratio is calculated at 1.5x, so the current level suggests the stock is a little expensive relative to fundamentals, but clearly cheaper than many direct peers. With numbers sending mixed signals, could the market correct in either direction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEBTOON Entertainment Narrative

If you’d rather chart your own path or challenge these views, you can dive into the data and shape your own assessment in under three minutes. So why not Do it your way today?

A great starting point for your WEBTOON Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Power up your portfolio by targeting stocks with standout potential using one of our easy, expertly designed screens below.

- Capture the upside of innovative tech by examining these 24 AI penny stocks that are shaping tomorrow’s digital economy.

- Boost your income stream and stability with these 20 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Get ahead of the curve with these 874 undervalued stocks based on cash flows to pinpoint stocks trading at attractive prices based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives