- United States

- /

- Entertainment

- /

- NasdaqGM:GAIA

Gaia (GAIA): Profitability Forecast Improves, Challenging Bearish Narrative After Years of Deepening Losses

Reviewed by Simply Wall St

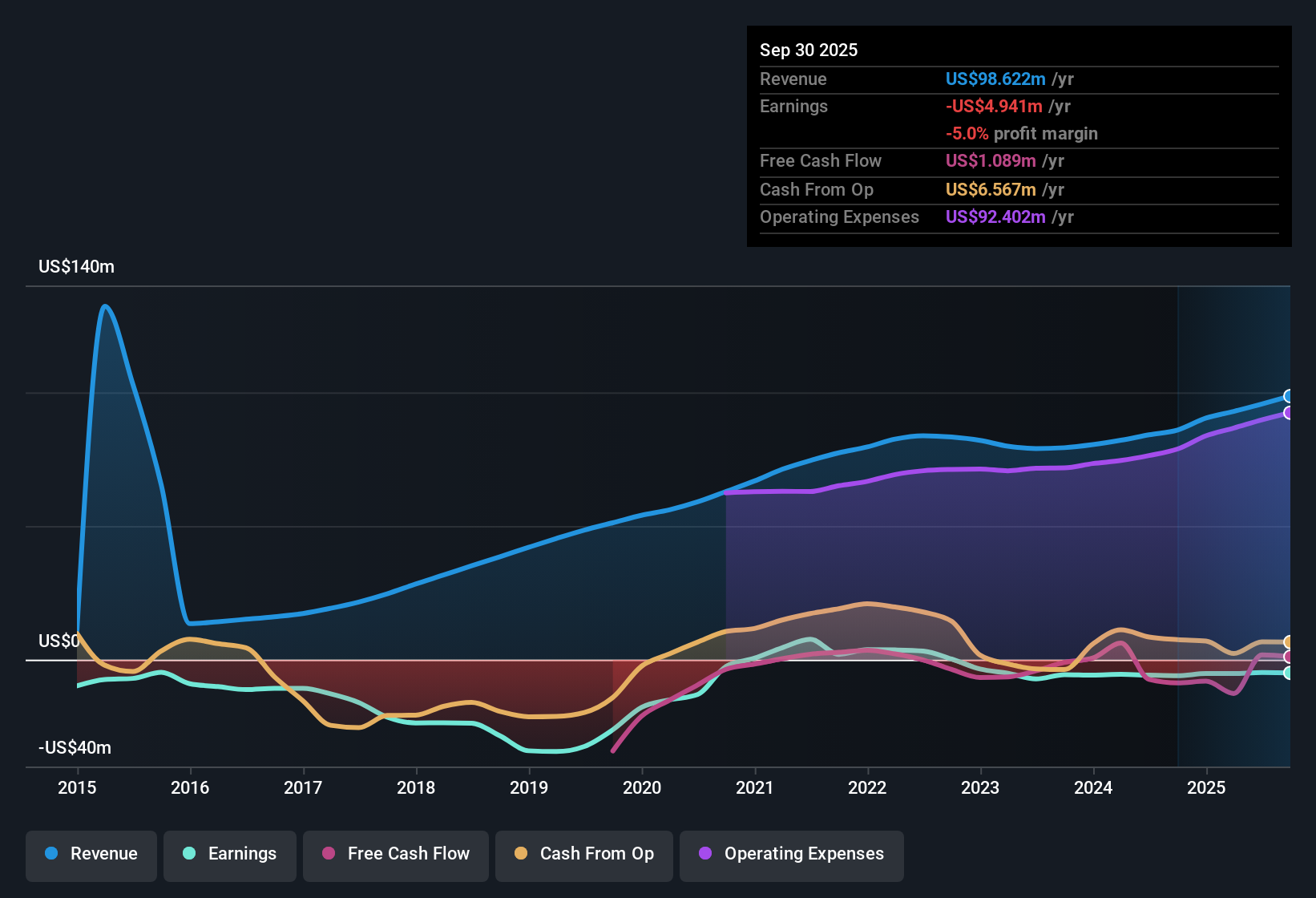

Gaia (GAIA) remains in the red, recording unprofitable results with net losses worsening at an average annual rate of 48.7% over the past five years. Despite the ongoing losses, forecasts now point to rapid improvement, with earnings expected to grow by 95.93% per year and a return to profitability within three years. This would outpace most of the market. Meanwhile, revenue growth is set to reach 14.1% annually, which exceeds the predicted 10.5% average across the US market. At a trading price of $4.61, shares sit well below an estimated fair value of $55.18 based on discounted cash flow analysis. The Price-To-Sales ratio of 1.2x stands above direct peers but remains under the industry average.

See our full analysis for Gaia.The next section dives into how these headline results stack up against the narratives driving sentiment in the Gaia story, shedding light on where expectations and reality intersect.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen but Profitability Forecast Shifts

- Net losses have increased at an average annual rate of 48.7% over the past five years, but projections show Gaia could become profitable within three years. This is a faster turnaround than most of its industry peers.

- Strong projected earnings and revenue growth heavily support optimism for a recovery.

- With earnings forecast to jump by 95.93% per year, bulls highlight this as a rare pace in streaming that could quickly reverse the company’s recent underperformance.

- Gaia’s above-market revenue growth target of 14.1% per year adds weight to the bullish view that the pivot toward profitability is not just theoretical but backed by accelerating fundamentals.

Valuation Discount Against DCF Fair Value

- Gaia’s shares trade at $4.61, significantly below the DCF fair value estimate of $55.18. This presents a deep discount rarely observed for a company targeting such high growth rates.

- This spread between current price and modeled fair value is seen as a major opportunity by positive-leaning investors.

- While the Price-To-Sales ratio of 1.2x stands higher than direct peers at 0.4x, it is still under the industry average. This allows valuation-focused bulls to argue that market skepticism has been overstated.

- The magnitude of the DCF fair value gap draws attention to how quickly sentiment could swing should profitability materialize as forecast, fueling a bullish thesis.

Premium to Peer Multiples Raises Scrutiny

- While Gaia’s Price-To-Sales multiple of 1.2x is below the industry norm (1.8x), it remains well above peers’ average of 0.4x. This highlights the scrutiny faced for trading at a premium during a period of unprofitability.

- Prevailing narratives acknowledge the tension here.

- Supporters argue the premium is justified by projected earnings growth of nearly 96% annually, emphasizing Gaia’s differentiation and leveraged exposure to wellness themes.

- Critics counter that the lack of recent profits means investors are still paying up for promises, not delivered results. Maintaining a valuation premium during losses exposes the stock to negative sentiment if growth targets fall short.

See our latest analysis for Gaia.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Gaia's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust revenue targets, Gaia remains unprofitable and trades at a premium to peers. This exposes investors to the risks of volatile financial results.

If you want steadier performance, check out stable growth stocks screener (2077 results) to discover companies delivering consistent growth and reliability no matter the market mood.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GAIA

Gaia

Operates a digital video subscription service and online community for underserved member base in the United States, Canada, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives