- United States

- /

- Media

- /

- NasdaqGS:SATS

EchoStar (SATS): Valuation in Focus Following Q3 Losses, $2.6B SpaceX Deal, and CEO Transition

Reviewed by Simply Wall St

EchoStar (SATS) unveiled a wave of developments as it reported a steep rise in third-quarter losses, announced a $2.6 billion spectrum sale deal with SpaceX, and handed the CEO role back to Charles W. Ergen.

See our latest analysis for EchoStar.

EchoStar's bold moves, including the $2.6 billion spectrum deal with SpaceX and its top-level leadership shuffle, come amid a period of extreme share price momentum. Despite a recent 1-month share price decline of 5.81%, EchoStar has delivered a year-to-date share price gain of 217.89% and an impressive 166.18% 1-year total shareholder return. All this signals that investors are weighing renewed strategic potential even as operational headwinds linger.

If you’re interested in uncovering what’s driving momentum in other corners of the market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock up over 215% year-to-date, yet facing heavy losses and leadership upheaval, the key question is whether EchoStar is still undervalued or if the market has already priced in all of its future growth.

Most Popular Narrative: 14.2% Undervalued

With EchoStar's fair value pegged at $84.29, notably above its last close at $72.32, the most widely followed narrative suggests that the company's valuation has meaningful upside if key strategies play out as intended.

EchoStar's investment in a unique wideband LEO direct-to-device satellite constellation, leveraging its global S-band and AWS-4 spectrum rights, positions it to address skyrocketing global demand for ubiquitous connectivity across consumer, enterprise, government, and IoT applications. This is likely to create new, high-margin wholesale revenue streams and accelerate long-term revenue growth.

Curious why analysts are so bullish on the satellite opportunity? The secret lies in visionary growth strategies and surprising financial assumptions. Want the inside story behind these bold projections? Only the full narrative reveals the hidden drivers of EchoStar’s fair value.

Result: Fair Value of $84.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and EchoStar’s heavy debt load could still disrupt its ambitious plans, potentially pressuring both earnings and investor sentiment.

Find out about the key risks to this EchoStar narrative.

Another View: Is the Market Already There?

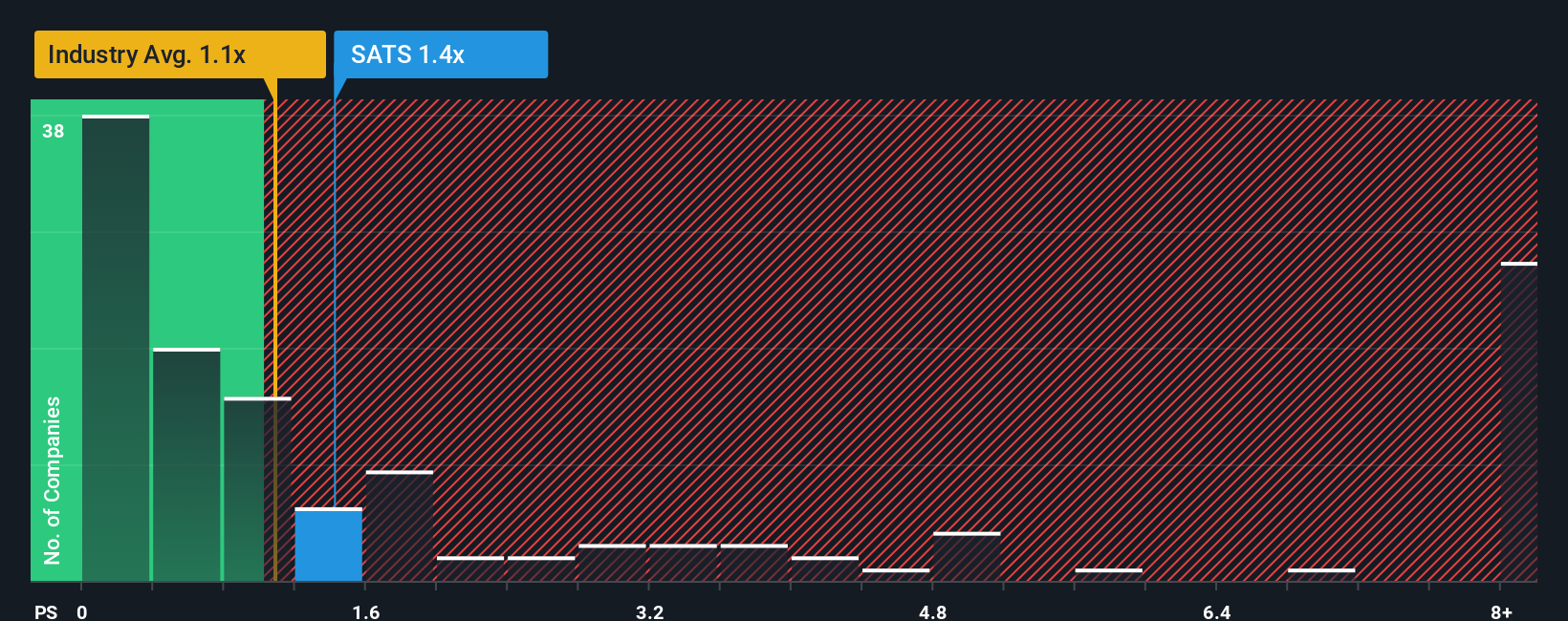

A different angle comes from comparing EchoStar’s price-to-sales ratio of 1.3x to benchmarks. While this is a bit pricey relative to the US Media industry average of 1x, it looks much cheaper next to a peer average of 4.2x. The market’s own fair ratio estimate also sits at 1.3x, meaning there is little room for adjustment unless the company’s outlook shifts dramatically. Could this suggest the easy valuation win has already passed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EchoStar Narrative

You can always dig into the numbers, challenge these takes, and build your own narrative from the ground up in just a few minutes with Do it your way

A great starting point for your EchoStar research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for success with a tailored search. There are valuable opportunities waiting that most investors never even notice. Don’t be the one who misses out just as the market heats up.

- Unlock potential future giants by reviewing these 3605 penny stocks with strong financials with strong financials quietly outperforming expectations in overlooked sectors.

- Boost your returns with consistent income by checking out these 20 dividend stocks with yields > 3% showing yields above 3% for those who prioritize robust payouts.

- Ride the innovation wave and see which companies are shaping healthcare’s future through AI by starting with these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Slight risk and overvalued.

Similar Companies

Market Insights

Community Narratives