- United States

- /

- Entertainment

- /

- NasdaqGS:EA

Can EA’s Share Surge Continue After Its Latest 32% Rally in 2025?

Reviewed by Bailey Pemberton

If you’re looking at Electronic Arts (EA) and debating your next move, you’re not alone. The stock has been on a roll lately, up 11.7% in the last week and 12.0% over the last month. Year to date, it’s surged 32.5%, and if you zoom out to the last five years, you’re looking at a climb of almost 54%. Those kinds of returns make anyone wonder if more gains are ahead or if it’s time to revisit what the market is valuing in EA right now.

Some of these climbs could be chalked up to recent shifts in investor attitude across the gaming sector. Strong interest in the intersection of franchises, digital sales, and emerging technology continues to catch Wall Street’s eye. It is easy to see why risk perceptions might be softening and growth stories getting more airtime, especially for a publisher that has weathered a lot and kept pushing innovation.

But impressive returns are not the full story. If you dig into how EA stacks up from a valuation perspective, the numbers hint at a disconnect. A quick check using six common valuation criteria actually gives EA a score of zero, meaning it is not undervalued under any of those measures right now.

Let’s dive into exactly how these valuation methods work and what they tell us about EA at the moment. And stick around; at the end, we will explore a smarter, more nuanced way to judge whether the stock is a buy at today’s price.

Electronic Arts scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Electronic Arts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting them back to their value today. This method gives insight into what the stock could be worth based on its expected ability to generate cash over time.

For Electronic Arts, the current Free Cash Flow stands at $1.76 Billion. Analysts forecast this figure to steadily grow, reaching around $2.65 Billion by 2030. It is important to note that while analyst estimates cover about five years out, later years are extrapolated based on historical and expected performance trends. All cash flows referenced here are in US Dollars.

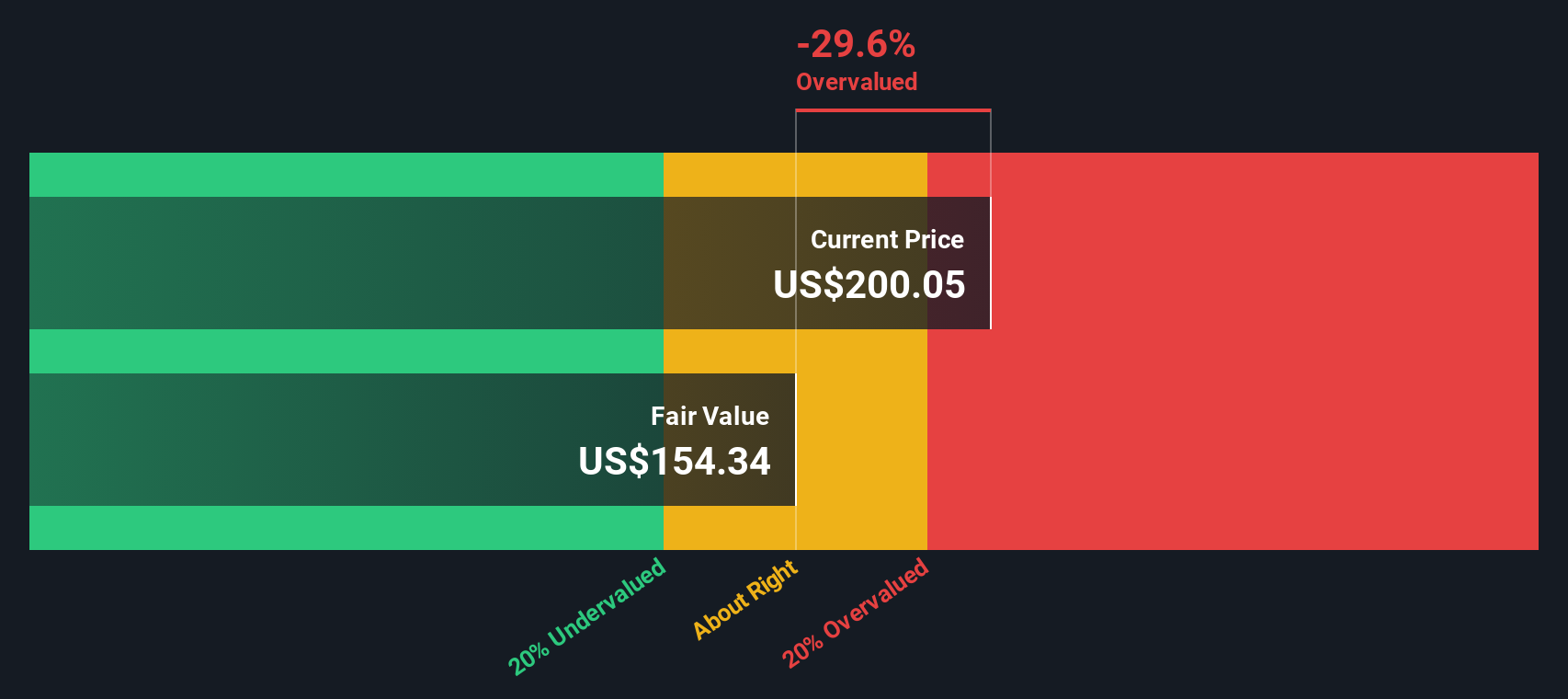

After running these cash flow projections through the DCF model, the estimated intrinsic value per share comes out to approximately $151.64. When compared to the current share price, this implies EA stock is about 27.5% above its DCF-based fair value. This suggests that it is currently overvalued by this particular measure.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Electronic Arts.

Approach 2: Electronic Arts Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for evaluating profitable companies because it directly compares a company’s stock price with its earnings. Investors often favor this ratio since it incorporates current profitability and gives a quick sense of how much the market is willing to pay for each dollar of profit.

Growth expectations and risk play a big role in what constitutes a “normal” or “fair” PE ratio. Generally, companies with strong growth prospects or lower perceived risks justify a higher PE, while slower-growth or riskier companies typically trade at lower PEs.

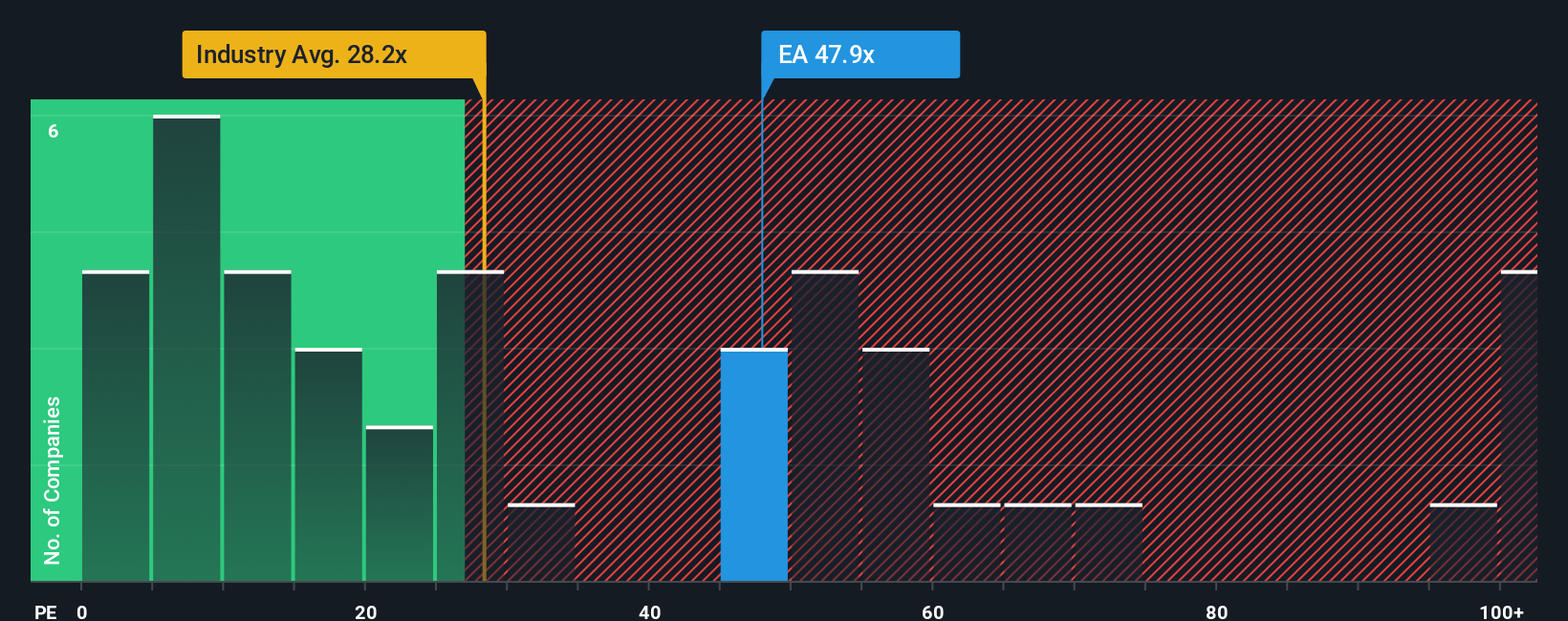

Right now, Electronic Arts trades at a PE ratio of 46.4x, which is a notch above its peer group average of 45.4x and comfortably higher than the entertainment industry average of 31.7x. What sets the benchmark is the “Fair Ratio,” a proprietary calculation by Simply Wall St, which blends not just industry factors but also EA’s specific growth outlook, profit margins, and risk profile. For EA, the Fair Ratio currently stands at 25.8x.

The Fair Ratio offers a more refined perspective than peer or industry comparisons alone because it factors in what truly matters to today's investors, including growth trends, company scale, and profitability in addition to sector standards. When comparing EA’s actual PE of 46.4x to its Fair Ratio of 25.8x, the stock appears significantly overvalued on an earnings basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Electronic Arts Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Simply put, a Narrative is your personal story about a company based on your perspective and supported by your own expectations for its future revenue, profits, and margins, all of which connect directly to your sense of fair value. Narratives help you bridge the gap between numbers and real-world events, empowering you to forecast where a stock like Electronic Arts could head next and why.

On Simply Wall St’s Community page, millions of investors are already using Narratives to map their views, whether bullish or bearish, onto live data. This makes the decision of when to buy or sell much more dynamic and grounded. By comparing your Narrative-based Fair Value against the current share price, you can see whether the market aligns with your outlook or if there might be an opportunity. As new information comes in, such as earnings or key news, Narratives update automatically, ensuring your thinking stays relevant and actionable.

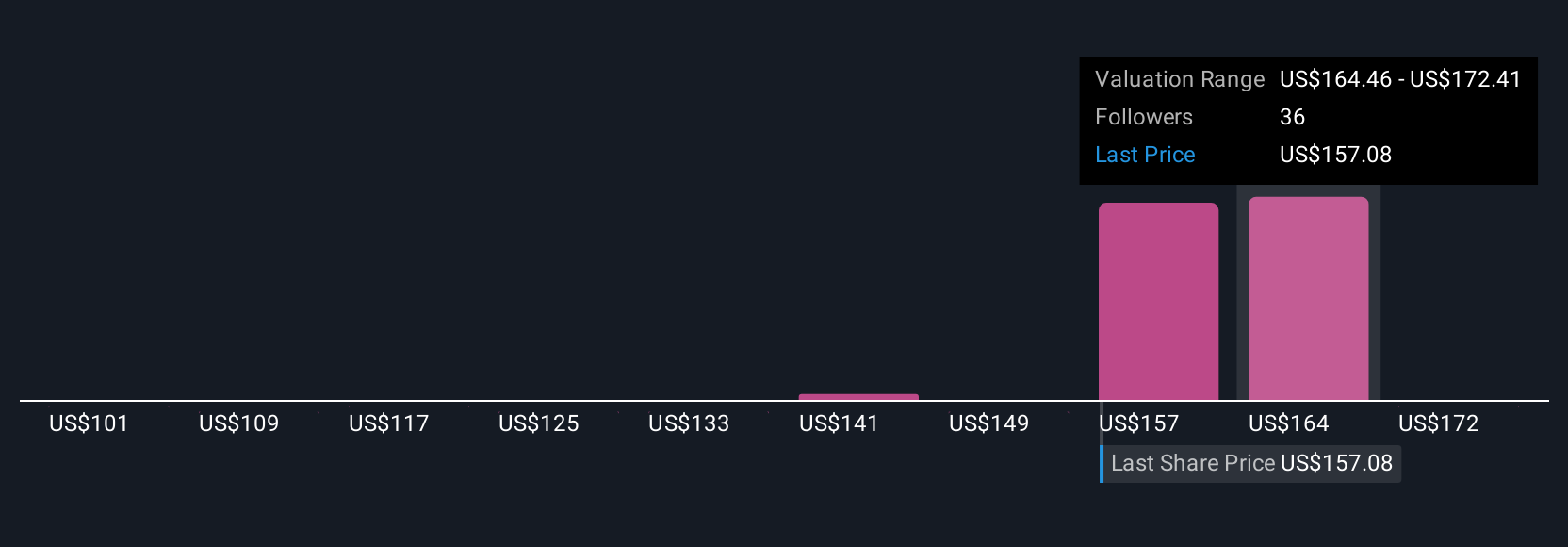

For example, one investor’s Narrative for EA, focused on live services growth and franchise launches, might justify a fair value as high as $210. Another investor, wary of declining net bookings and shifting industry trends, might see a much lower value near $148.

Do you think there's more to the story for Electronic Arts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EA

Electronic Arts

Develops, markets, publishes, and delivers games, content, and services for game consoles, PCs, and mobile phones worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026