- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Exploring Take-Two Interactive (TTWO) Valuation: Is There More Room for Growth After Recent Outperformance?

Reviewed by Simply Wall St

See our latest analysis for Take-Two Interactive Software.

Take-Two Interactive’s strong run has not gone unnoticed. The stock has posted a 39% share price return year-to-date and an impressive 58% total shareholder return over the past year. Recent price momentum suggests investors are increasingly optimistic about the company’s growth prospects and underlying fundamentals, particularly after a series of quarterly results that exceeded expectations.

If you’re interested in what’s powering other tech trends in the market right now, it’s a great time to check out the latest opportunities in the sector with See the full list for free.

But with shares so close to analyst price targets and strong recent performance, are investors looking at an undervalued opportunity? Or has the market already priced in all the expected future growth?

Most Popular Narrative: 5.6% Undervalued

Take-Two Interactive Software's narrative fair value estimate stands at $270.34 per share, which is moderately above its last close of $255.12. The narrative points to upbeat expectations for blockbuster franchises and profitability, while also weighing in elements that could tip the scales.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high-profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), support management's outlook for record net bookings and enhanced profitability in the coming years.

Want to know the secret behind this valuation boost? The narrative banks on future-shaping releases and margin gains, but it is one ambitious forecast you will want to see for yourself. How are these projections justified, and what is the wildcard growth lever? The full narrative provides all the details.

Result: Fair Value of $270.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting gamer preferences and possible delays in key franchise releases could quickly change the story for Take-Two’s valuation outlook.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Gauging Value Through Sales Ratios

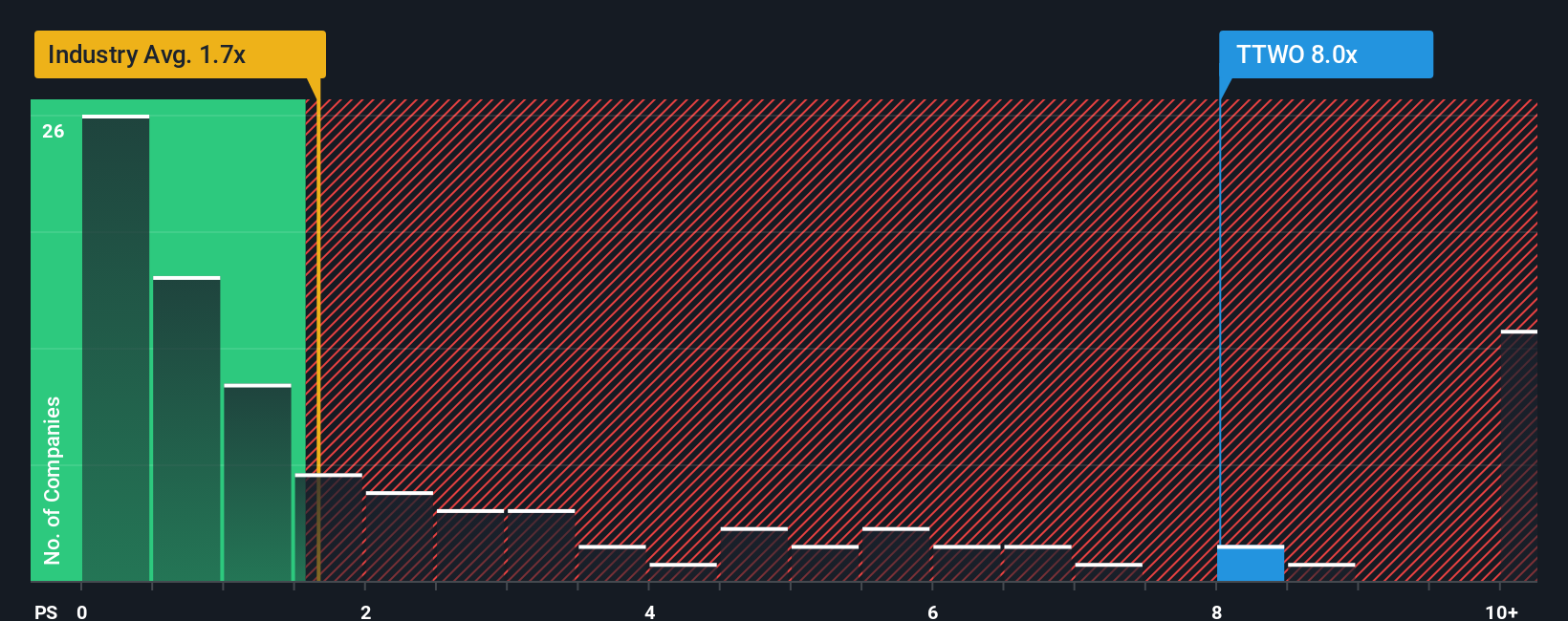

While the fair value estimate points to a possible undervaluation, comparing Take-Two’s price-to-sales ratio tells a different story. At 8.1x, it is much higher than both the industry average of 2x and its own fair ratio of 5.1x. This signals greater valuation risk, especially if growth expectations slip. Will sentiment keep the premium afloat, or could the market move closer to the fair ratio over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you have your own interpretation of the numbers or would rather dig in and build a fresh perspective, you can develop a custom narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

Don't let the next opportunity slip by. Give yourself an edge with fresh stock picks and distinctive investment themes curated by Simply Wall Street's expert tools.

- Tap into potential game-changers by tracking these 877 undervalued stocks based on cash flows that could offer value well beyond today's market sentiment.

- Fuel your watchlist with smart innovation and catch the momentum from these 27 AI penny stocks putting artificial intelligence at the heart of their growth.

- Streamline your passive income strategy by pursuing reliable yields among these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion