- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

The Bull Case For Meta Platforms (META) Could Change Following Vishal Shah’s Appointment to Lead AI Division

Reviewed by Sasha Jovanovic

- In late October 2025, Meta Platforms appointed Vishal Shah as head of product management for its AI Division, as CEO Mark Zuckerberg signaled greater focus on artificial intelligence to compete with key industry players.

- This leadership change arrives ahead of Meta’s scheduled AI summit presentations and follows expanding partnerships in renewable energy to power its growing data center operations.

- We'll explore how the appointment of Vishal Shah to lead AI product management could impact Meta's long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Meta Platforms Investment Narrative Recap

To be a Meta Platforms shareholder today, you need to believe in the company’s ability to translate massive investments in AI infrastructure and talent into sustained user engagement and scalable advertising revenue, despite elevated capital outlays and fierce competition. The recent appointment of Vishal Shah as head of AI product management reinforces Meta’s commitment to innovation but does not materially change the main short-term catalyst, progress in AI-driven advertising, or the biggest risk, which remains margin pressure from heavy spending. Among recent announcements, Meta’s expanded renewable energy agreements in Texas stand out. These power purchase agreements support the growing energy requirements of Meta’s data centers, directly aligned with its long-term AI ambitions, and may bolster the company’s ability to support next-generation computing and ad platforms. Yet, despite these bold moves, one risk investors should be acutely aware of is rising costs potentially outpacing revenue growth, especially if…

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms' outlook anticipates $275.9 billion in revenue and $92.1 billion in earnings by 2028. This projection relies on a 15.6% annual revenue growth rate and a $20.6 billion earnings increase from the current $71.5 billion.

Uncover how Meta Platforms' forecasts yield a $848.43 fair value, a 36% upside to its current price.

Exploring Other Perspectives

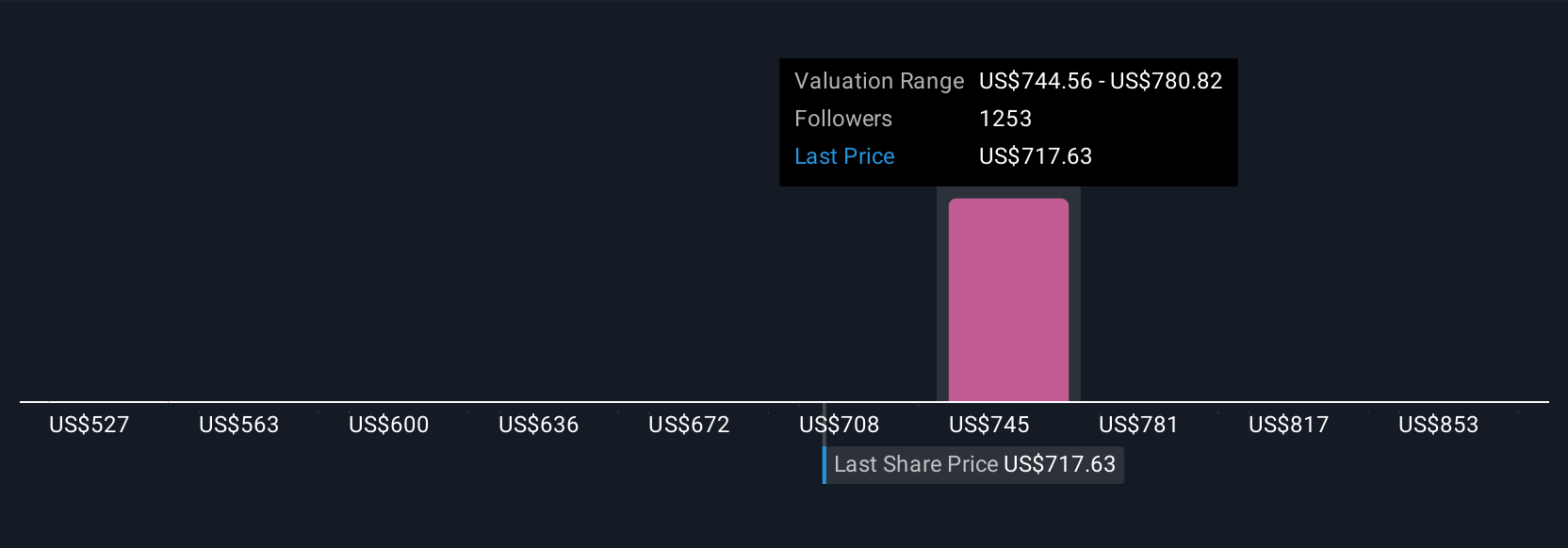

Simply Wall St Community members provided 103 fair value estimates for Meta, spanning US$538 to over US$1,136 per share. Still, with the company’s expense growth in focus, your outlook could differ widely depending on expectations for future profitability and execution risk.

Explore 103 other fair value estimates on Meta Platforms - why the stock might be worth 13% less than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives