- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Is Tripadvisor’s (TRIP) Viator Integration Strategy Shifting the Investment Case?

Reviewed by Sasha Jovanovic

- In recent weeks, Tripadvisor reiterated its plan to integrate Viator rather than spin it off, aiming for approximately US$85 million in cost savings and a potential 20% EBITDA boost; meanwhile, activist investor 13D Management initiated a significant position, and CFO Mike Noonan engaged with investors at a major tech conference in Arizona.

- This integration-focused strategy, combined with renewed activist interest, signals growing confidence in Tripadvisor’s drive for operational synergies and improved profitability.

- We’ll examine how Tripadvisor’s decision to integrate Viator, rather than divest it, could influence its investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Tripadvisor Investment Narrative Recap

To invest in Tripadvisor, you need to believe in management’s ability to drive higher profitability and user engagement even as competition rises and organic traffic weakens. The recent decision to integrate Viator, rather than spin it off, may accelerate operational efficiencies and support near-term EBITDA, but doesn’t materially change the primary risk, Tripadvisor’s difficulty in reversing core traffic and revenue declines due to paid marketing reliance and intensifying competitive threats.

The most relevant announcement here is Tripadvisor’s plan to generate approximately US$85 million in cost savings and achieve a 20 percent EBITDA boost by integrating Viator. This aligns with a key catalyst: the push to scale its experiences marketplace and respond to global consumer shifts toward experiential travel, which management and several investors now see as crucial for the next phase of growth.

However, while operational efficiencies may improve margins in the short run, investors should still watch for renewed declines in organic user growth, since...

Read the full narrative on Tripadvisor (it's free!)

Tripadvisor's outlook anticipates $2.3 billion in revenue and $144.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.1% and a $79.6 million increase in earnings from current earnings of $65.0 million.

Uncover how Tripadvisor's forecasts yield a $18.16 fair value, a 25% upside to its current price.

Exploring Other Perspectives

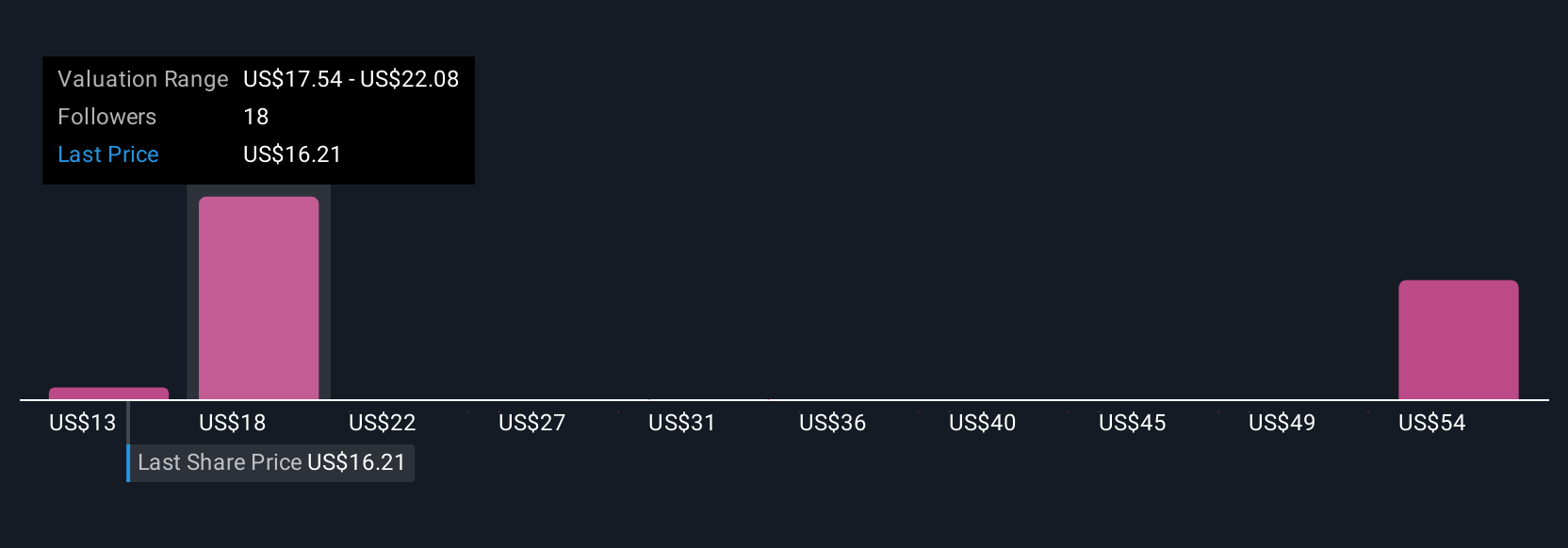

Seven members of the Simply Wall St Community value Tripadvisor’s fair price between US$13.50 and US$33.47, highlighting wide divergence. Views span profitability gains from Viator’s integration to persistent competitive headwinds, so explore these different takes to see how your outlook compares.

Explore 7 other fair value estimates on Tripadvisor - why the stock might be worth over 2x more than the current price!

Build Your Own Tripadvisor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tripadvisor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tripadvisor's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives