- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox (FOXA) Valuation in Focus as Shares Climb 21% Over Three Months

Reviewed by Simply Wall St

See our latest analysis for Fox.

Momentum has picked up for Fox, with the share price gaining over 15% in the past month and capping a 35% share price return year-to-date. The stock's 12-month total shareholder return now stands at 49%, which suggests that investors are warming to its potential, even as news headlines have quieted down recently.

If you're interested in seeing which other fast-moving names investors are watching, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing and momentum building, the big question now is whether Fox is undervalued, offering investors a potential entry point, or if the market has already priced in the next phase of its growth.

Most Popular Narrative: 6.4% Undervalued

Fox's most-followed narrative sets a fair value of $70.50 for the stock, roughly $4.50 above the most recent close. This suggests that, in the eyes of key market-watchers, Fox still has room to rally even after its latest gains. Let’s look at one catalyst that could be fueling this view.

Robust secular trends toward live news and sports consumption, evidenced by Fox's record-breaking Super Bowl and continued cable news dominance, indicate ongoing strong demand for Fox's core content. This supports resilient advertising revenue and stable affiliate fees.

Want to know what bold assumptions push Fox’s value above recent highs? The real shocker is how much future growth and profitability this narrative is banking on. Intrigued by the underlying financial bets such as audience power and digital expansion? The full story unpacks the key drivers that could make or break this fair value call.

Result: Fair Value of $70.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising content costs and ongoing shifts away from traditional TV could present challenges for Fox's long-term revenue and profit stability.

Find out about the key risks to this Fox narrative.

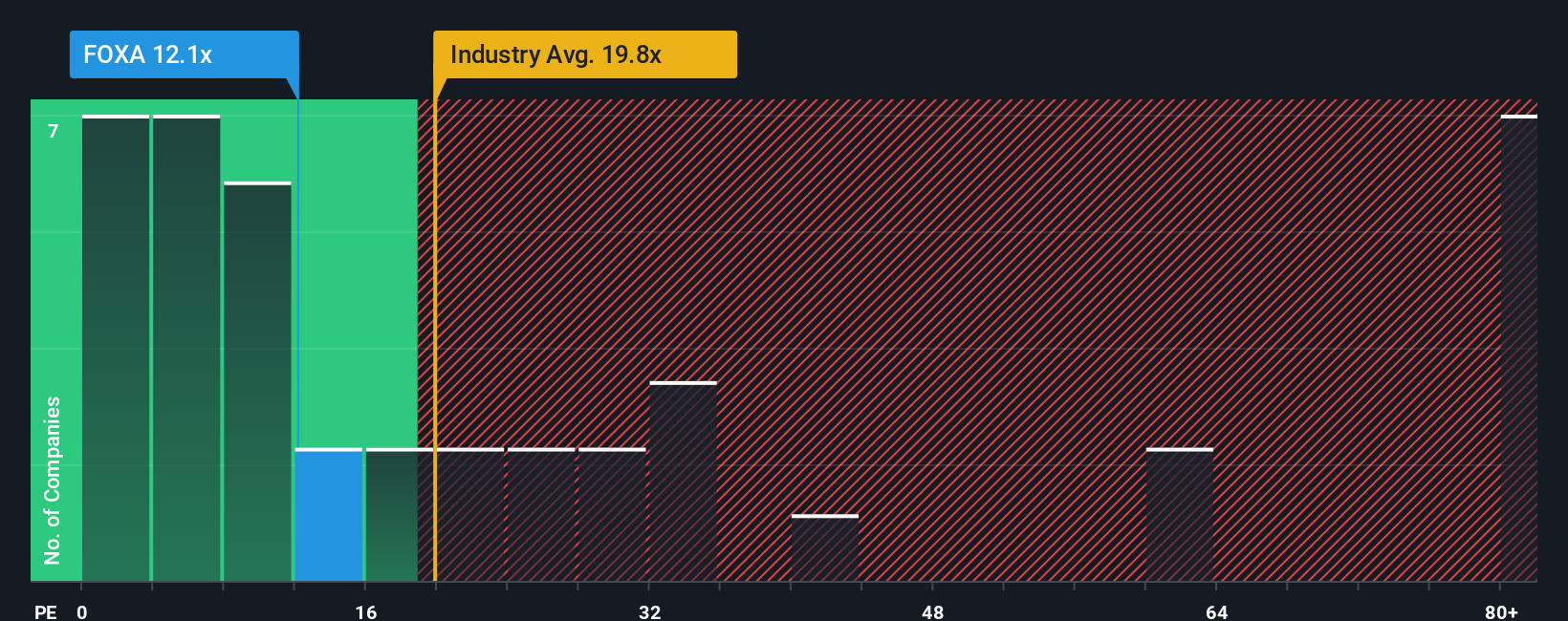

Another View: Market Multiples Send Mixed Signals

While one method pegs Fox's fair value above today's price, market multiples paint a more complex picture. Fox trades at 14.4x earnings, which is much higher than the peer average of 6.9x, but below the broader US Media industry at 16.6x. The fair ratio suggests the multiple could climb to 18.4x. Is this a sign of hidden value, or a reason for caution as the market re-evaluates the company’s growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fox Narrative

Not convinced by the consensus or eager to dig deeper into the numbers yourself? You can craft your own view in just a few minutes with Do it your way.

A great starting point for your Fox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next opportunity slip through your fingers. Challenge yourself by looking beyond Fox and take the lead with these compelling investment paths on Simply Wall Street:

- Capture income potential by reviewing these 16 dividend stocks with yields > 3% offering yields above 3% and solid fundamentals for steady returns.

- Get ahead of the curve and check out these 25 AI penny stocks reshaping industries with groundbreaking artificial intelligence innovation.

- Maximize value by finding these 874 undervalued stocks based on cash flows analyzed for attractive prices based on their current and future cash flows. Stay sharp, the best deals move fast.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives