- United States

- /

- Media

- /

- NasdaqCM:SGRP

A Piece Of The Puzzle Missing From SPAR Group, Inc.'s (NASDAQ:SGRP) 29% Share Price Climb

The SPAR Group, Inc. (NASDAQ:SGRP) share price has done very well over the last month, posting an excellent gain of 29%. Unfortunately, despite the strong performance over the last month, the full year gain of 2.4% isn't as attractive.

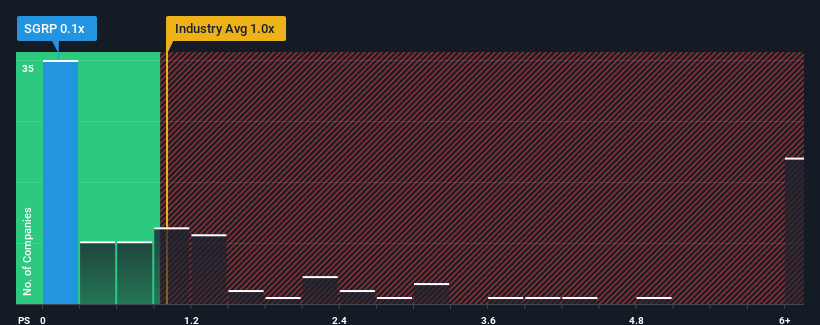

Although its price has surged higher, SPAR Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Media industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SPAR Group

How Has SPAR Group Performed Recently?

SPAR Group's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on SPAR Group will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on SPAR Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SPAR Group's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 13% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 2.2% over the next year. That's shaping up to be similar to the 4.0% growth forecast for the broader industry.

With this in consideration, we find it intriguing that SPAR Group's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Despite SPAR Group's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of SPAR Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - SPAR Group has 3 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGRP

SPAR Group

Provides merchandising and brand marketing services in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives