- United States

- /

- Interactive Media and Services

- /

- NasdaqGM:EVER

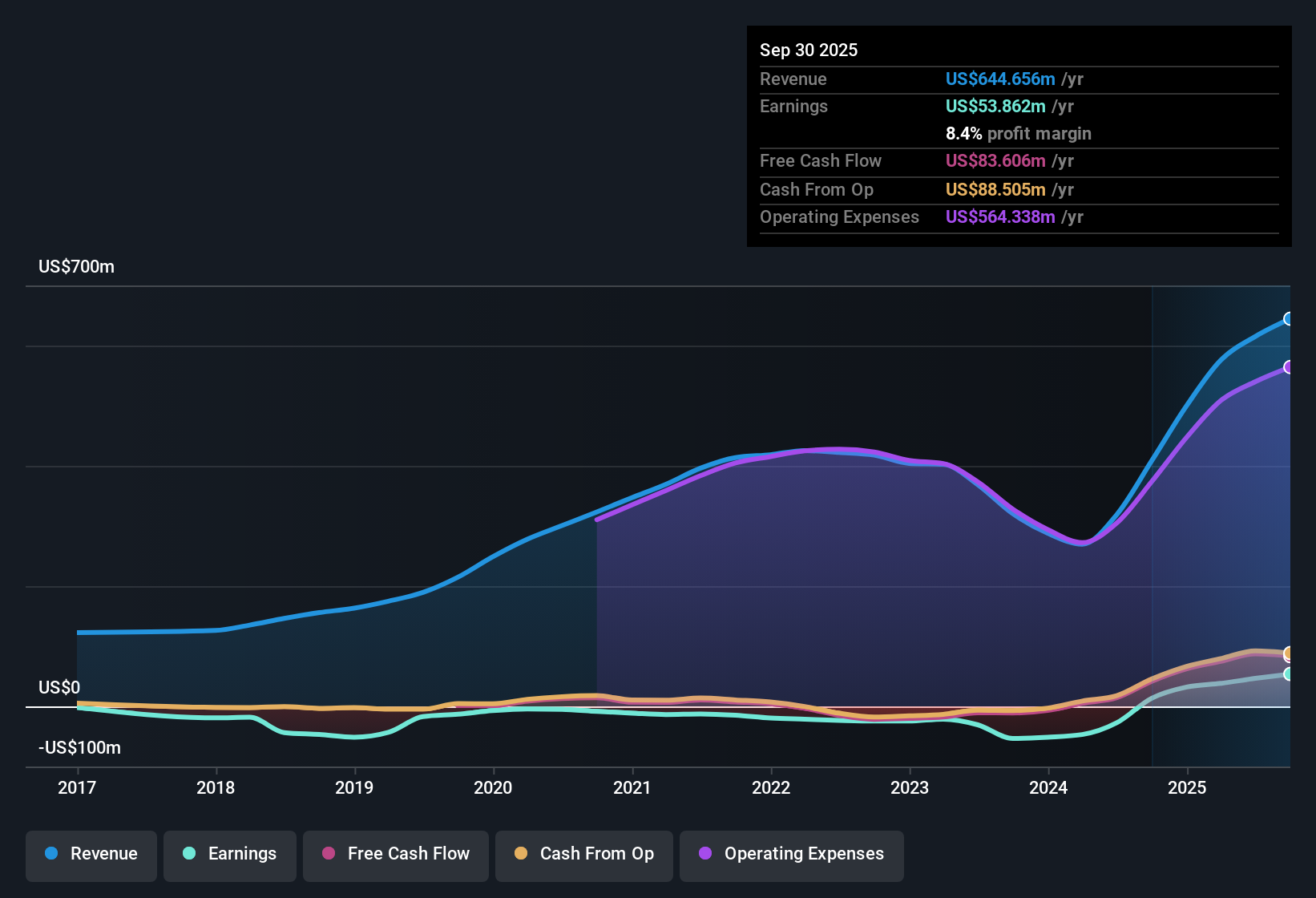

EverQuote (EVER): Net Profit Margin Jumps to 8.4%, Reinforcing Bullish Value Narratives

Reviewed by Simply Wall St

EverQuote (EVER) delivered a net profit margin of 8.4% this year, up sharply from last year’s 3.3%, with EPS soaring as earnings grew 298.5% year-over-year. Over the past five years, the company’s earnings have grown at an impressive 32.5% annually, while analysts are calling for continued, though slower, annual earnings growth of 13.2% alongside revenue growth of 10.3%. With no major risks on the radar and solid value metrics, investors are likely to focus on the company’s surge in profitability and the fact that its stock trades well below the estimated fair value, even as forecast growth trails the broader market.

See our full analysis for EverQuote.The next step is to set these headline numbers against the dominant narratives in the community and the broader market to see where expectations match reality, and where surprises may be lurking.

See what the community is saying about EverQuote

AI Initiatives Expand Margins

- AI-driven efficiencies have lifted EverQuote’s net profit margin to 8.4%, up from 3.3% the year before. EBITDA margins recently hit record levels according to consensus narrative takeaways.

- Analysts’ consensus view:

- Consensus notes that expanding insurer integrations and AI-driven "Smart Campaigns" have improved spend efficiency by 20% for carriers. This has contributed to deeper client relationships and improved retention.

- Consensus also flags that ongoing automation and adoption of AI, from new voice agents to engineering copilots, are driving operating efficiency and positioning EverQuote for sustained cash flow growth.

For deeper insight into how EverQuote's digital transformation and margin expansion stack up against market expectations, check the full consensus narrative breakdown. 📊 Read the full EverQuote Consensus Narrative.

Diversifying Revenue Beyond Auto

- Growth outside of auto insurance is gathering momentum, with home and renters insurance segments delivering a 23% year-over-year increase and sequential gains in the most recent quarter, per consensus narrative data.

- Analysts’ consensus view:

- Consensus highlights that diversification across insurance verticals and increased multiproduct adoption among agents is broadening revenue streams and reducing single-segment risk. This is seen as key to supporting long-term stability.

- However, consensus also notes that most of EverQuote’s growth is still anchored in auto, and continued challenges in expanding non-auto verticals could limit durable earnings growth if momentum slows.

Shares Trade Well Below Fair Value

- EverQuote’s current share price of $24.28 is at a significant discount to the DCF fair value of $76.34. Its forward P/E of 16.5 times undercuts the US interactive media and services industry average of 16.9 times and peers at 71 times.

- Analysts’ consensus view:

- The consensus narrative emphasizes that the analyst price target stands at $33.40, over 37% above the current share price. This incorporates forecasts for annual earnings growth of 13.2% and margin gains to 9.2% within three years.

- Consensus also points out that expectations for revenue and earnings growth at EverQuote trail the broader US market (10.3% vs. 10.5% and 13.2% vs. 16%), which may temper enthusiasm for a rapid re-rating unless the company surprises to the upside or sector momentum accelerates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EverQuote on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? It only takes a few minutes to turn your insights into a narrative that reflects your perspective. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding EverQuote.

See What Else Is Out There

While EverQuote’s future growth is projected to lag behind broader market expectations, particularly in expanding non-auto verticals, this could limit the company’s long-term upside.

If reliable expansion matters more to you, check out stable growth stocks screener (2077 results) to find companies delivering steadier and more consistent growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EverQuote might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EVER

EverQuote

Operates an online marketplace for insurance shopping in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives