- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Does the Recent 16% Pullback Signal Opportunity in Meta Platforms for 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Meta Platforms is fairly priced right now, or if there is hidden value the market might be missing? You're in the right place for a clear-cut look at where the stock stands.

- Although shares have seen a dip of 4.7% over the last week and are off 16.0% for the month, Meta is still up 0.5% year-to-date and has notched an impressive 8.9% gain over the past year.

- There's been buzz recently about Meta's intensified push into AI technology and new virtual reality features, which has attracted investor attention and sparked both optimism and debate. Ongoing regulatory discussions around digital advertising are also featuring prominently, adding some extra uncertainty to the mix.

- Meta Platforms scores a solid 5 out of 6 on the main undervaluation checks. This sets up a deeper dive into what the valuation numbers are really saying, and provides a perspective that goes beyond the usual metrics.

Find out why Meta Platforms's 8.9% return over the last year is lagging behind its peers.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present. This method helps investors determine how much those future earnings are worth today. It provides a fundamental lens to assess whether a stock may be under- or overvalued.

For Meta Platforms, the latest reported Free Cash Flow (FCF) stands at $58.81 billion. Analysts forecast Meta’s annual FCF to grow significantly, with estimates suggesting a jump to $97.00 billion by 2029. Extrapolations continue to show growth beyond that period. While analysts only supply forecasts for five years, Simply Wall St projects free cash flows even further using their in-house model, providing a more comprehensive long-term perspective.

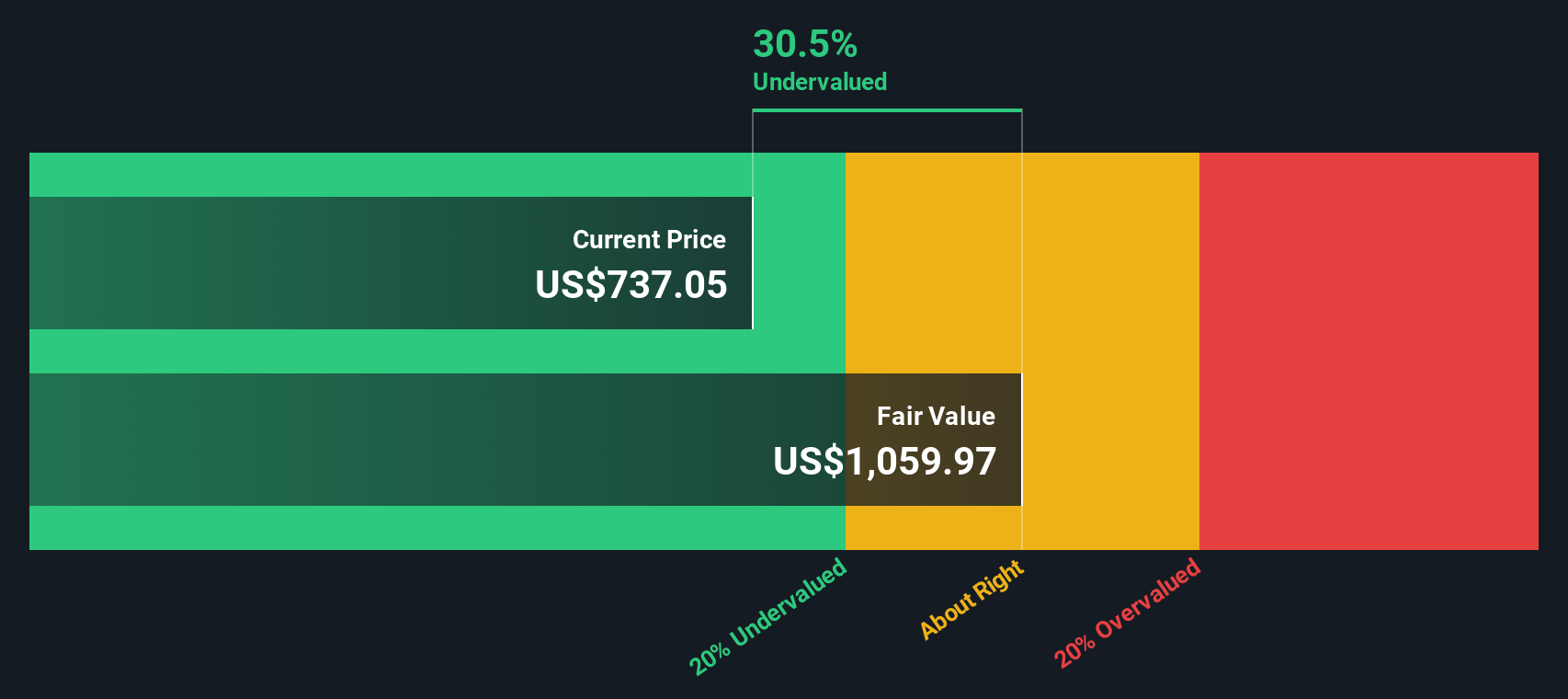

According to the 2 Stage Free Cash Flow to Equity approach, Meta Platforms’ estimated intrinsic value per share is $1,081.44. When compared to the current share price, this suggests that Meta’s stock is approximately 44.3% undervalued based on DCF projection.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 44.3%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Meta Platforms Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is one of the most widely used measures for valuing profitable companies like Meta Platforms. It provides a snapshot of how much investors are willing to pay for each dollar of current earnings, making it especially relevant when a company is generating consistent profits.

Growth expectations and risk play a big role in determining what a "normal" or "fair" PE ratio should be. Companies with higher growth prospects or lower perceived risk tend to justify higher PE ratios, while slower-growing or riskier businesses usually trade at lower multiples.

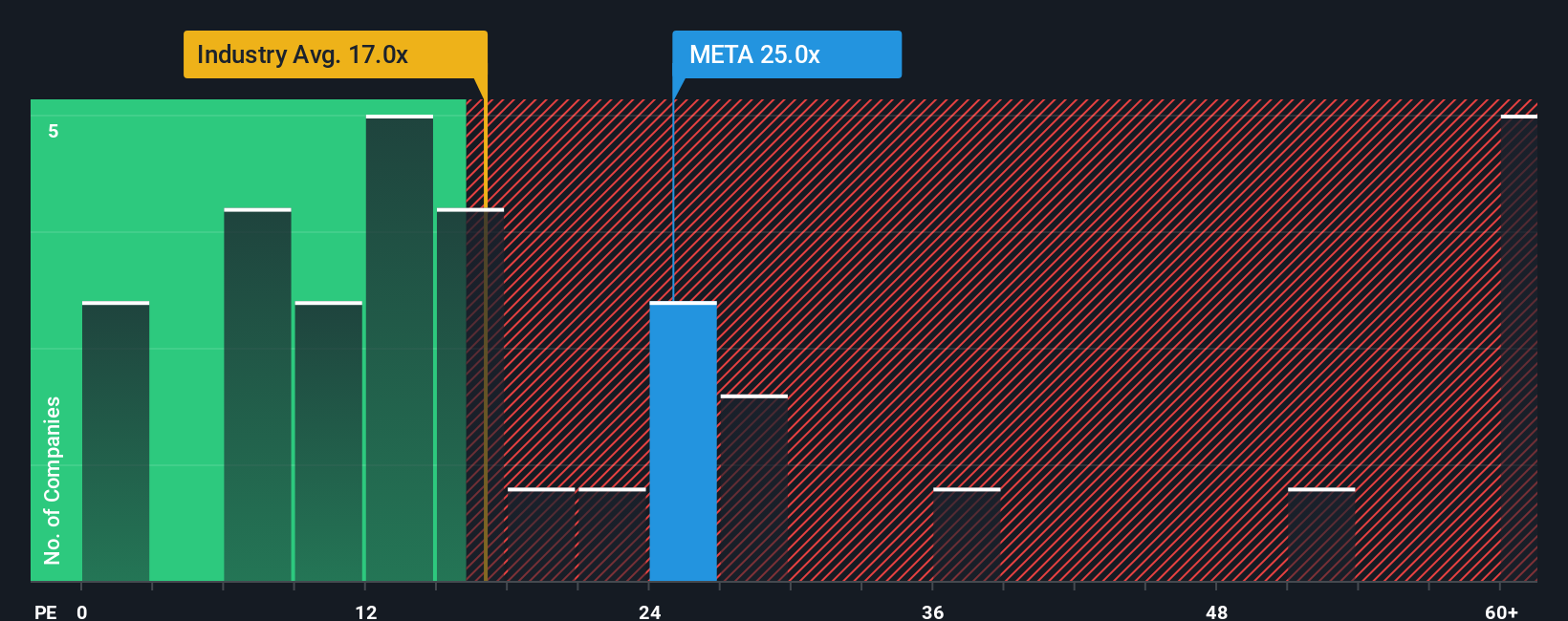

Meta Platforms currently trades at a PE ratio of 25.9x. This sits above the Interactive Media and Services industry average of 16.6x, but below the peer group average of 35.9x. This reflects Meta's strong profitability and perceived stability, yet also some investor caution amid recent market volatility.

Simply Wall St introduces the “Fair Ratio,” a tailored valuation multiple that adjusts for factors like earnings growth, profit margins, industry, market cap and risk. For Meta Platforms, the Fair Ratio stands at 40.1x, indicating that the company has fundamentals meriting a higher multiple than both the industry and most peers. The Fair Ratio goes beyond simple benchmarking by factoring in future potential and the unique risk profile of Meta.

With Meta's current PE of 25.9x versus a Fair Ratio of 40.1x, the stock appears undervalued on this metric, as its market price does not reflect its strong underlying fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

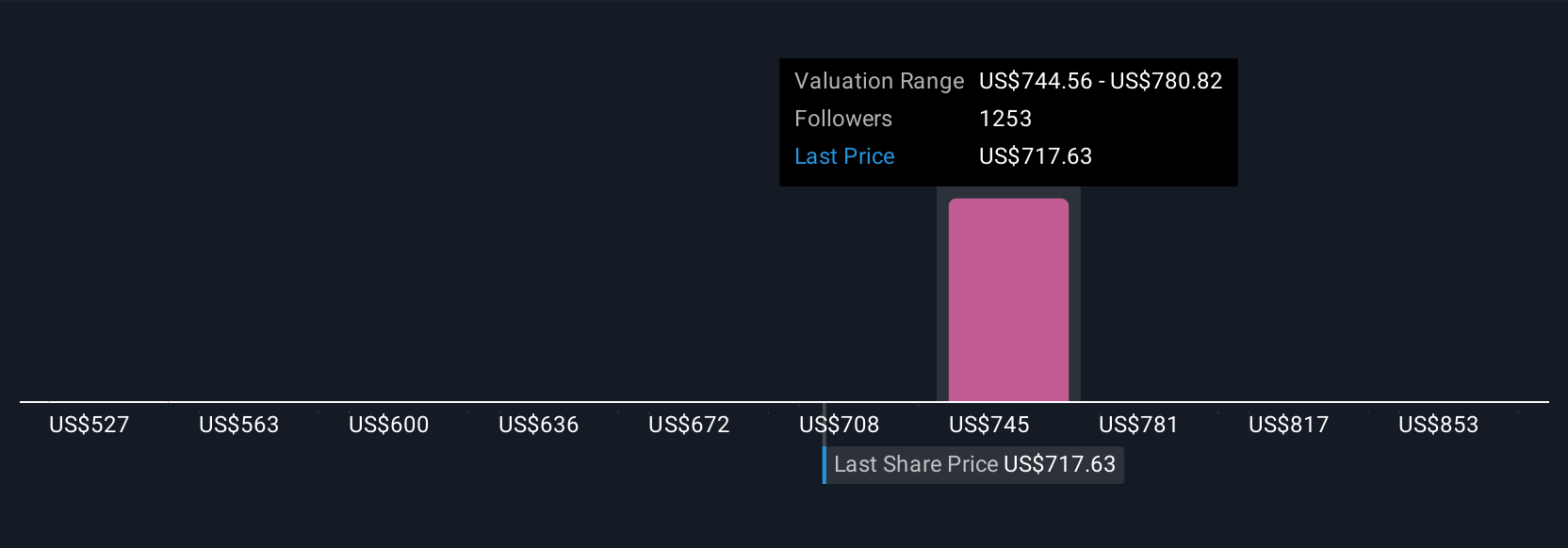

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story or perspective about a company. It connects what you believe about Meta Platforms’ future (its products, revenue, margins, and risks) with a financial forecast and a calculated fair value. Unlike traditional models, Narratives let you articulate your viewpoint directly through the numbers, making your assumptions clear and actionable.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to build and share their investment theses. Narratives help you decide when to buy or sell by showing if your fair value is above or below the current price, and they automatically update with every new earnings report or major news item.

For example, one Meta Platforms Narrative projects a bold fair value of $1,086 per share based on rapid AI revenue growth, while a more cautious Narrative pegs fair value at $658, expecting margin pressures and regulatory headwinds. By creating or following Narratives, you can compare your logic with others and quickly see how new information alters the investment story. This approach can support smarter, more dynamic decisions in a changing market.

For Meta Platforms, we will make it easy for you with previews of two leading Meta Platforms Narratives:

- 🐂 Meta Platforms Bull Case

Fair Value: $841.42

Undervalued by: 28.4%

Expected Revenue Growth Rate: 16.5%

- AI-driven ad targeting and platform innovations are expected to drive improved user engagement, ad performance, and diversified revenue streams.

- Ongoing investments in AI infrastructure, digital commerce, and messaging monetization position Meta for durable revenue growth and a strong competitive moat.

- Key risks include rising capital expenditures for AI, uncertain metaverse monetization timelines, regulatory headwinds, and intense competition in digital content and advertising.

- 🐻 Meta Platforms Bear Case

Fair Value: $538.09

Overvalued by: 11.9%

Expected Revenue Growth Rate: 10.5%

- Revenue diversification continues through Reality Labs and innovations in AR/VR. Meta’s aggressive AI investments bring rising costs and uncertain payoff timelines.

- AI-driven advertising growth is promising, yet the overall business remains heavily dependent on the core ad segment and exposed to global economic pressures as well as digital advertising headwinds.

- Significant regulatory scrutiny, execution risk in metaverse initiatives, and high ongoing capital expenditures may limit margin expansion and predictability of future returns.

Do you think there's more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives