- United States

- /

- Media

- /

- NasdaqGM:TTD

How Does a New CRO at Trade Desk (TTD) Reflect Shifts in Leadership and Revenue Strategy?

Reviewed by Sasha Jovanovic

- The Trade Desk recently appointed Anders Mortensen as Chief Revenue Officer, following his tenure at Google and Fujitsu, to lead global revenue strategy and replace long-serving executive Jed Dederick, who will assist with the transition through year-end.

- Mortensen’s extensive digital advertising experience comes at a pivotal time for The Trade Desk, as the company faces increased competition and evolving industry challenges.

- Now, we’ll explore how the leadership transition and management’s cautious guidance could influence The Trade Desk’s investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Trade Desk Investment Narrative Recap

To believe in The Trade Desk as a shareholder, you need confidence in the ongoing migration of digital ad budgets to connected TV and advanced programmatic platforms, along with the company's ability to differentiate through innovation, scale, and client loyalty. The recent CRO appointment, while significant for commercial leadership, is unlikely to materially alter the most immediate catalysts, such as continued rapid growth in connected TV adoption, or the main risk, which remains The Trade Desk's dependence on large global brand clients subject to macro uncertainty and competitive pressure.

Among recent announcements, the launch of Audience Unlimited, a new upgrade for third-party data utilization, stands out as particularly relevant. With advertisers increasingly seeking precision and measurable ROI, this release further strengthens The Trade Desk’s core catalyst: higher-value ad campaigns driven by AI and better data, which could reinforce client retention and platform spending, even as management maintains cautious guidance and competition intensifies.

However, it is equally important to be aware of rising risks from concentrated revenue exposure to large brands and macro headwinds that could quickly shift client ad budgets...

Read the full narrative on Trade Desk (it's free!)

Trade Desk's narrative projects $4.3 billion in revenue and $823.2 million in earnings by 2028. This requires 17.1% yearly revenue growth and a $406 million increase in earnings from $417.2 million today.

Uncover how Trade Desk's forecasts yield a $69.53 fair value, a 46% upside to its current price.

Exploring Other Perspectives

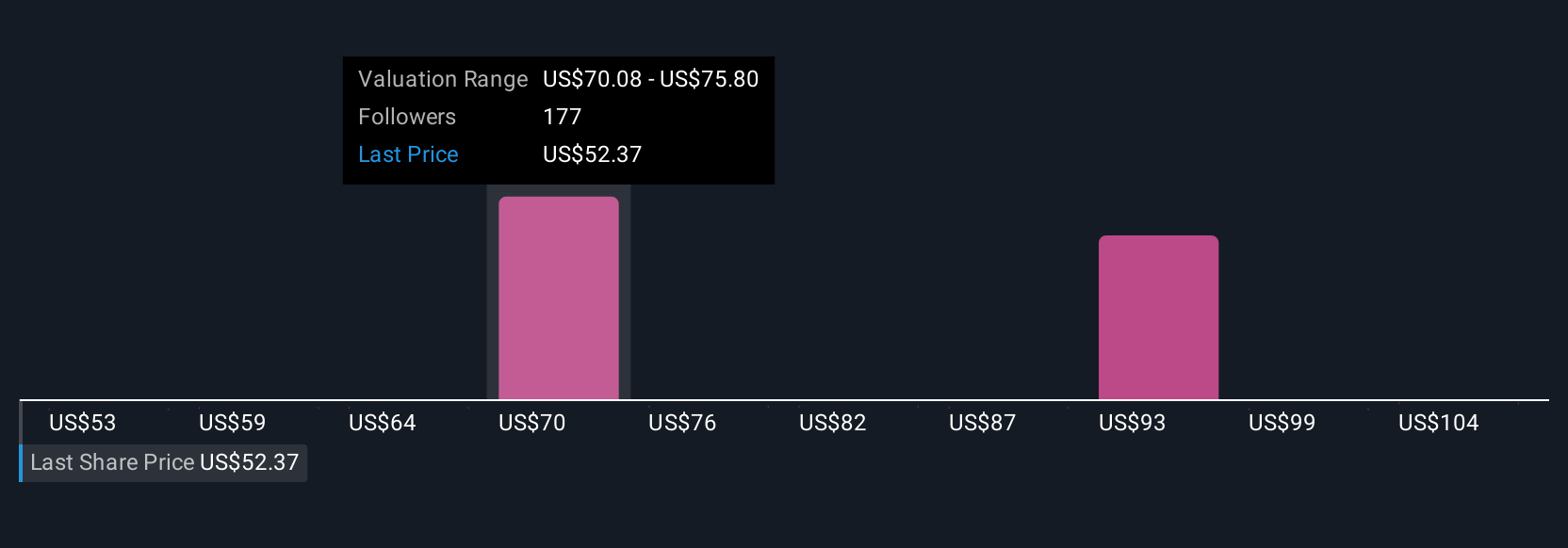

Simply Wall St Community members have shared 39 unique fair value estimates for The Trade Desk, spanning from US$39.48 to US$111.31 per share. While views differ widely, many highlight that the company’s exposure to competitive threats from closed ad ecosystems could play a key role in future outcomes, so reviewing these varied perspectives may offer valuable context.

Explore 39 other fair value estimates on Trade Desk - why the stock might be worth 17% less than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives