- United States

- /

- Media

- /

- NasdaqGM:TTD

How Recent Privacy Regulation News Is Shaping The Value Debate Around Trade Desk

Reviewed by Bailey Pemberton

- Wondering if Trade Desk is a bargain or just another tech story? You are not alone, plenty of investors are asking whether its current price truly reflects its long-term value.

- The stock has taken a hit lately, dropping 8.6% in the last week and 8.4% over the past month, with a steep year-to-date slide of 59.9%. Despite this, it is still clinging to an 8.9% gain over three years.

- Recently, the market's mood toward digital advertising shifted after reports of changing privacy regulations and new partnerships among ad-tech giants. This has investors re-evaluating how much risk and opportunity is built into Trade Desk's share price.

- Right now, Trade Desk scores a 2 out of 6 on our valuation checks, suggesting there may be room for debate about whether it's undervalued. Let us walk through a few popular approaches to valuation and share an even smarter way to measure what the company is really worth at the end of the article.

Trade Desk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Trade Desk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach to estimate a company's intrinsic value by forecasting its future cash flows and discounting them back to their present value. This method gives investors an idea of what Trade Desk could be worth based on its ability to generate cash in the coming years.

For Trade Desk, the most recent twelve months’ Free Cash Flow was $787.5 Million. Analyst estimates project Free Cash Flow to rise steadily, with five-year forecasts reaching $1.57 Billion by the end of 2029. Beyond 2029, Simply Wall St extrapolates growth to arrive at a ten-year Free Cash Flow of nearly $2.44 Billion. It is worth noting that projections become increasingly speculative the further out they go.

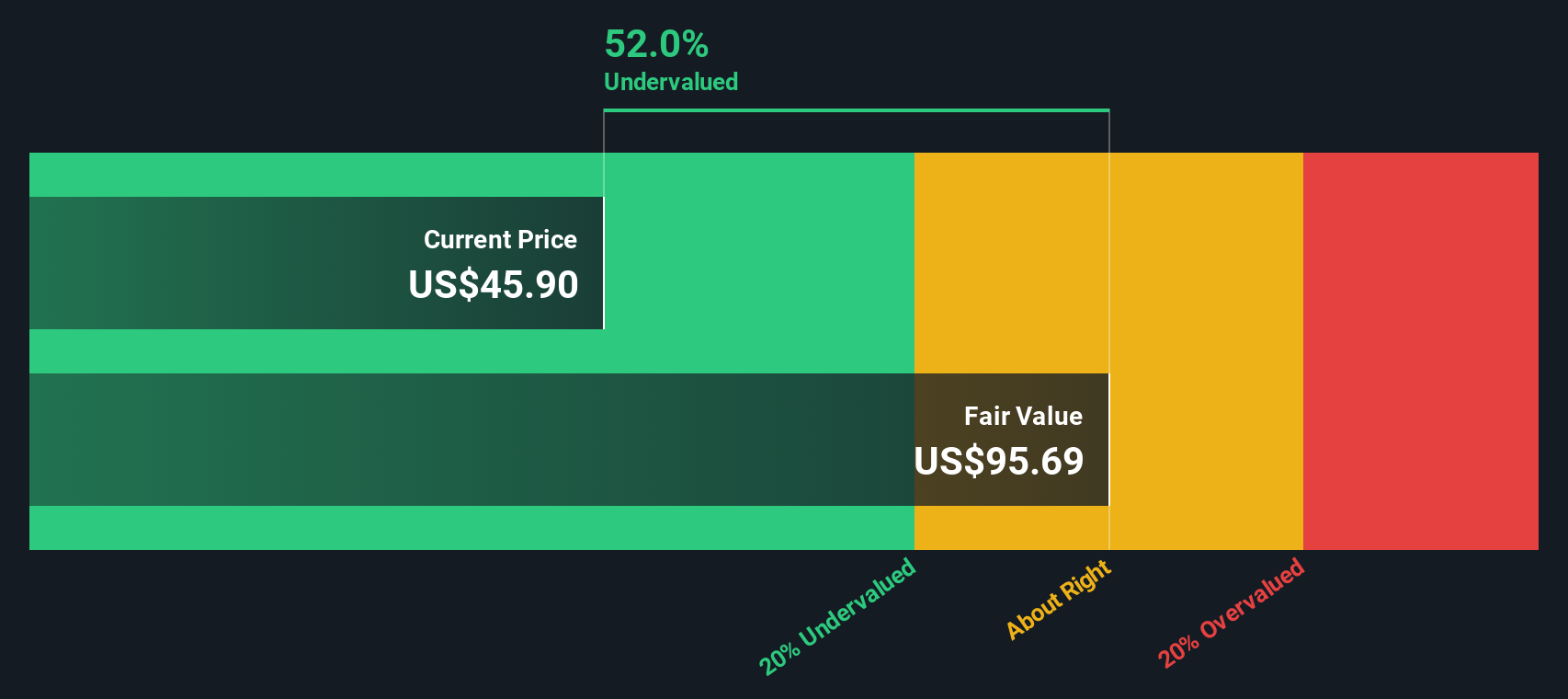

The current DCF model used for Trade Desk applies a "2 Stage Free Cash Flow to Equity" methodology. Based on this projection, the estimated intrinsic value of the stock is $96.48 per share. With Trade Desk currently trading at a 51.0% discount to this value, the implication is that the stock may be significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Trade Desk is undervalued by 51.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Trade Desk Price vs Earnings

For profitable companies like Trade Desk, the price-to-earnings (PE) ratio is often used as a primary benchmark for valuation. The PE ratio enables investors to compare how much they are paying for each dollar of current earnings, making it especially useful for businesses generating strong profits and cash flows.

In summary, a "normal" or "fair" PE ratio depends on how quickly a company is expected to grow and how much risk is involved. Businesses with higher expected earnings growth or lower risk often command higher PE ratios, while those facing uncertainty or limited growth tend to trade at discounts.

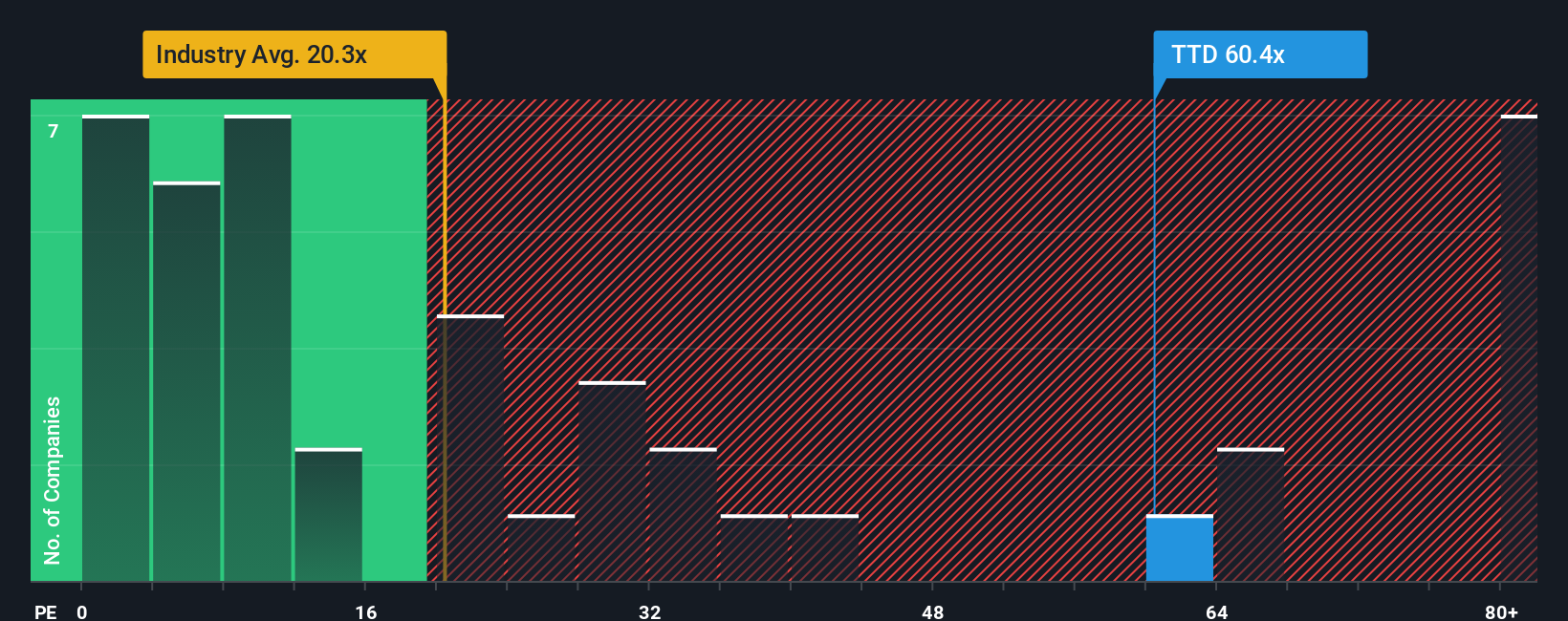

Currently, Trade Desk trades at a significant 55.4x earnings, well above the US Media industry average of 16.1x and the peer group average of 30.3x. At first glance, this premium might seem excessive, but it likely reflects investor expectations for sustained growth and the company's position in digital advertising.

This is where Simply Wall St's "Fair Ratio" comes in. This proprietary metric estimates an appropriate PE multiple for Trade Desk based on a combination of its earnings growth, profit margins, competitive landscape, risks, and market size. Unlike a direct comparison to industry averages or peers, the Fair Ratio considers what actually makes Trade Desk unique by projecting how much its specific strengths and risks should be valued by the market. For Trade Desk, the Fair Ratio is set at 28.8x, much lower than its current PE.

Because Trade Desk’s actual PE is significantly higher than its Fair Ratio, the stock appears overvalued by this measure, even when accounting for its strong growth profile and profitability.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Trade Desk Narrative

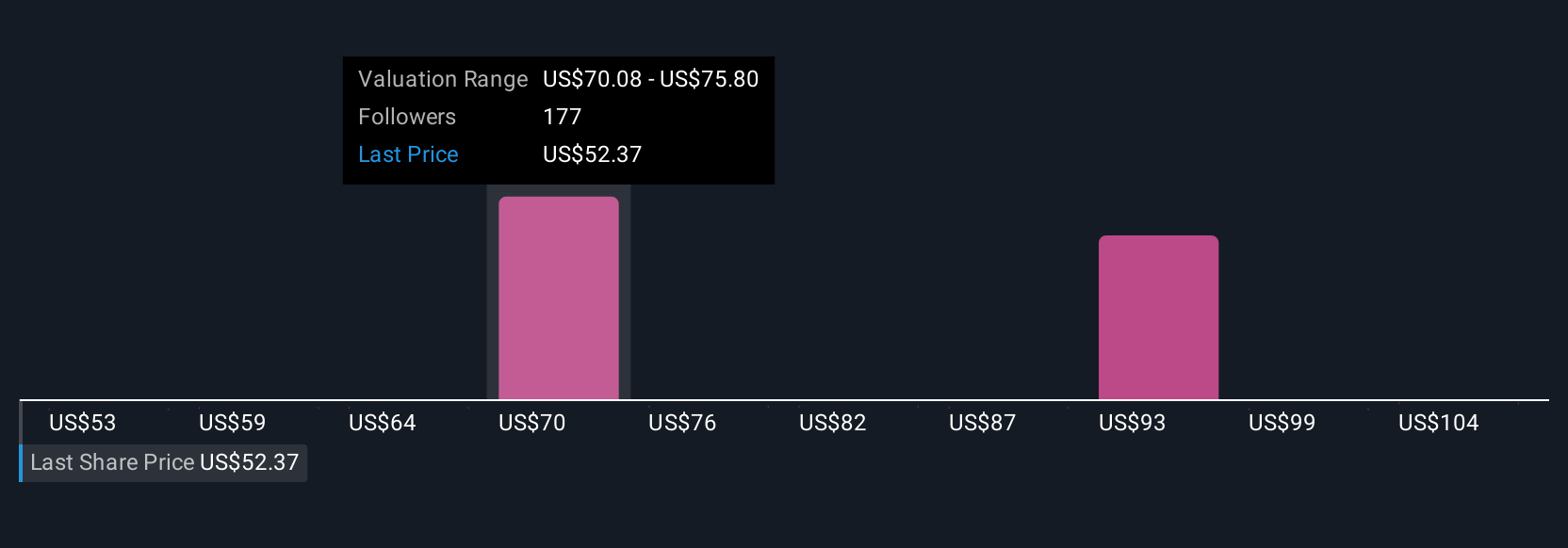

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply a story that you, as an investor, bring to the numbers. It connects your perspective (what you believe about a company’s future, like revenue and margin growth) to a financial forecast, and ultimately, to a fair value.

On platforms like Simply Wall St’s Community page, which is used by millions, creating or following Narratives is easy and accessible for every investor. Narratives let you clearly lay out the assumptions driving your view. For example, you might expect Trade Desk to keep outpacing the shift to connected TV, grow margins, and unlock global markets, or you might see risks in its reliance on large clients and heavy competition.

Each Narrative dynamically links these expectations to a fair value, which can then be compared to the current price so you can decide when to buy or sell. Instant updates are available as new news or earnings are released. For Trade Desk, some investors are very bullish, expecting price targets as high as $135, while others remain cautious with values as low as $34, depending on their views of growth, margin expansion, and competitive threats. Your Narrative can be just as unique as your outlook.

Do you think there's more to the story for Trade Desk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives