- United States

- /

- Media

- /

- NasdaqGS:LEE

Shareholders in Lee Enterprises (NASDAQ:LEE) have lost 67%, as stock drops 11% this past week

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Lee Enterprises, Incorporated (NASDAQ:LEE) shareholders. Unfortunately, they have held through a 67% decline in the share price in that time. And over the last year the share price fell 25%, so we doubt many shareholders are delighted. Furthermore, it's down 34% in about a quarter. That's not much fun for holders.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Lee Enterprises

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Lee Enterprises has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

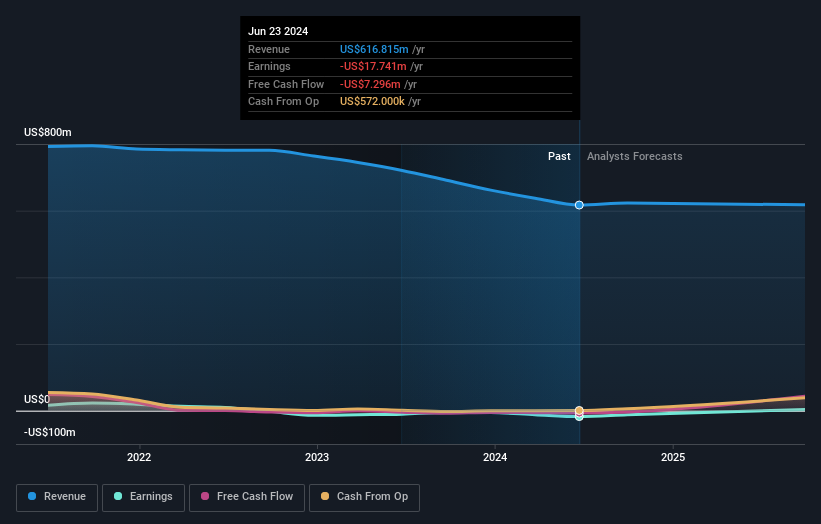

Arguably the revenue decline of 8.3% per year has people thinking Lee Enterprises is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Lee Enterprises' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Lee Enterprises had a tough year, with a total loss of 25%, against a market gain of about 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Lee Enterprises (1 is a bit unpleasant) that you should be aware of.

Of course Lee Enterprises may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LEE

Lee Enterprises

Provides local news and information, and advertising services in the United States.

Undervalued low.