- United States

- /

- Media

- /

- NasdaqGS:NWSA

A Closer Look at News Corp (NWSA) Valuation After Strong Earnings and Positive Rate Cut Signals

Reviewed by Simply Wall St

News (NWSA) shares moved higher after the company beat quarterly earnings expectations, posting revenue growth and stronger profits. Wider market sentiment was also lifted by fresh optimism around potential interest rate cuts.

See our latest analysis for News.

Despite a tough year for News shareholders, with a one-year total return of -13.75% and recent momentum fading—down 4.14% over the past month and 15.14% over the past quarter—the upbeat earnings report and hints of easier monetary policy have sparked renewed interest. Looking further back, long-term investors have still seen solid gains, as the three- and five-year total shareholder returns remain strongly positive.

If shifting market sentiment has you looking for fresh ideas, now’s a great moment to discover fast growing stocks with high insider ownership.

With the stock trading well below analyst price targets and still boasting strong long-term returns, investors are left to wonder: Is News currently undervalued, or has the market already priced in its future growth?

Most Popular Narrative: 32% Undervalued

The current fair value derived from the most popular narrative stands noticeably above News's last closing price, highlighting a significant gap between market expectations and analyst projections. This gulf points toward substantial optimism around future growth drivers, despite recent share price declines.

News Corp's growing portfolio of digital and professional information services (for example, Dow Jones Risk & Compliance and new B2B data analytics acquisitions) positions it to capture expanding demand for high-quality, business-critical information. This supports revenue growth and earnings stability through higher recurring digital subscription and data licensing income.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $37.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in print media performance and growing competition in digital could weigh on News's future growth. This may make these optimistic forecasts harder to achieve.

Find out about the key risks to this News narrative.

Another View: Is the Market Overestimating?

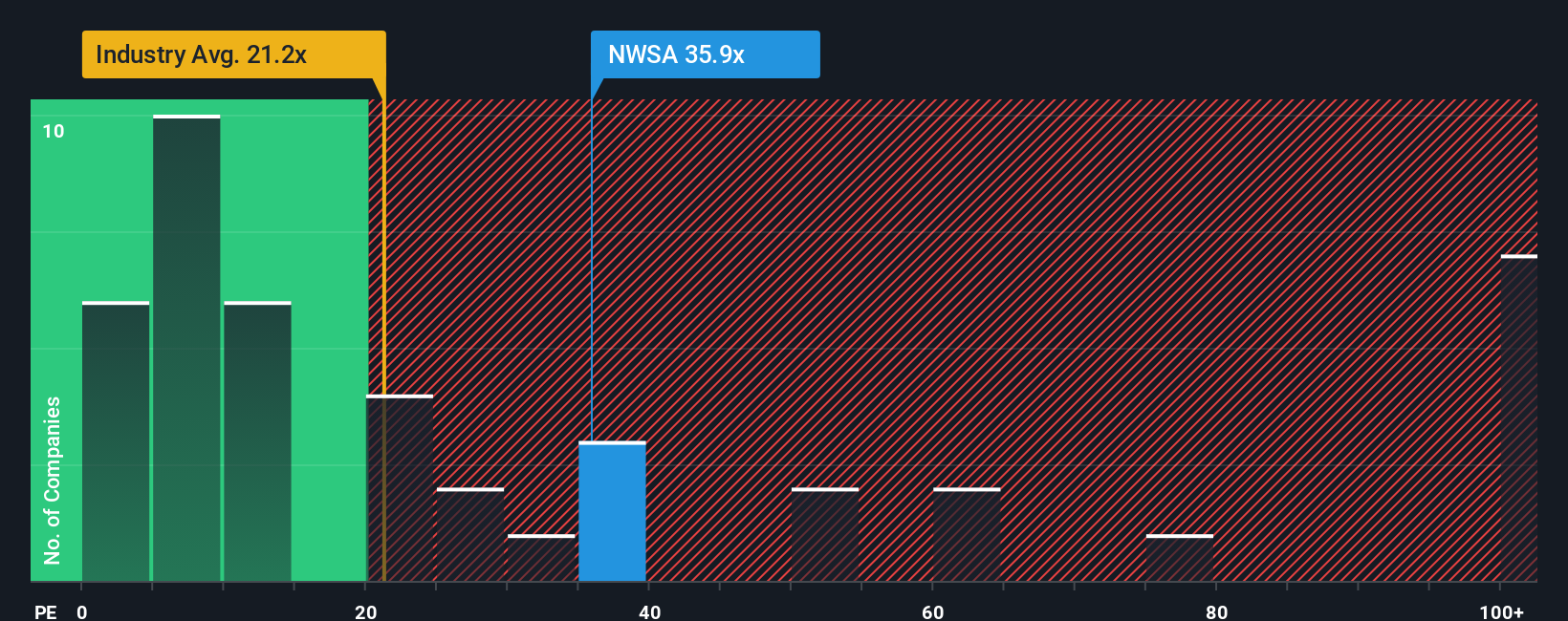

Looking at valuation from another angle, News trades at a price-to-earnings ratio of 29.8 times. This is noticeably higher than both its industry average of 16.1 times and peers at 16.9 times. Compared to the fair ratio of 20.6 times, this suggests the stock may be priced for high expectations. Does this raise the risk of a correction if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own News Narrative

If you want to put the numbers to the test or have a different perspective on News, you can shape your own analysis in minutes, your way Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding News.

Ready to Find Your Next Big Opportunity?

Don’t let today’s market momentum pass you by. Supercharge your strategy by acting on smarter investment ideas from Simply Wall Street’s powerful screeners below.

- Capture high yields as you assess these 15 dividend stocks with yields > 3%, tailored for income-focused investors seeking reliable payouts above 3%.

- Seize the edge in healthcare breakthroughs with these 30 healthcare AI stocks, spotlighting companies using artificial intelligence to revolutionize patient care.

- Capitalize on tomorrow’s tech trends and tap into these 26 AI penny stocks, packed with innovative leaders driving AI advancements in every sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if News might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWSA

News

A media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success