- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Did Yann LeCun's Planned Exit Just Shift Meta Platforms' (META) AI Trajectory?

Reviewed by Sasha Jovanovic

- Meta Platforms announced that Yann LeCun, its Vice President & Chief AI Scientist and a key architect of the company’s AI leadership, will leave at the end of 2025 to start a new artificial intelligence venture.

- Just days prior, Articul8 disclosed its selection by AWS and Meta for the exclusive AWS Startups: Building with Llama program, spotlighting Meta’s open-source Llama ecosystem as a core technology powering advanced, industry-specific generative AI solutions.

- We’ll explore how LeCun’s planned departure may influence Meta’s evolving artificial intelligence ambitions and overall investment case.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Meta Platforms Investment Narrative Recap

To invest in Meta Platforms, you need to believe that the company’s heavy bets on AI, digital advertising, and platform engagement will ultimately boost revenue and profit, despite the risks from rising costs, regulatory pressures, and execution challenges in speculative ventures like the metaverse. The announced departure of Yann LeCun, while symbolically significant given his pivotal AI leadership, does not appear to meaningfully change Meta’s most immediate catalysts (AI-driven advertising, engagement) or top risks (cost growth, regulatory hurdles) in the short term. One relevant announcement is Meta’s selection of Articul8 for the AWS Startups: Building with Llama program, which highlights the ongoing business value and industry use cases built on Meta’s open-source Llama AI ecosystem. This underscores how Meta’s AI strategy is becoming increasingly integral to both external partnerships and platform innovation, supporting its core growth catalysts around AI-powered personalization and advertising. However, investors should also consider that even with robust AI pipelines and strong user engagement, there remains significant risk if expense growth for advanced AI and data infrastructure outpaces revenue, threatening margins and free cash flow over time...

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms' outlook anticipates $275.9 billion in revenue and $92.1 billion in earnings by 2028. This is predicated on forecast annual revenue growth of 15.6% and an earnings increase of $20.6 billion from current earnings of $71.5 billion.

Uncover how Meta Platforms' forecasts yield a $841.42 fair value, a 42% upside to its current price.

Exploring Other Perspectives

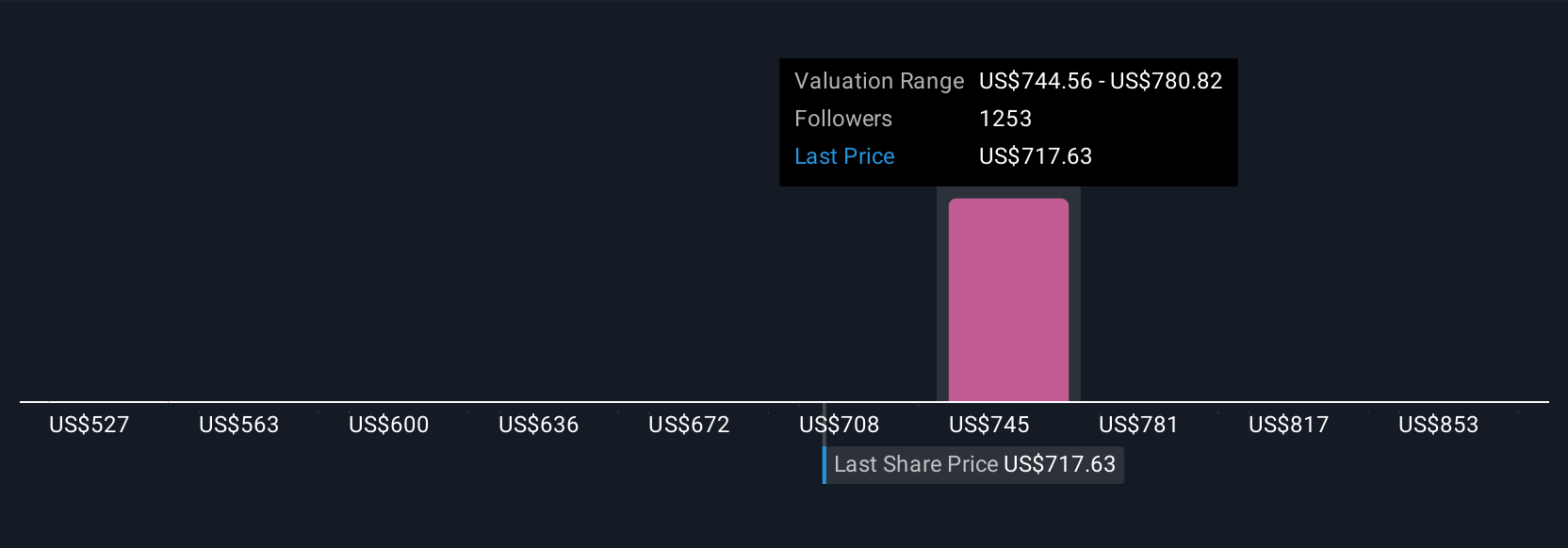

More than 100 fair value estimates from the Simply Wall St Community span US$538 to US$1,082 per share. With so much debate among retail investors and rising spending on AI infrastructure, the range of outlooks is worth exploring as you consider the company’s future path.

Explore 102 other fair value estimates on Meta Platforms - why the stock might be worth 9% less than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives