- United States

- /

- Entertainment

- /

- NasdaqGS:IQ

iQIYI (NasdaqGS:IQ): A Fresh Look at Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

iQIYI (NasdaqGS:IQ) shares have pulled back over the past week, catching the eye of investors tracking media stocks. The recent move prompts a closer look at the company’s current valuation and fundamentals in light of recent trading patterns.

See our latest analysis for iQIYI.

After rallying earlier in the year, iQIYI’s share price momentum has cooled in recent weeks. Despite a solid 90-day share price return of 18.23%, the one-year total shareholder return stands at -8.55%, reflecting that enthusiasm has pulled back as investors weigh up recent risk and reward signals for the business.

If you’re following shifts in the media space, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With fundamentals showing modest growth but the share price still well below its five-year high, the key question remains: is iQIYI undervalued at current levels or is the market already factoring in its future prospects?

Most Popular Narrative: 12.3% Undervalued

Compared to the recent close at $2.14, the most widely followed analyst narrative suggests iQIYI’s fair value is higher at $2.44. This gap hints that investors may not be fully appreciating some emerging trends.

"Heavy reliance on costly hit content, economic headwinds, and fierce competition threaten revenue stability, margin growth, and successful international expansion. Catalysts: About iQIYI: Through its subsidiaries, provides online entertainment video services in the People’s Republic of China. What are the underlying business or industry changes driving this perspective?"

Curious what could drive the next re-rating of iQIYI? The narrative leans on a set of bold profitability forecasts and an anticipated margin surge that could surprise the market. Want to see which underlying assumptions power this premium valuation? Take a closer look at the full story.

Result: Fair Value of $2.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained declines in core membership and advertising revenue, along with high content costs, could present challenges to iQIYI's margin recovery and future growth narrative.

Find out about the key risks to this iQIYI narrative.

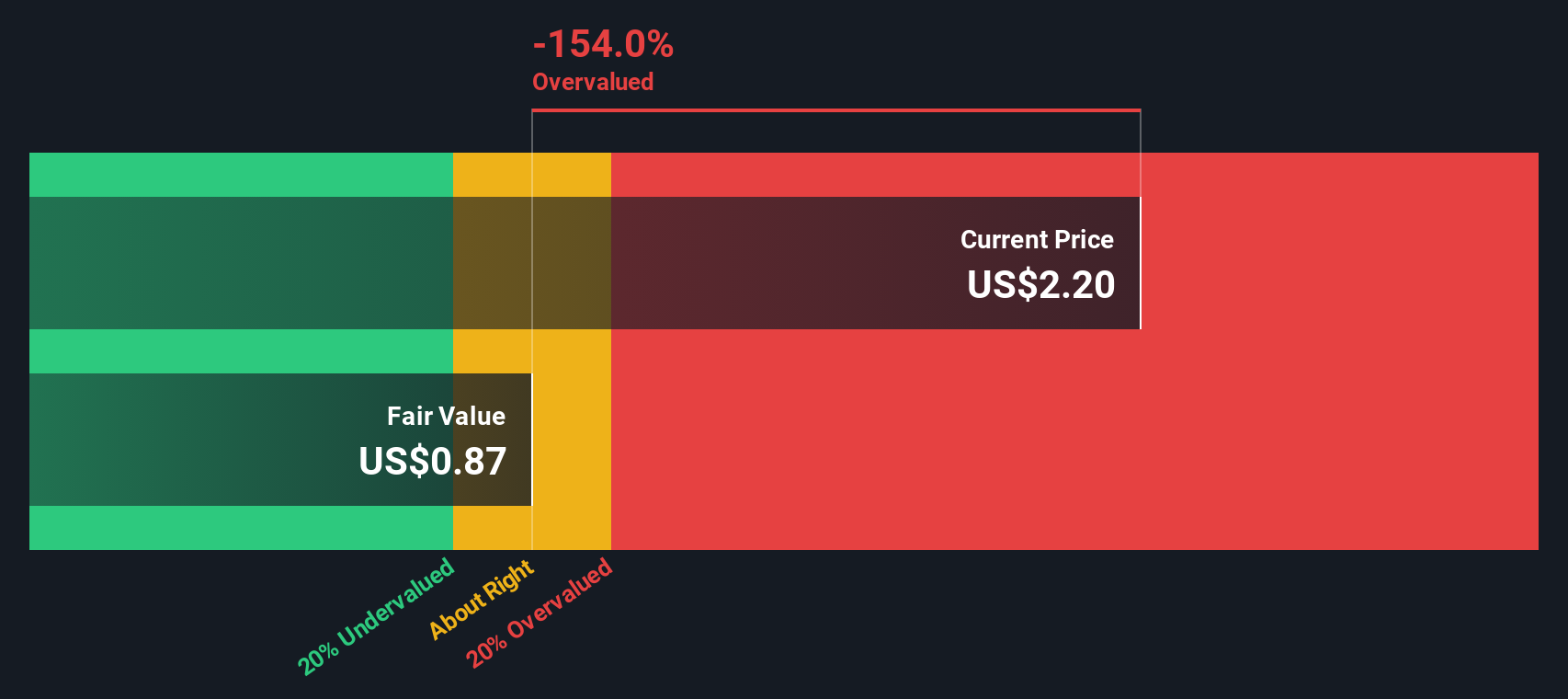

Another View: Discounted Cash Flow Model

Taking a different approach, our SWS DCF model suggests that iQIYI might actually be overvalued, with a calculated fair value of just $0.87 compared to the current price of $2.14. This model weighs projected future cash flows rather than analyst forecasts or earnings multiples. It offers a conservative perspective. Does this highlight overlooked risks, or is the market seeing something the model cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out iQIYI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own iQIYI Narrative

If you have a different viewpoint or enjoy independent analysis, you can dig into the numbers yourself and shape your own story in just minutes. Do it your way

A great starting point for your iQIYI research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait for the next big story to pass you by. Tap into fresh investment ideas that could reshape your portfolio using the Simply Wall Street Screener.

- Unlock the potential of undervalued companies by reviewing these 875 undervalued stocks based on cash flows poised for growth based on strong cash flow metrics.

- Target steady cash returns and boost your income with these 16 dividend stocks with yields > 3% offering yields above 3%.

- Capitalize on the rise of artificial intelligence by checking out these 25 AI penny stocks that are pushing the boundaries of technology and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iQIYI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IQ

iQIYI

Through its subsidiaries, provides online entertainment video services in the People’s Republic of China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives