- United States

- /

- Media

- /

- NasdaqCM:SGRP

SPAR Group, Inc. (NASDAQ:SGRP) Stock Catapults 72% Though Its Price And Business Still Lag The Industry

SPAR Group, Inc. (NASDAQ:SGRP) shares have continued their recent momentum with a 72% gain in the last month alone. The annual gain comes to 118% following the latest surge, making investors sit up and take notice.

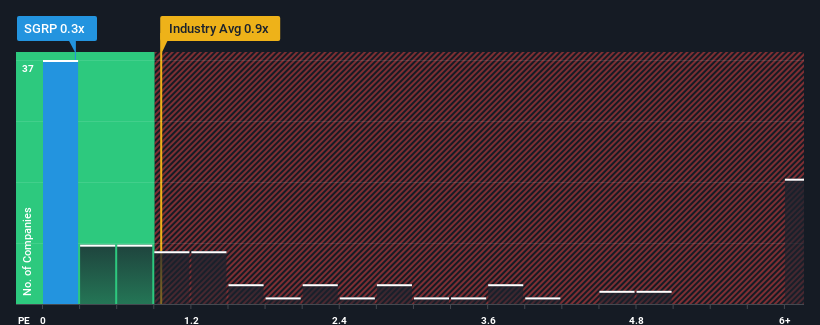

Even after such a large jump in price, SPAR Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Media industry in the United States have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SPAR Group

What Does SPAR Group's Recent Performance Look Like?

Recent times haven't been great for SPAR Group as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think SPAR Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

SPAR Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 16% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 29% over the next year. With the industry predicted to deliver 4.4% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that SPAR Group's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From SPAR Group's P/S?

The latest share price surge wasn't enough to lift SPAR Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of SPAR Group's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, SPAR Group's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

There are also other vital risk factors to consider and we've discovered 6 warning signs for SPAR Group (2 make us uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of SPAR Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGRP

SPAR Group

Provides merchandising and brand marketing services in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives