- United States

- /

- Media

- /

- NasdaqGS:MGNI

The Bull Case for Magnite (MGNI) Could Change Following Launch of Live Scheduler for Event Ad Management

Reviewed by Sasha Jovanovic

- On November 18, 2025, Magnite introduced Live Scheduler, an industry-first tool within its SpringServe platform designed to help media owners seamlessly plan, activate, and measure advertising around live events through a standardized framework.

- This launch establishes a new level of transparency and efficiency for live event ad management, directly addressing fragmentation in live streaming and enhancing value for both media owners and advertisers.

- We'll explore how Live Scheduler’s real-time ad planning capabilities may influence Magnite’s current investment narrative and future outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Magnite Investment Narrative Recap

To be a Magnite shareholder, you have to believe in the continued shift of advertising dollars from traditional TV to digital and connected TV (CTV), which Magnite seeks to capture through advancements like the new Live Scheduler. While this product could strengthen Magnite’s competitive edge in CTV by reducing fragmentation and boosting transparency, its impact on top-line growth and immediate margin expansion remains modest in the short term, especially given the ongoing customer concentration risk tied to large streamers.

Out of Magnite’s recent announcements, the Viant Technology integration with the SpringServe platform stands out. This partnership, announced November 6, further streamlines access for advertisers and amplifies transparency, complementing the goals of Live Scheduler and reinforcing Magnite’s role as a key independent platform in a market where agency and advertiser demand for clear, direct supply paths is rising.

In contrast, investors should be mindful of the risk posed by high customer concentration, particularly if a major CTV partner were to...

Read the full narrative on Magnite (it's free!)

Magnite's outlook anticipates $796.3 million in revenue and $189.5 million in earnings by 2028. This scenario requires 5.1% annual revenue growth and an increase in earnings of $146.4 million from the current $43.1 million.

Uncover how Magnite's forecasts yield a $28.19 fair value, a 108% upside to its current price.

Exploring Other Perspectives

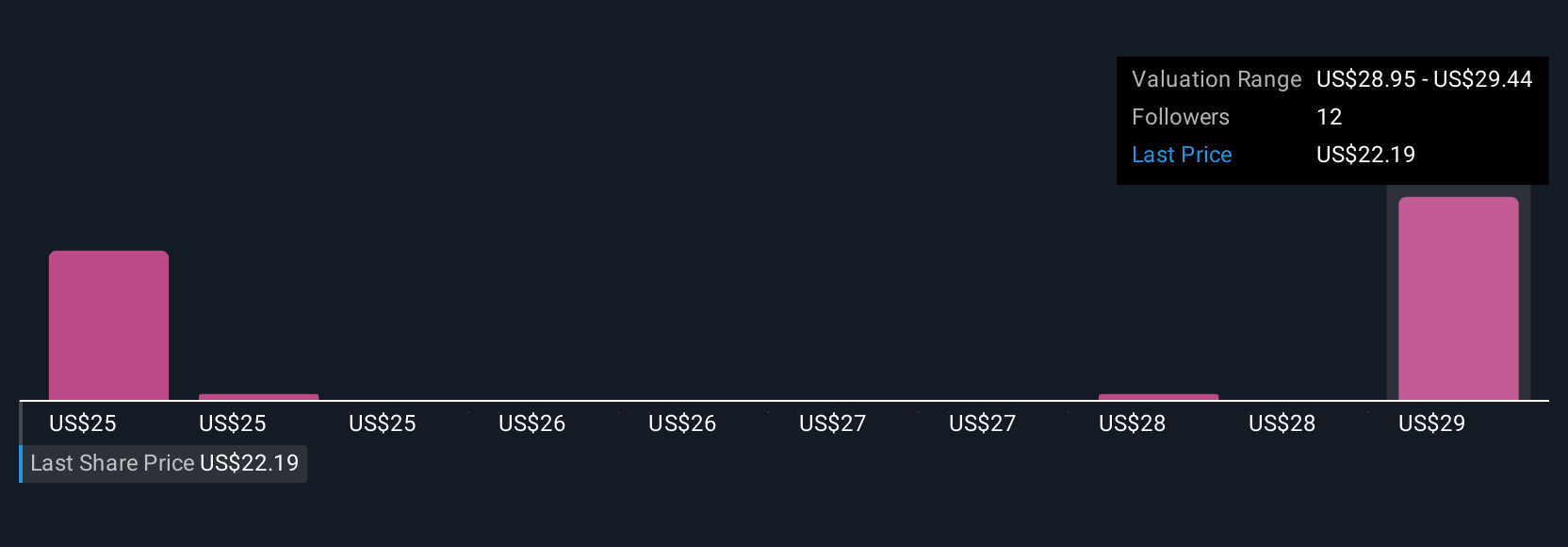

Simply Wall St Community members submitted five fair value estimates for Magnite, ranging from US$24.70 to US$42.07 per share. Considering these varied valuations, remember that customer concentration risk with major CTV streamers may shape Magnite’s future earnings profile in ways that several participants are focused on; see how opinions and forecasts differ.

Explore 5 other fair value estimates on Magnite - why the stock might be worth over 3x more than the current price!

Build Your Own Magnite Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magnite research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magnite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magnite's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives