- United States

- /

- Media

- /

- NasdaqGM:GAMB

Has GAMB’s 54% Drop Created an Opportunity After Recent Regulatory Uncertainty?

Reviewed by Bailey Pemberton

- Wondering if Gambling.com Group is a golden opportunity trading below its fair value, or if the recent turbulence has put the stock in the bargain bin? Let’s take a closer look at what is really behind the current price.

- Shares have slipped by 6.7% over the last week and are down a hefty 54.6% year-to-date, highlighting how much sentiment and perceived risk can shift for this stock.

- Ongoing discussions surrounding digital gambling legislation and increased competition in the affiliate marketing space have stirred the pot. These factors are prompting investors to re-evaluate their outlook. Regulatory updates in key U.S. states and evolving strategic partnerships continue to dominate headlines, adding to both excitement and uncertainty.

- Despite the ups and downs, Gambling.com Group currently scores an impressive 6 out of 6 on our valuation checks, suggesting the potential for upside if the market is being too pessimistic. Next, we will break down how different valuation models frame the company’s fair value, and stick around to see our favorite way to cut through the noise.

Find out why Gambling.com Group's -33.9% return over the last year is lagging behind its peers.

Approach 1: Gambling.com Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to today’s value. This approach gives investors a view of what the business could be worth based on its ability to generate cash over time.

For Gambling.com Group, the latest reported Free Cash Flow (FCF) stands at $29.3 million. Analysts forecast steady annual growth, with projections reaching $131.1 million by 2035. Estimates for the next five years are based on analyst forecasts, while years beyond that are extrapolated by Simply Wall St.

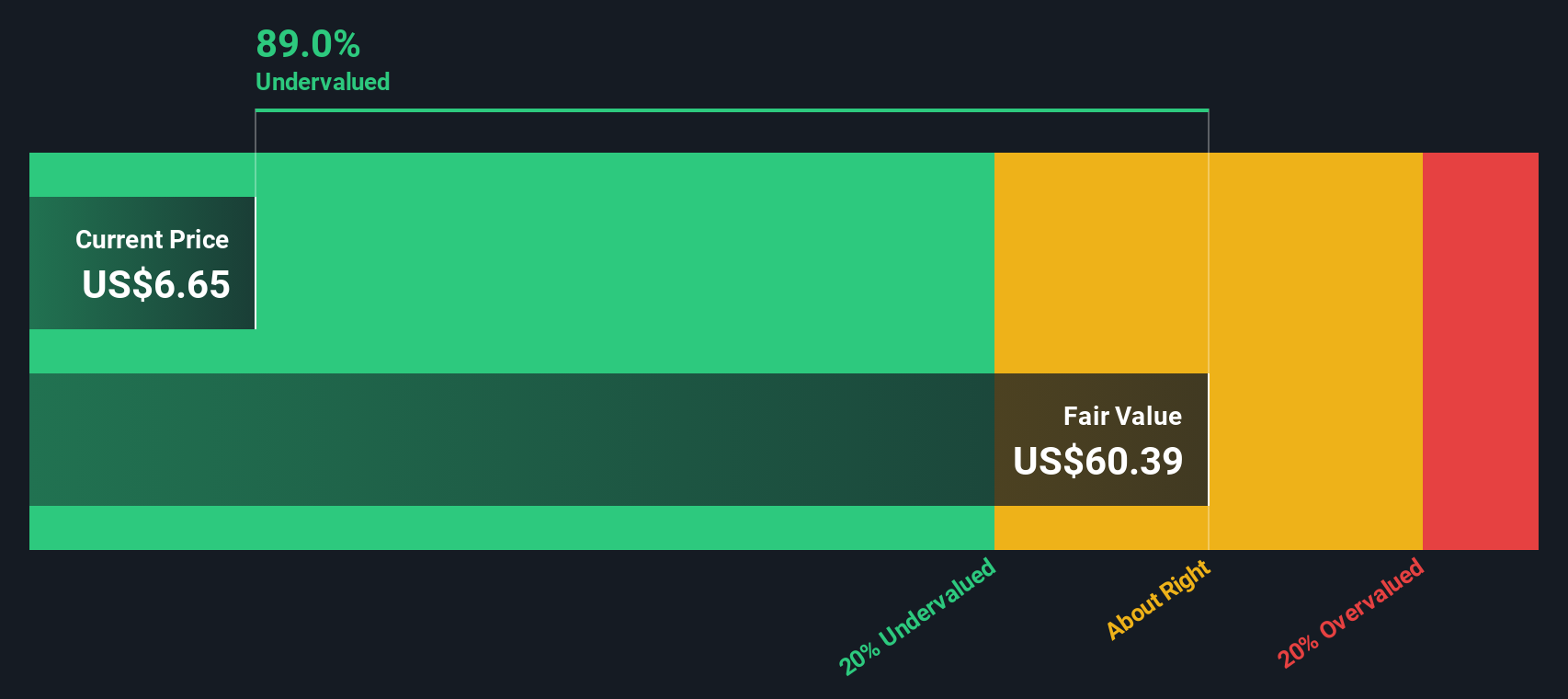

Using the 2 Stage Free Cash Flow to Equity method, the model concludes that the company’s intrinsic value is $60.33 per share. When compared to the current market price, this suggests the stock is trading at an 89.0% discount to its underlying worth, which signals a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gambling.com Group is undervalued by 89.0%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Gambling.com Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a useful way to value established, profitable companies like Gambling.com Group because it directly relates the market price of the stock to its actual earnings. A lower PE can signal a bargain if the company is expected to grow, while a higher PE may be justified if the business has strong growth prospects and low risk.

Gambling.com Group currently trades at a PE ratio of 16.6x. For context, the industry average stands at 16.6x, and the peer group is at a much higher 64.3x. This puts GAMB in line with the broader Media industry but well below many direct competitors.

Simply Wall St calculates a “Fair Ratio” for each company using factors such as historical and forecast earnings growth, profit margins, size, and risks unique to the business. For Gambling.com Group, the Fair Ratio is estimated at 26.2x, which is considerably higher than both the company’s current PE and the industry average. This Fair Ratio is a more tailored benchmark than a simple industry or peer comparison as it takes the company’s growth outlook and risk profile into account.

Since Gambling.com Group’s actual PE is 16.6x, noticeably lower than its Fair Ratio of 26.2x, the shares appear undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gambling.com Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your version of a company’s story, backed up with your own forecasts for future revenue, profit, and margins, that drives your estimate of fair value, rather than relying purely on rigid financial formulas.

With Narratives, you connect the dots between Gambling.com Group’s unique business developments, your specific assumptions, and what you think the shares are worth. This makes your investment thesis transparent and easy to track. Narratives are available right on Simply Wall St’s Community page, used by millions of investors as a dynamic decision-making tool.

By comparing your own Fair Value to the current price, Narratives help you spot when a stock may be undervalued or overvalued. Each Narrative automatically updates when new events such as regulatory changes or earnings reports emerge, so your fair value reflects the latest outlook.

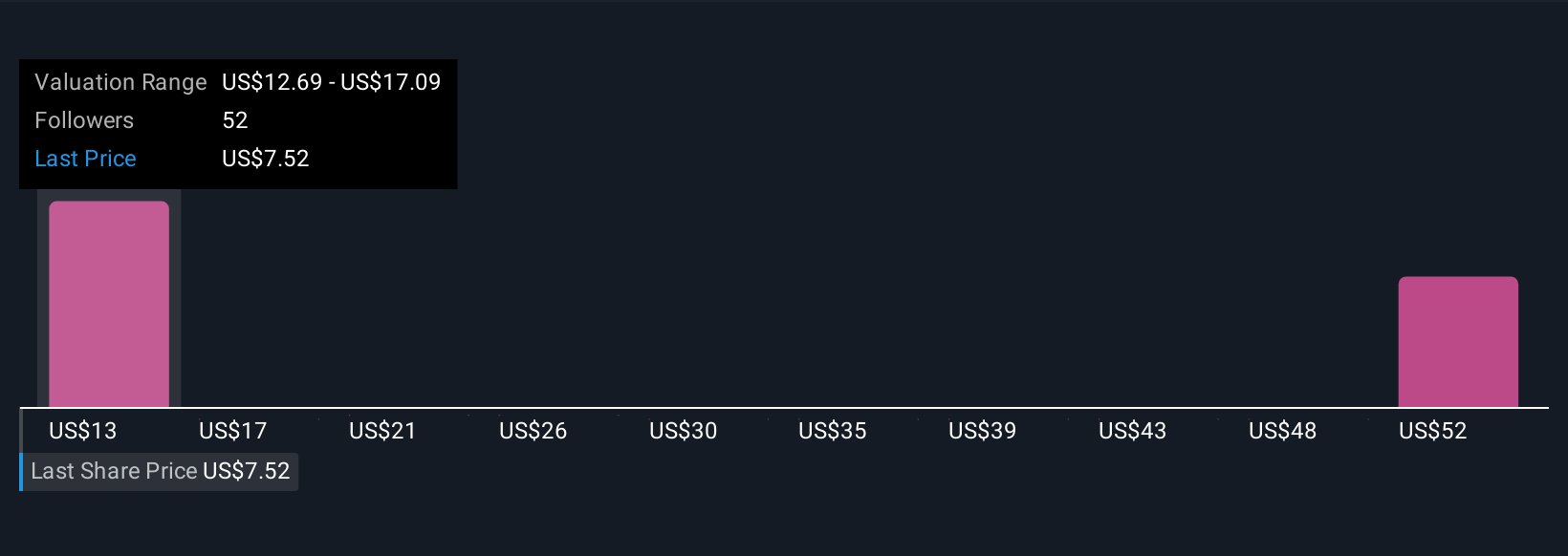

For example, some investors see accelerating North American legalization, new tech investments, and diversified digital revenues supporting a fair value of $17.00 per share. More cautious investors, wary of regulatory and competitive risks, see fair value closer to $11.00. Narratives make it simple to see these different perspectives and update your own anytime new facts arrive.

Do you think there's more to the story for Gambling.com Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GAMB

Gambling.com Group

Operates as a performance marketing company for the online gambling industry in North America, the United Kingdom, Ireland, rest of Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives