- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (TTD): Assessing Valuation After Strong Q3 Earnings and Raised Revenue Guidance in a Tougher Market

Reviewed by Simply Wall St

Trade Desk (TTD) just posted third quarter earnings that topped expectations and bumped up its revenue forecast for the next quarter. However, the company still faces some headwinds from slowing growth and intensifying competition.

See our latest analysis for Trade Desk.

Trade Desk’s strong Q3 results and its new revenue target sparked some optimism, but recent events, including an accelerated share buyback, have not stopped the slide in performance metrics. The company’s share price is now down 65.85% year-to-date, and its one-year total shareholder return is similarly weak at -65.71%, reflecting fading momentum as growth concerns mount. Despite beating forecasts, investors remain cautious about upcoming challenges and stiff competition in the digital advertising space.

If you’re thinking about different ways to find momentum in the market, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a steep discount to analyst price targets while growth concerns remain front and center, investors now face a key question: is Trade Desk undervalued, or are markets already factoring in the tougher road ahead?

Most Popular Narrative: 41.7% Undervalued

With a narrative fair value of $68.97 and Trade Desk’s last close at $40.21, the market is pricing in much more pessimism than analysts tracking the company’s future growth and margins.

The full rollout and high adoption of the new AI-powered Kokai platform, including new tools like Deal Desk and supply chain innovation (OpenPath, Sincera integration), is already leading to greater than 20% better campaign performance and causing existing clients to increase spend at a much faster rate. As the remaining clients transition and the product matures, this should drive step function increases in platform efficiency, gross margin, and average revenue per client.

Curious what radical assumptions are fueling this massive upside? The narrative’s fair value hinges on bold projections for revenue, margins, and transformative new products. Find out which powerful drivers analysts are betting on and why their target is so much higher than today’s price.

Result: Fair Value of $68.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on a few major clients and rising competition from dominant platforms could quickly undermine the current growth narrative for Trade Desk.

Find out about the key risks to this Trade Desk narrative.

Another View: Multiples Suggest a Premium Price

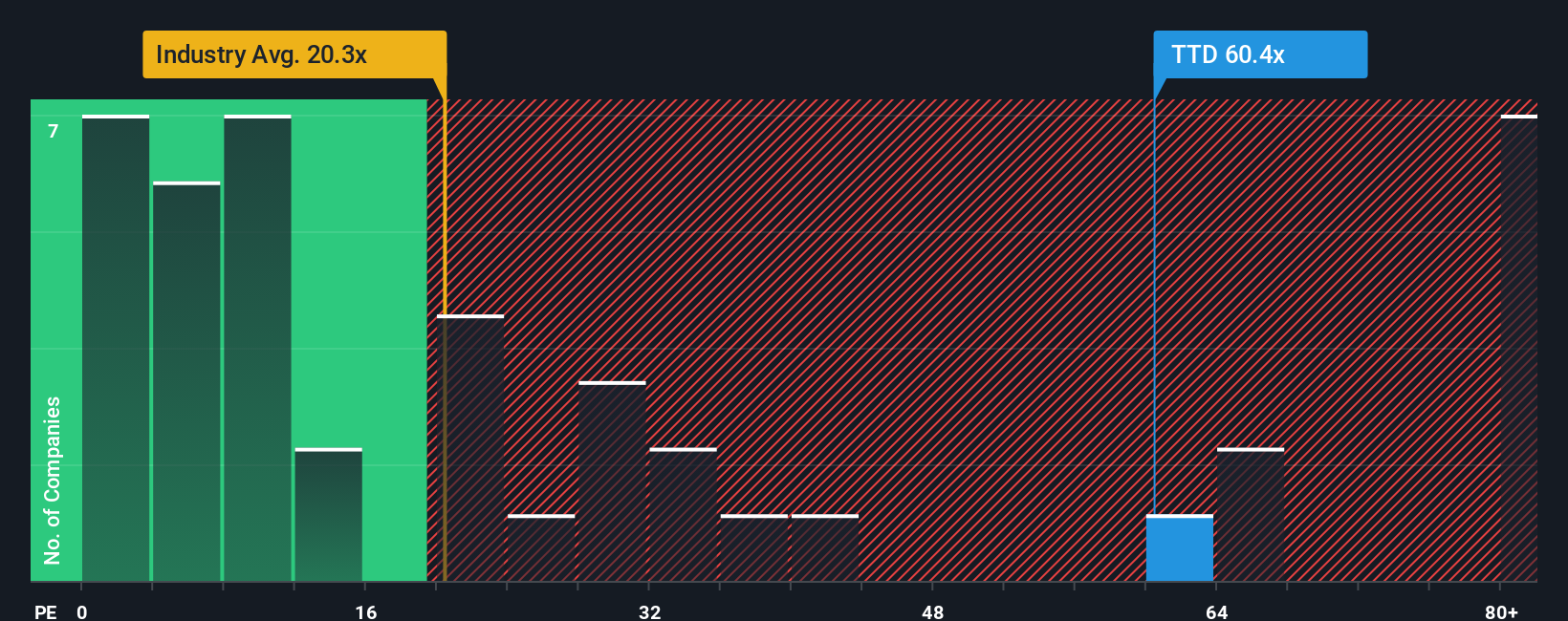

While our SWS DCF model points to Trade Desk trading at a steep discount, earnings multiples tell a different story. The company’s price-to-earnings ratio currently stands at 44.3x, which is well above the industry average of 16.1x, its peers’ 24.3x, and the fair ratio of 28x. This significant premium raises questions about whether optimism is already reflected in the price or if the market is overestimating future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trade Desk Narrative

If you want to challenge the consensus or take a hands-on approach, it takes just a few minutes to generate your own perspective and narrative. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Trade Desk.

Looking for more investment ideas?

Don’t let opportunity slip away while others get ahead. Use Simply Wall Street’s tools to pinpoint stocks that match your strategy and supercharge your watchlist.

- Catch fast-growing innovators as you track these 27 AI penny stocks, which are pushing boundaries in artificial intelligence and redefining what’s possible in tech.

- Unlock the advantage of reliable yields by targeting income potential via these 18 dividend stocks with yields > 3%, offering attractive payouts above 3%.

- Ride the wave of digital transformation by checking out these 82 cryptocurrency and blockchain stocks, poised to capitalize on blockchain breakthroughs and the rise of digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives