- United States

- /

- Interactive Media and Services

- /

- NasdaqGM:RUM

Assessing Rumble (RUM) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Rumble.

After a steep 28% drop in the past month, Rumble’s share price momentum appears to be fading compared to earlier in the year. The year-to-date share price return is -52.5%. Despite this volatility, its one-year total shareholder return is only modestly negative, suggesting that longer term holders have fared a bit better than recent buyers.

If you’re looking to spot what else is shifting in today’s market, now is an ideal time to expand your search and discover fast growing stocks with high insider ownership

With shares now trading well below recent highs, is Rumble’s current price an attractive entry point for investors, or is the market already factoring in all potential growth ahead?

Most Popular Narrative: 59% Undervalued

Rumble’s most widely followed valuation narrative suggests significant upside compared to its last close, projecting a fair value well above current price levels. This sharp gap sets the stage for a bold growth story built on future strategic moves.

*The upcoming launch of Rumble Wallet, with integrated crypto tipping and international payments, is poised to increase global user acquisition and drive engagement by tapping new markets where decentralized, creator-driven monetization is highly valued. This should accelerate top-line revenue growth and expand the platform's total addressable market.*

What’s under the hood of this valuation? A future where revenue surges, margins turn dramatically, and growth ambitions rewrite investor expectations. Guess which financial leap supports this sky-high target? The narrative’s numbers reveal the blueprint you can’t afford to miss.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy investment in growth, as well as risks tied to regulatory pressure or underperforming partnerships, could undermine this optimistic outlook and slow Rumble’s momentum.

Find out about the key risks to this Rumble narrative.

Another View: Market Multiples Raise Questions

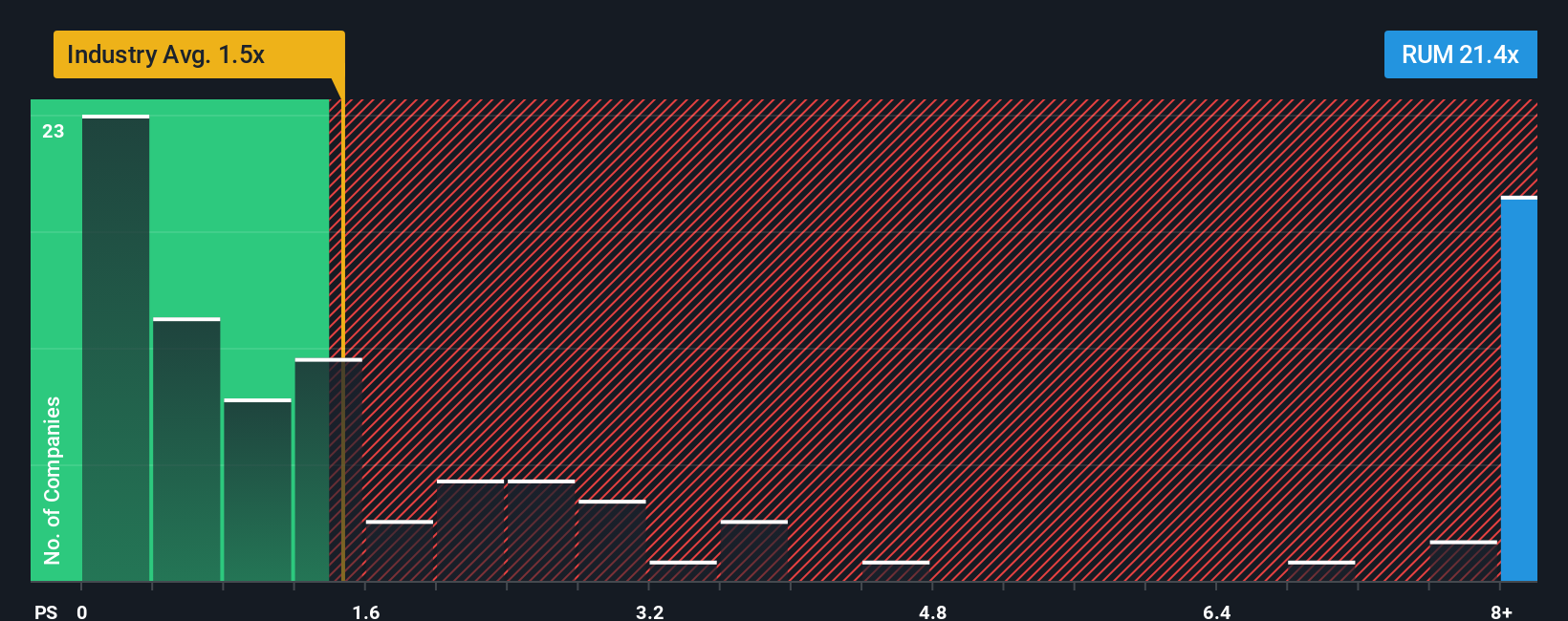

Looking at the price-to-sales ratio, the story changes. Rumble trades at 19.2x sales, which is much higher than the US industry average of 1.4x and peers at 2.7x. The fair ratio is 1.1x, suggesting the stock carries significant valuation risk if growth falls short of expectations. Could the market rethink its optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rumble Narrative

If your perspective differs or you’re eager to dig into the numbers yourself, crafting your own thesis takes just a few minutes. Do it your way

A great starting point for your Rumble research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready to Unearth Smarter Stock Opportunities?

Don’t wait for the market to leave you behind. Take charge of your portfolio and capture tomorrow’s winners by zeroing in on breakthrough investment trends right now.

- Track down the next wave of solid returns by targeting stable companies offering great yields through these 16 dividend stocks with yields > 3%. These companies consistently reward shareholders.

- Seize the potential of innovation by evaluating fast-moving disruptors using these 24 AI penny stocks. These companies are pushing advances in automation, analytics, and artificial intelligence.

- Target future leaders in computing power by searching for uniquely positioned opportunities with these 27 quantum computing stocks. These companies are transforming industries with game-changing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RUM

Rumble

Operates video sharing platforms and cloud services in the United States, Canada, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives