- United States

- /

- Media

- /

- NasdaqGS:LBRD.K

Why Liberty Broadband (LBRD.K) Is Down 5.6% After Exit From Video and Impairment-Driven Losses

Reviewed by Sasha Jovanovic

- Liberty Broadband Corporation reported its third-quarter 2025 results, recording a net loss of US$154 million compared to net income of US$142 million a year earlier as revenues declined and a significant impairment charge was recognized.

- The company exited its video business to focus on broadband and wireless, while launching a US$300 million rights offering and securing over US$140 million in expansion grants to support its shift in operational priorities.

- We’ll consider how the impairment charge and increased capital-raising reflect on Liberty Broadband’s future growth and overall investment outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Liberty Broadband Investment Narrative Recap

To be a Liberty Broadband shareholder today, you need confidence in its transition to a pure-play broadband and wireless provider, and in the long-term value tied to Charter Communications. The latest quarterly loss, driven by a sizable impairment charge and lower revenue, has drawn attention to execution risk from the business shift, while share performance underscores that the Charter acquisition remains the primary short-term catalyst and the company’s dependency on Charter exposure is the central risk; the impact from these announced Q3 results is material to both. Among Liberty Broadband’s recent moves, the launch of a US$300 million rights offering stands out in connection with its revised strategy, boosting liquidity and flexibility for broadband initiatives at a critical moment as it moves past its video business and prepares for the next stage tied to the Charter merger. However, in contrast to headline catalysts, investors should be aware of ongoing regulatory and competitive pressures that...

Read the full narrative on Liberty Broadband (it's free!)

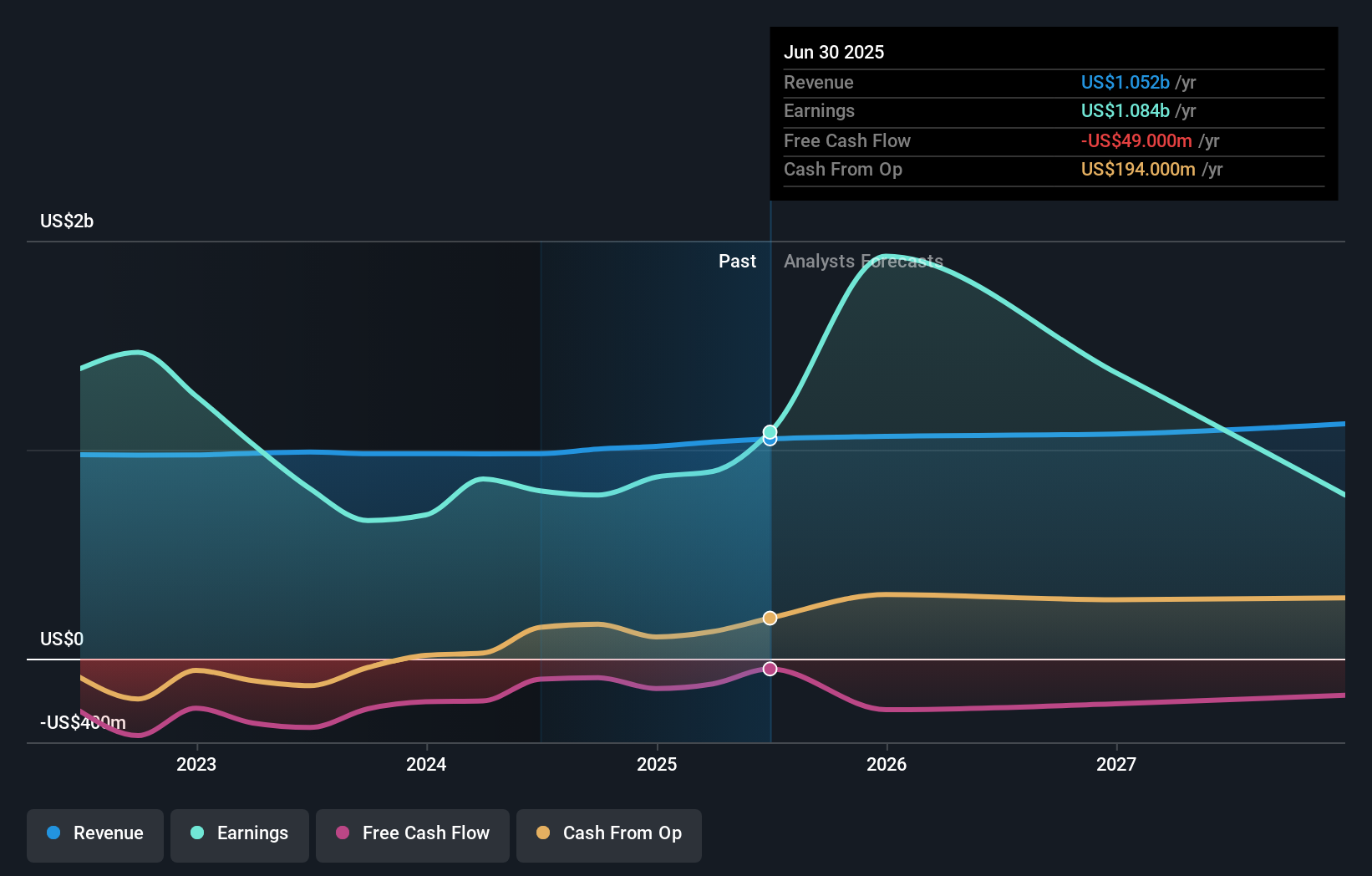

Liberty Broadband is projected to generate $1.1 billion in revenue and $778.5 million in earnings by 2028. This outlook implies 2.6% annual revenue growth and a decrease in earnings of $321.5 million from the current $1.1 billion level.

Uncover how Liberty Broadband's forecasts yield a $99.00 fair value, a 97% upside to its current price.

Exploring Other Perspectives

Private investor fair value estimates for Liberty Broadband on Simply Wall St cluster between US$83 and US$99 per share from only two viewpoints. Strong reliance on Charter presents an ongoing risk that could shape future outcomes, so be sure to consider alternative analyses and opinions when forming your own outlook.

Explore 2 other fair value estimates on Liberty Broadband - why the stock might be worth just $83.00!

Build Your Own Liberty Broadband Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liberty Broadband research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Liberty Broadband research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liberty Broadband's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LBRD.K

Liberty Broadband

Engages in a range of communications businesses in the United States.

Proven track record and fair value.

Market Insights

Community Narratives