- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

CarGurus (CARG): Examining Valuation Following Strong Q3 Results and Upbeat Growth Outlook

Reviewed by Simply Wall St

CarGurus (CARG) delivered stronger-than-expected third-quarter results, with both revenue and profit coming in above forecasts. Marketplace and international revenues climbed by double digits, and net income more than doubled compared to the previous year.

See our latest analysis for CarGurus.

Fresh off its Q3 beat, CarGurus’ share price has gained 12.5% over the past three months as investors responded to robust Marketplace growth, upbeat guidance, and its assertive share buyback program. However, the 1-year total shareholder return is still down 4.2%. Momentum appears to be on the upswing, fueled by product launches and optimism for continued platform expansion.

If CarGurus' rebound has you interested in what else is gathering steam, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying after CarGurus’ Q3 earnings beat and upbeat guidance, the big question is whether the recent surge reflects a bargain price or if the market is already factoring in the company’s future growth trajectory.

Most Popular Narrative: 16.1% Undervalued

With CarGurus trading at $33.34 and the most widely followed narrative placing fair value at $39.75, the narrative implies meaningful upside from recent levels. Here is one of the core drivers that shapes this outlook.

"Expansion and deeper adoption of data-driven analytics tools and AI-powered solutions across the dealer base are creating higher engagement, improved retention, and more actionable insights. These developments are expected to drive sustained Marketplace revenue growth and support increasing margins as dealers see measurable ROI and make CarGurus central to their workflow."

Curious what bold assumptions get CarGurus to this target? One critical variable is a projected acceleration in future margins and profit. Intrigued to see if the forecast is achievable or overly ambitious? The full narrative unpacks the key numbers and surprising growth bets behind this valuation.

Result: Fair Value of $39.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CarGurus still faces challenges, including rising digital competition and unproven long-term growth outside North America. These factors could alter the current outlook.

Find out about the key risks to this CarGurus narrative.

Another View: Market Comparisons Paint a Different Picture

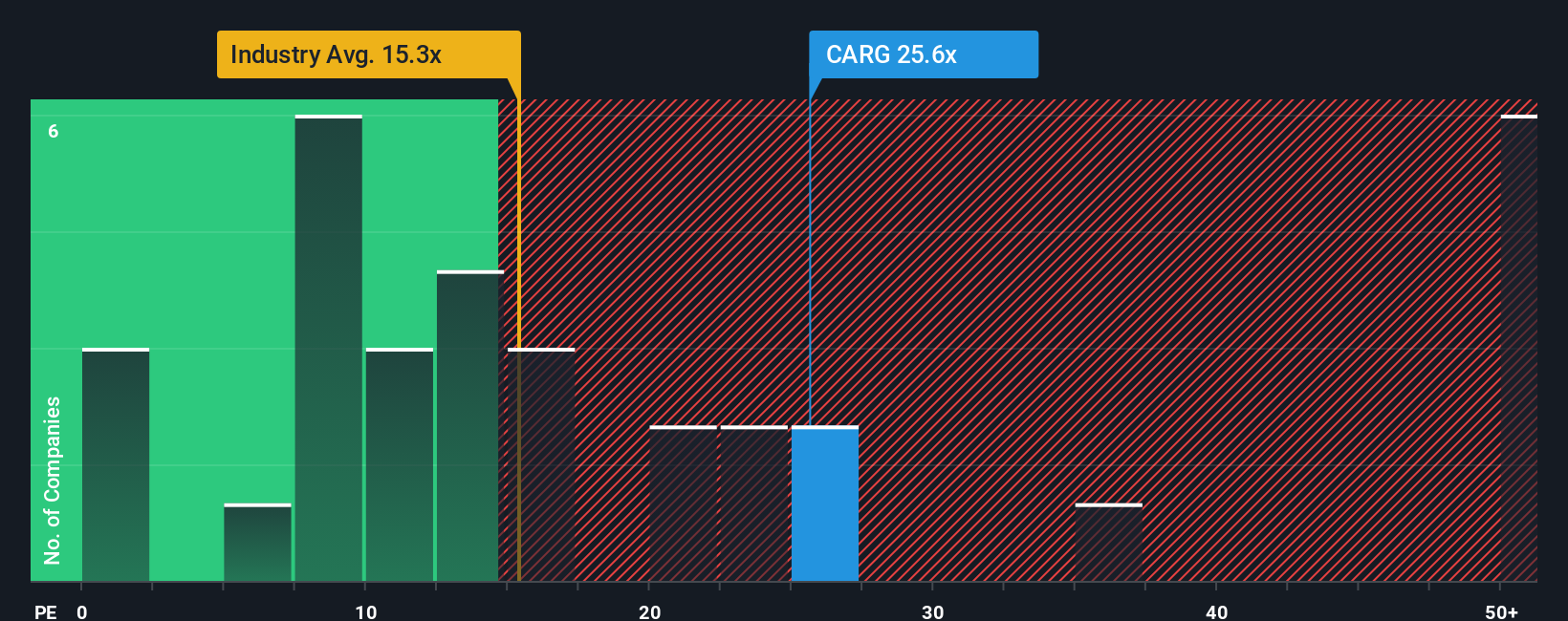

While our first look suggested CarGurus is undervalued, using the common price-to-earnings ratio (20.9x) tells a more cautious story. The stock trades at a higher multiple than both the US Interactive Media and Services industry average (17x) and its peer average (13.3x). However, the fair ratio sits at 21x, which suggests the market is not far off fair value. Does this mean the big upside is already priced in, or is the narrative underestimating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarGurus Narrative

If you see the story differently or want to dig into the numbers yourself, it only takes a few minutes to build your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CarGurus.

Ready for More Smart Investment Opportunities?

Bored of the same old stock picks? There are hidden winners in every corner of the market, so don’t let the next breakout pass you by. Supercharge your portfolio with fresh ideas tailored to today’s fast-moving trends using the power of the Simply Wall Street Screener.

- Uncover strong returns by tapping into these 16 dividend stocks with yields > 3% delivering yields above 3% for income-focused investors.

- Ride the momentum in artificial intelligence by targeting growth leaders among these 25 AI penny stocks shaping tomorrow’s tech landscape.

- Catch companies trading below their true value by scouting these 876 undervalued stocks based on cash flows that could be tomorrow’s outperformance stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives