- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Assessing Take-Two Interactive Software (TTWO) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Take-Two Interactive Software (TTWO) shares have nudged lower over the past month, with investors parsing the recent performance. While no major event has rocked the headlines, some are taking a closer look at how the stock’s valuation compares.

See our latest analysis for Take-Two Interactive Software.

After jumping earlier this year, Take-Two’s momentum has faded a bit, with the share price pulling back over the past month. Even so, investors who stuck with the company have enjoyed a 32% total shareholder return over the past year and an impressive 138% total return over three years. This suggests long-term potential remains strong despite short-term volatility.

If you’re interested in finding other compelling opportunities in the sector, check out fast growing stocks with high insider ownership.

With Take-Two’s recent pullback and robust long-term returns, the key question now is whether the current share price undervalues the company’s future prospects or if the market has already factored in all of its potential growth.

Most Popular Narrative: 14% Undervalued

Take-Two Interactive Software’s most followed valuation narrative puts fair value at $274.49, notably higher than the recent close of $235.03. This implies meaningful room for upside if projections play out. The calculations reflect both optimism for future growth and specific expectations for margin and revenue expansion.

Strategic investments in technology, AI, and content pipeline efficiency, along with a strong release slate featuring multiple high-profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), support management's outlook for record net bookings and enhanced profitability in the coming years.

Curious what kind of game-changers support this valuation? Dive in for the growth targets, bold margin projections, and the blockbuster launch pipeline that analysts are banking on. There’s one profit forecast in particular raising eyebrows. See how it could set a new standard for the industry.

Result: Fair Value of $274.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains, as heavy dependence on blockbuster franchises and rising development costs could hinder Take-Two’s ability to meet bullish growth targets.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: The Multiples Perspective

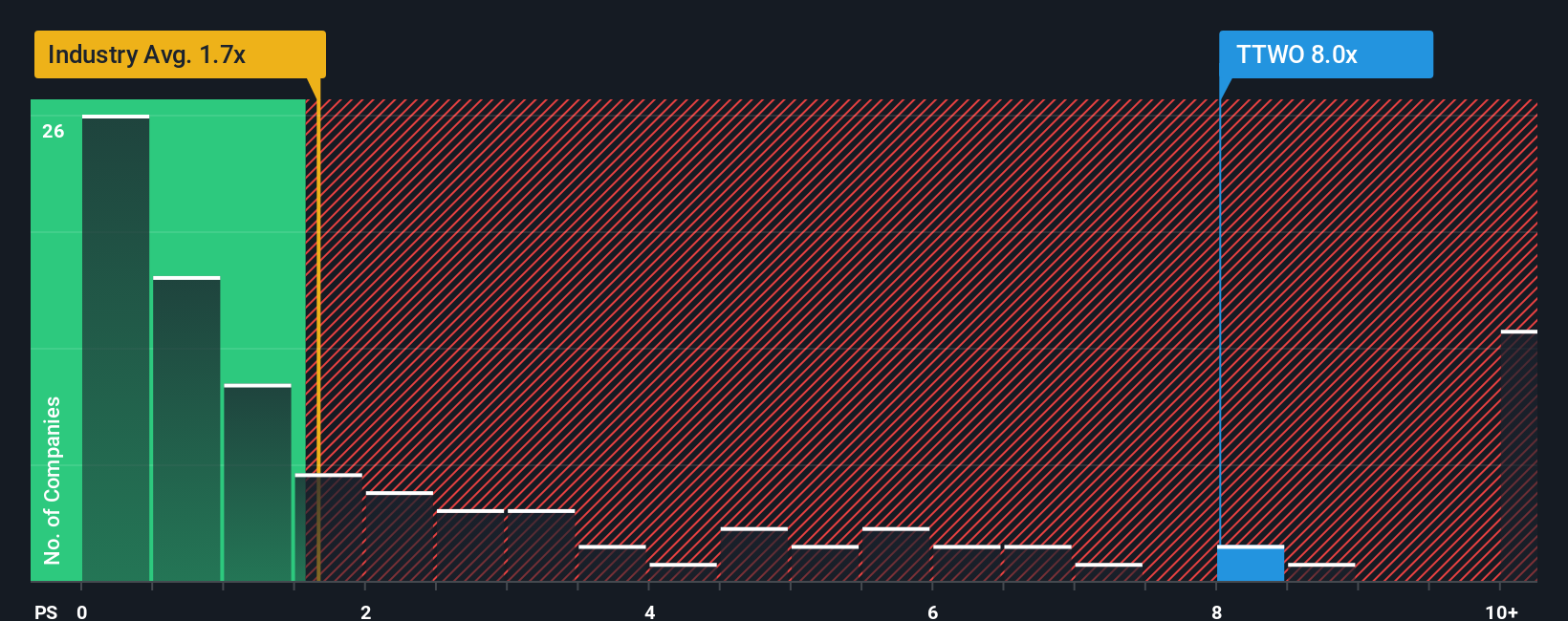

While the consensus view sees Take-Two as undervalued based on analyst forecasts, the market’s current price-to-sales ratio tells a different story. Take-Two trades at about 7x sales, which is much steeper than the peer average of 6.3x, the industry’s 1.5x, and even well above its fair ratio of 4.9x.

This gap suggests investors are paying a premium for future potential, not proven profits, raising questions about valuation risk. Will the company’s results catch up to this higher bar, or could expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

Feel free to dive into the numbers and shape your own perspective. Building a custom narrative for Take-Two is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Take-Two Interactive Software.

Looking for More Investment Ideas?

Smart investors never settle for just one play. Unlock fresh strategies by acting now on opportunities that others might overlook. The next breakout stock could be a click away.

- Seize the potential for strong income streams by searching among these 16 dividend stocks with yields > 3% offering yields above 3% and robust fundamentals.

- Capitalize on rapid tech advancements and tap into growth with these 24 AI penny stocks that are pushing boundaries in artificial intelligence.

- Position yourself early in the digital finance revolution by checking out these 82 cryptocurrency and blockchain stocks leading the charge in blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion