- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive Software (NasdaqGS:TTWO) Unveils NBA 2K26 with Star Athletes and New Features

Take-Two Interactive Software (NasdaqGS:TTWO) saw a share price increase of 16% over the last quarter, influenced by key announcements such as the reveal of the NBA 2K26 cover athletes and new gameplay features, which could have boosted investor sentiment. These announcements coincided with ongoing market trends like Nvidia's milestone market cap and broader tech market stability, which generally supported tech stock prices. Take-Two's recent product launches and anticipated game releases such as Borderlands 4 and Mafia: The Old Country have likely contributed to the favorable price movement, offering potential growth avenues amidst a stable market environment.

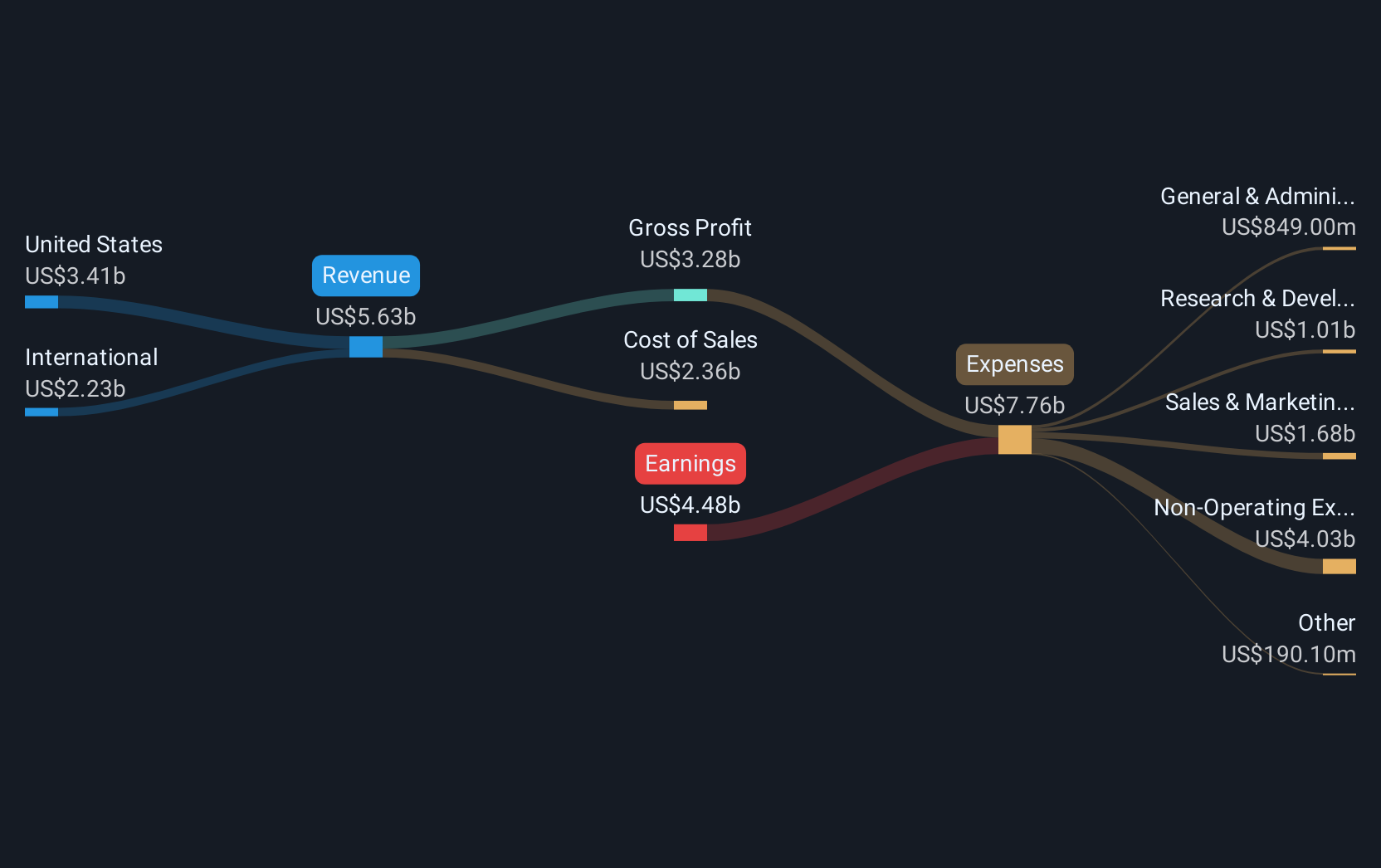

Take-Two Interactive Software's recent announcements, including the NBA 2K26 cover athletes, have likely supported favorable investor sentiment, contributing to the short-term 16% share price increase. This optimism may also extend to future revenue and earnings forecasts as key game releases are expected to drive positive momentum through fiscal 2026 and 2027. These developments could enhance net bookings and operating margins, potentially leading to stronger financial performance.

Over a longer-term three-year period, the company's total return, including share price and dividends, achieved 97.20%. This performance demonstrates a significant appreciation in value over time. However, when compared to the US Entertainment industry, which returned 65.8% over the past year, Take-Two underperformed over this shorter timeframe.

With Take-Two's current share price at US$231.84, analysts' consensus price target stands at US$223.96, indicating a 3.5% lower target. This suggests the market may currently view the company's shares as fairly valued given the anticipated growth and challenges ahead. Upcoming game releases like Grand Theft Auto VI are expected to be key catalysts affecting revenue and earnings, yet analysts continue to express varying views on the potential financial outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.