- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite’s Valuation in Focus After 29.5% Annual Surge and Streaming Partnerships

Reviewed by Bailey Pemberton

- Wondering if Magnite is actually a bargain or if recent buzz is just hype? You are in good company, as many investors are digging deeper to figure out if the stock is undervalued right now.

- Despite a choppy stretch over the last month, with the share price dropping 11.3%, Magnite has still delivered a strong 29.5% gain over the past year and sits up 6.2% so far in 2024.

- Recent news coverage has zeroed in on Magnite’s growing role in connected TV advertising and its strategic partnerships with major streaming platforms. These updates have added fuel to ongoing debates about Magnite’s long-term place in the digital advertising ecosystem and may be driving renewed investor attention.

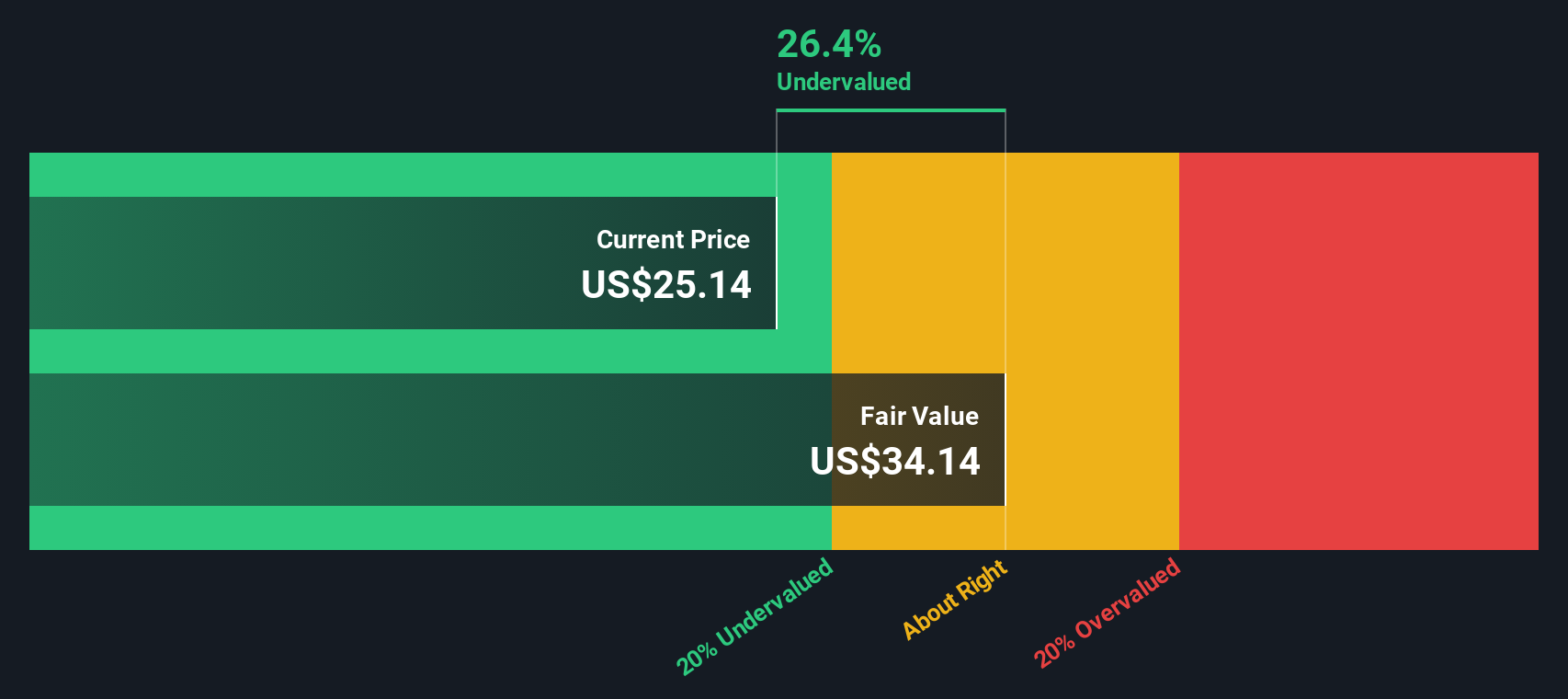

- On our valuation checks, Magnite scores a 4 out of 6, suggesting it could be undervalued by several measures. Next up, we will break down each approach, but as you will see soon, there is an even better way to look at a stock's real worth.

Approach 1: Magnite Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This gives investors an idea of what the business is truly worth if it continues along current growth expectations.

For Magnite, the DCF uses the 2 Stage Free Cash Flow to Equity approach. Currently, the company generates $175.49 million in free cash flow annually. Analysts have provided estimates up to five years ahead. For longer-term forecasts, Simply Wall St extrapolates further using industry growth trends. According to these projections, Magnite's annual free cash flow could climb to $867.69 million by 2035.

After applying the discount rate to these projected cash flows, the model calculates an intrinsic value of $115.82 per share. Based on the current price, the DCF implies that Magnite is trading at an 85.2% discount. This means the stock is significantly undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Magnite is undervalued by 85.2%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Magnite Price vs Earnings (PE)

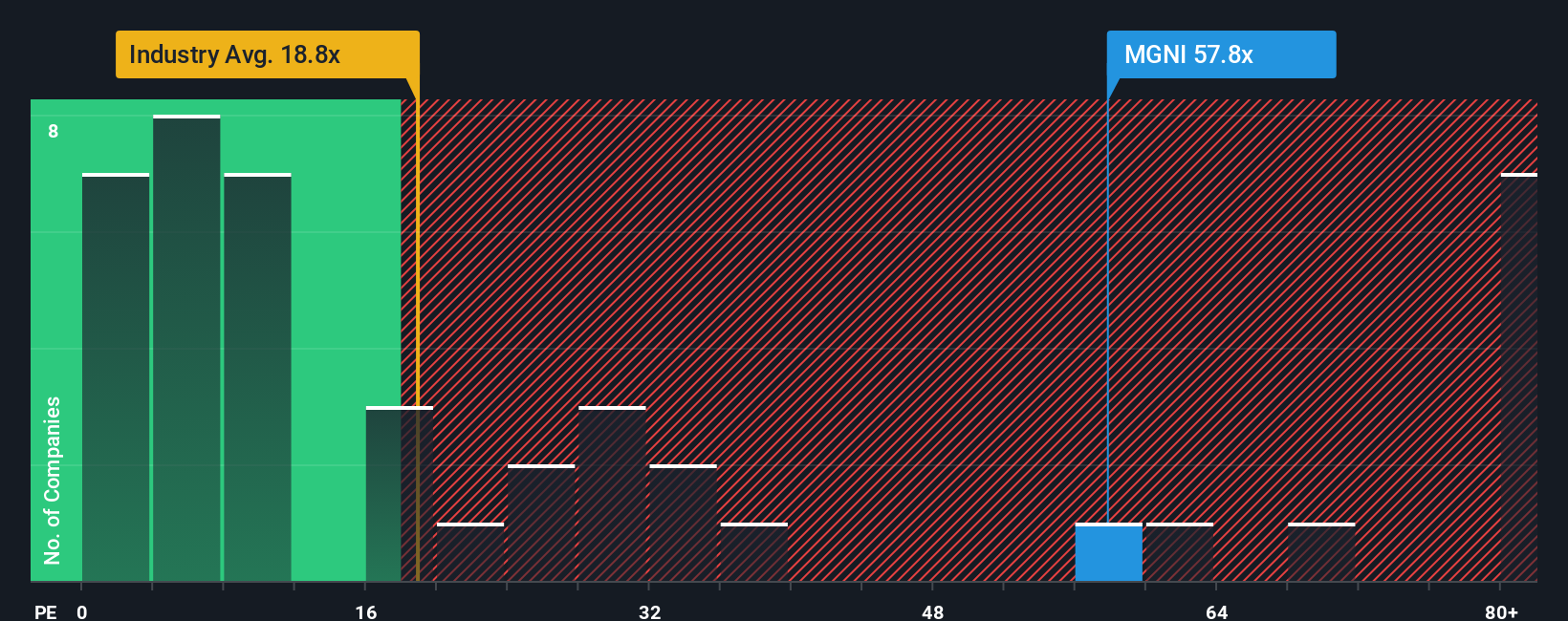

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for companies that are consistently profitable like Magnite. It allows investors to assess how much they are paying for each dollar of the company’s earnings, making it a practical tool for comparing potential investments.

A "normal" or "fair" PE ratio can vary depending on expectations for future growth, the perceived risk level, and how the company compares to industry peers. Higher growth companies or those with lower risks often command higher PE multiples, while riskier or slower-growing businesses usually trade at a discount.

Magnite currently trades at a PE ratio of 56.46x. This is above the industry average PE of 17.49x, but below the peer average of 63.34x. However, instead of just looking at these benchmarks, Simply Wall St calculates a proprietary "Fair Ratio." For Magnite, this Fair Ratio is 27.27x. This figure reflects tailored factors such as the company’s earnings growth outlook, profit margin, its place in the Media sector, its market capitalization, and stock-specific risks.

The Fair Ratio approach helps investors move beyond simple comparisons with peers and industry averages by factoring in all the key drivers of valuation. It aims to align expectations with the company’s actual characteristics, making it a practical way to judge whether a stock’s price is justified.

Comparing Magnite’s current PE ratio of 56.46x to its Fair Ratio of 27.27x, the stock appears overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Magnite Narrative

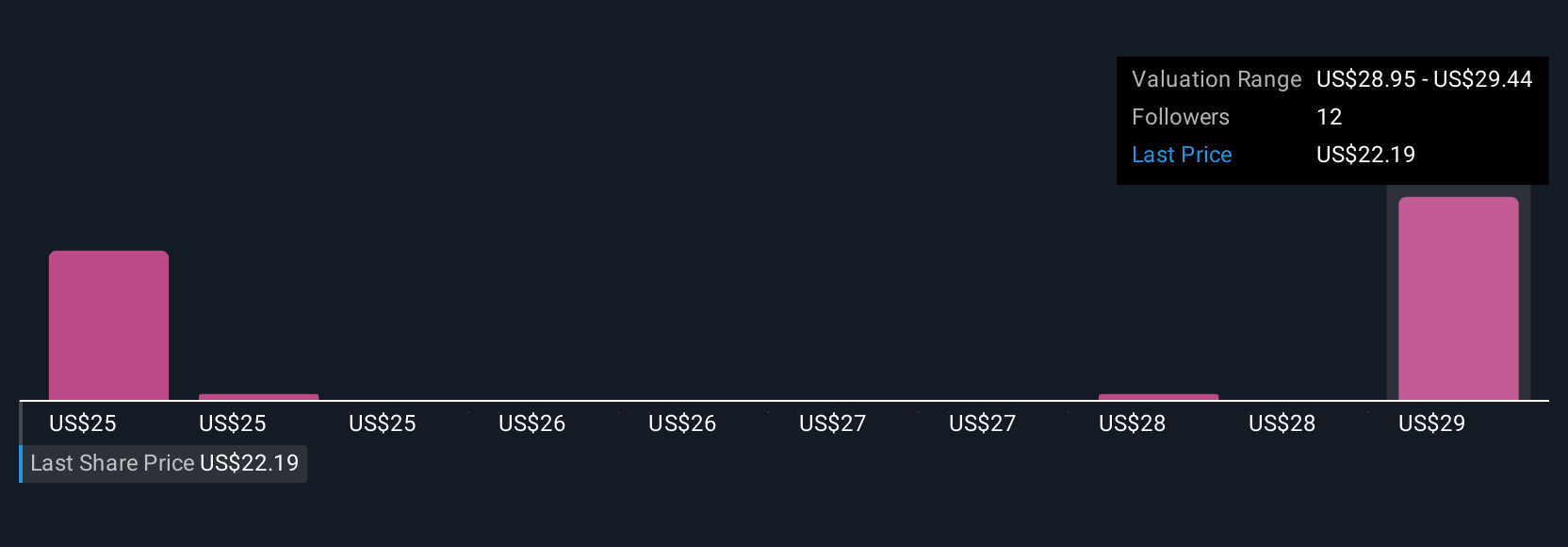

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are a simple, powerful tool that let you set your own perspective on a company’s future by combining your assumptions for revenue, earnings, and profit margins with your view of what the business can achieve. Each Narrative connects a company’s real-world story, such as upcoming partnerships, market shifts, or regulatory changes, to a tailored financial forecast, translating your big-picture thesis into a fair value estimate for the stock.

On Simply Wall St, Narratives are available to all investors in the Community page and are used by millions to see how their outlook compares to others. Narratives make it easy to decide whether to buy, hold, or sell. Simply compare your Fair Value (based on your Narrative) to the current market Price, and adjust as news or earnings updates come in because Narratives are updated dynamically when new information is released.

For example, when it comes to Magnite, some investors in the Community see strong growth from streaming and project a Fair Value over $39.00 per share, while others factor in industry headwinds and set a more conservative Fair Value closer to $24.00. This shows how Narratives capture a wide range of perspectives in real time.

Do you think there's more to the story for Magnite? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives