Stock Analysis

- United States

- /

- Media

- /

- NasdaqGS:LBRD.K

Fewer Investors Than Expected Jumping On Liberty Broadband Corporation (NASDAQ:LBRD.K)

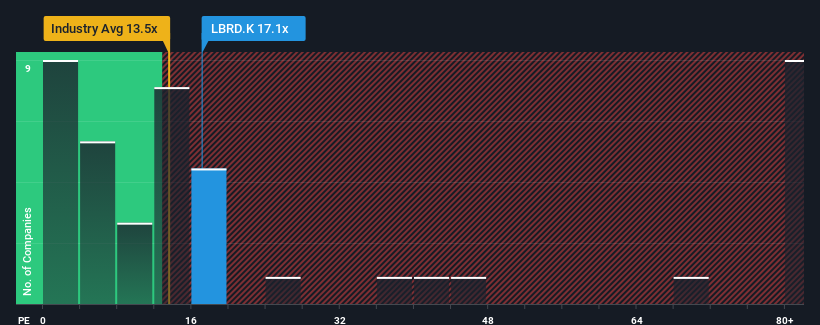

It's not a stretch to say that Liberty Broadband Corporation's (NASDAQ:LBRD.K) price-to-earnings (or "P/E") ratio of 17.1x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Liberty Broadband has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Liberty Broadband

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Liberty Broadband's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 50%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 265% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 63% over the next year. Meanwhile, the rest of the market is forecast to only expand by 10%, which is noticeably less attractive.

In light of this, it's curious that Liberty Broadband's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Liberty Broadband's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Liberty Broadband's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Liberty Broadband (of which 1 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on Liberty Broadband, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Liberty Broadband is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LBRD.K

Slightly overvalued with questionable track record.