- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MOMO

Hello Group (NASDAQ:MOMO) earnings and shareholder returns have been trending downwards for the last five years, but the stock climbs 6.3% this past week

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Hello Group Inc. (NASDAQ:MOMO) share price dropped 77% over five years. That's not a lot of fun for true believers. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Hello Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Hello Group moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline. The revenue decline of around 1.4% would not have helped the stock price. So it seems weak revenue and dividend trends may have influenced the share price.

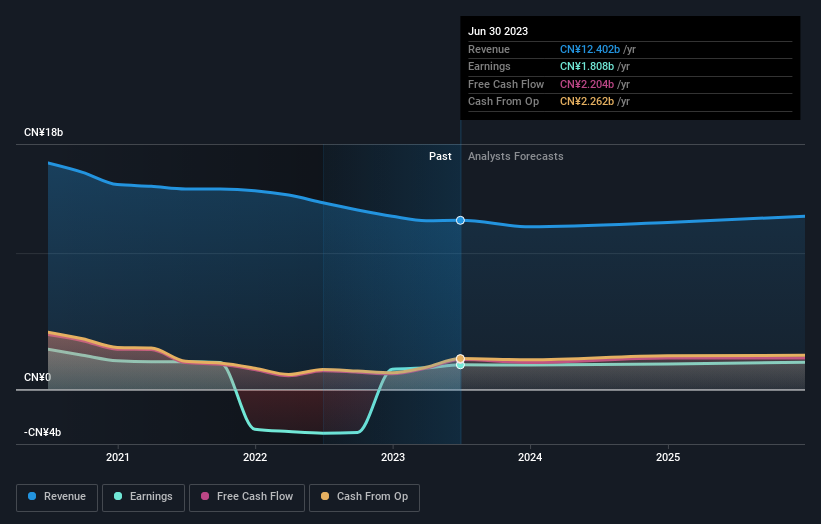

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Hello Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hello Group the TSR over the last 5 years was -69%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Hello Group shareholders have received a total shareholder return of 37% over one year. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Hello Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hello Group you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hello Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MOMO

Hello Group

Provides mobile-based social and entertainment services in the People’s Republic of China.

Flawless balance sheet and undervalued.