- United States

- /

- Media

- /

- NasdaqGS:STGW

Will Stagwell’s (STGW) New European Hire Bolster Its Regional Integration and Growth Strategy?

Reviewed by Sasha Jovanovic

- Stagwell recently announced the appointment of James Denton-Clark as Chief Growth & Client Officer for Europe, entrusting him with business growth, collaboration, and client relationship management across the region.

- This move brings nearly three decades of leadership experience to Stagwell’s European operations, underscoring the company’s focus on sustained international expansion and regional integration following key launches in Italy and the UK.

- We'll now explore how the addition of an experienced European growth leader could reshape Stagwell's broader investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Stagwell Investment Narrative Recap

To own Stagwell, you need to believe the company can accelerate profitable growth by leveraging global expansion and digital transformation, while overcoming integration risks and revenue concentration among major tech clients. The appointment of James Denton-Clark as Chief Growth & Client Officer for Europe is a positive step for Stagwell's international ambitions, but it does not fundamentally change the near-term catalysts or the primary risks, such as execution on integration and dependence on large clients.

Of the recent announcements, the July launch of Stagwell Media Platform stands out as most relevant, as it is aimed at enhancing operational efficiencies and global client solutions, two areas where Denton-Clark’s leadership will likely intersect. Both moves support the underlying thesis that cross-regional integration and digital offerings remain critical to achieving Stagwell’s margin and growth targets.

By contrast, investors should be aware that reliance on a concentrated group of tech clients remains a significant concern if spending patterns shift...

Read the full narrative on Stagwell (it's free!)

Stagwell's outlook anticipates $3.4 billion in revenue and $363.8 million in earnings by 2028. This implies a 6.4% annual revenue growth rate and a $365.5 million increase in earnings from current earnings of $-1.7 million.

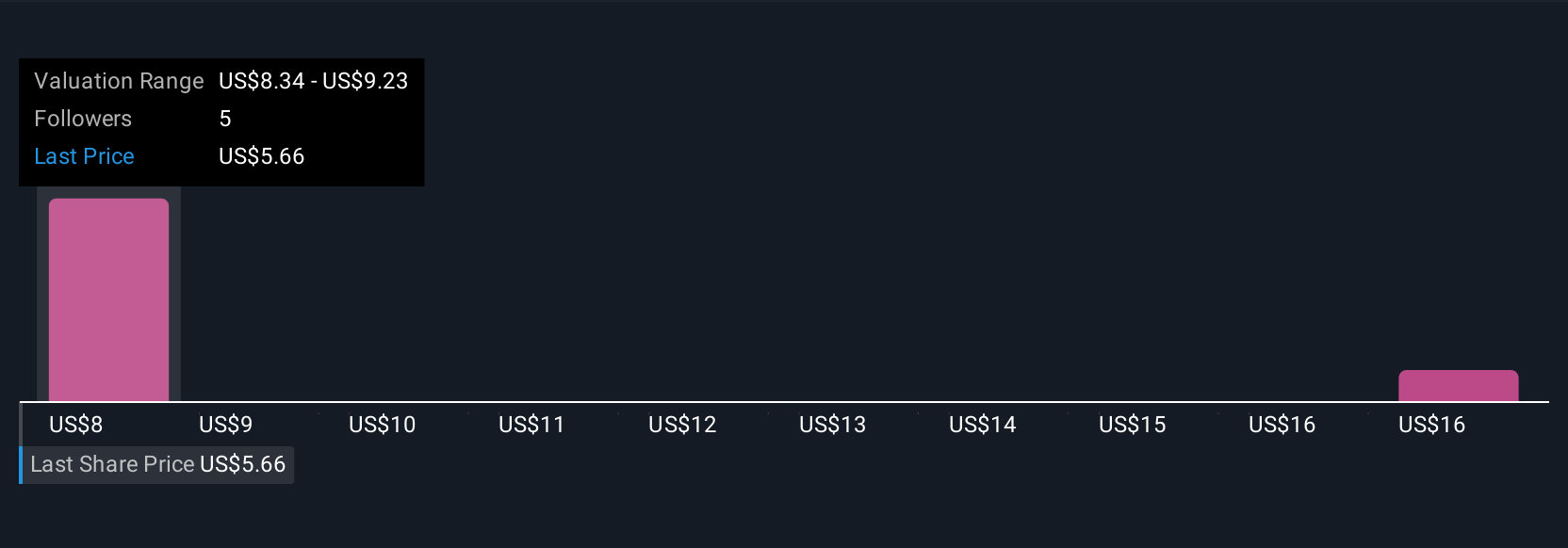

Uncover how Stagwell's forecasts yield a $7.81 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Stagwell range from US$7.81 to US$41.95 across 3 perspectives. This variety reflects how much broader earnings growth potential and integration execution could influence results, so check multiple viewpoints before drawing conclusions.

Explore 3 other fair value estimates on Stagwell - why the stock might be worth over 7x more than the current price!

Build Your Own Stagwell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stagwell research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stagwell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stagwell's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STGW

Stagwell

Provides digital transformation, performance media and data, consumer insights and strategy, and creativity and communications services in the United States, the United Kingdom, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives