- United States

- /

- Entertainment

- /

- NasdaqGS:BATR.K

Atlanta Braves Holdings (BATR.K): Loss Reduction Outpaces Expectations But Revenue Growth Lags Market Narrative

Reviewed by Simply Wall St

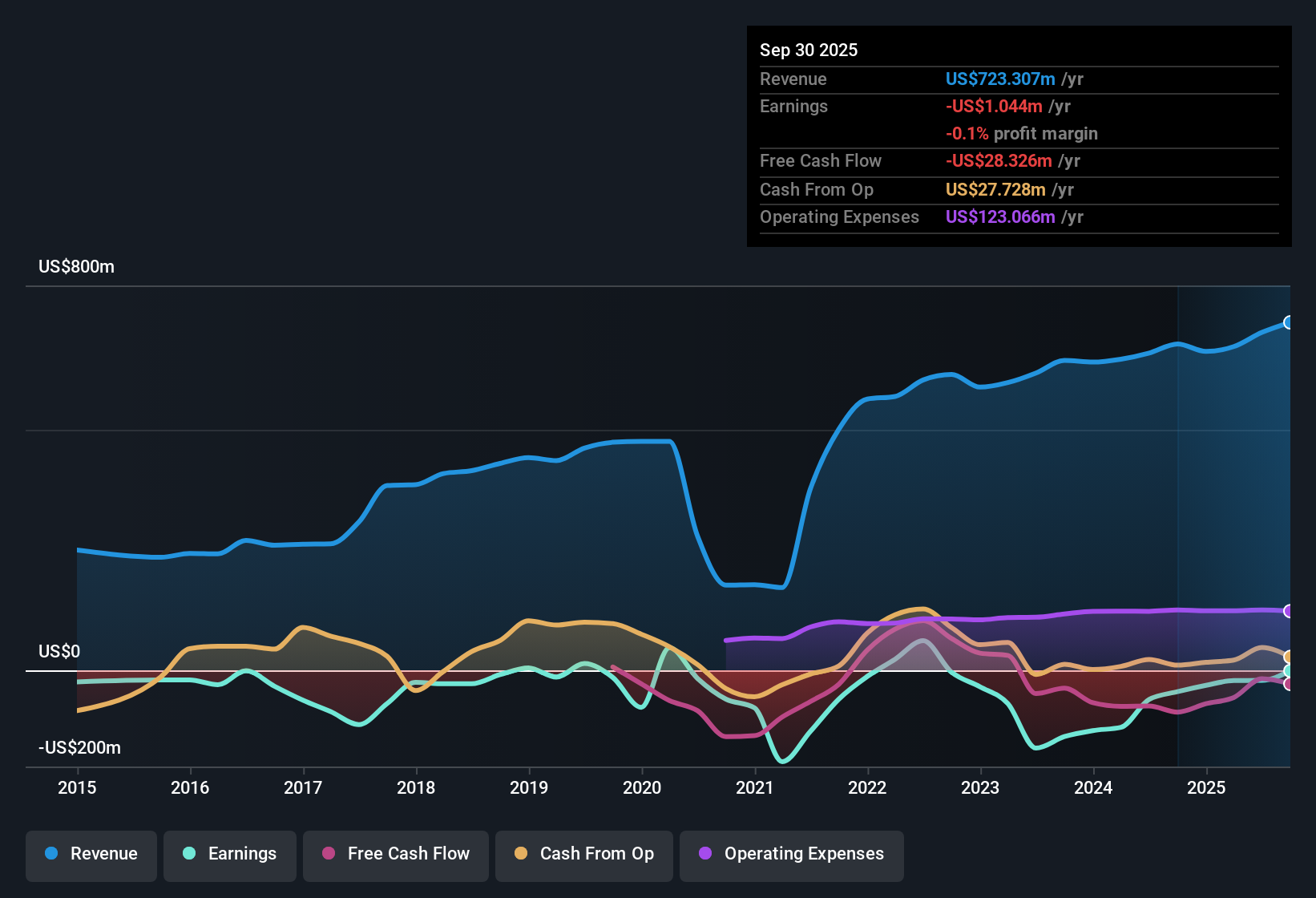

Atlanta Braves Holdings (BATR.K) remains unprofitable but has managed to reduce its losses by 6.9% per year over the past five years. With earnings projected to grow at 61.05% annually and the turning point to profitability anticipated within three years, ongoing loss reduction and expected profit growth are now the key points for investors keeping an eye on the company's earnings trajectory.

See our full analysis for Atlanta Braves Holdings.Next up, we will stack these headline results against the community narratives to see how the numbers reinforce or disrupt the story investors have been following.

See what the community is saying about Atlanta Braves Holdings

Mixed-Use Growth vs Baseball Volatility

- Expanded revenue streams from The Battery Atlanta and Pennant Park, anchored by newly added high-profile tenants, now help buffer core results against swings in team performance and ticket demand.

- Analysts' consensus view sees this diversification as stabilizing for earnings but also flags a real risk: franchise revenues still hinge on team health and playoff runs, with player injuries driving ticket and merchandising volatility. Mixed-use expansion could face possible headwinds from softer rental demand and broader economic factors.

- Consensus highlights strong recurring real estate operating income. However, any slowdown would quickly test the resilience of these offsets if team attendance or broadcast growth were to stumble.

- Consensus also acknowledges that rising operating costs and capital investments could squeeze margins if revenue increases don't keep pace.

- To see how analysts balance these strengths and weaknesses in a unified outlook for Atlanta Braves Holdings, follow the full consensus narrative to dig deeper into the numbers. 📊 Read the full Atlanta Braves Holdings Consensus Narrative.

Premium Price-to-Sales Ratio Stands Out

- At 3.6x, Atlanta Braves Holdings’ price-to-sales ratio sits well above both the peer group and the US Entertainment industry average of 1.7x, signaling a steep premium compared to similar stocks.

- Analysts' consensus view argues that this elevated valuation can only be justified if franchise earnings and margins converge on the industry average. Achieving this may require sustained double-digit earnings growth, expanding profit margins toward 9.4 percent, and ongoing success in both media rights and real estate leasing.

- Consensus calls out the discounted cash flow (DCF) fair value of $11.18, which trails the $40.15 share price, suggesting investors are betting on optimistic future growth or strategic assets not reflected in the DCF approach.

- The consensus takes a cautious tone, underscoring that ongoing high debt levels and ambitious capex plans add financial leverage, making robust margin expansion a critical requirement to maintain this valuation premium over time.

Analyst Target Implies 25.9% Upside from Current Price

- The current share price of $40.15 is 25.9 percent below the consensus analyst price target of $58.40, reflecting optimism about future earnings even though Atlanta Braves Holdings remains unprofitable for now.

- According to consensus narrative, for the stock to reach that target within three years, profits would need to swing from -$21 million to $79.9 million. This represents a major turnaround that relies on execution of new media contracts, real estate momentum, and a rebound in team performance.

- Consensus points out that achieving these earnings would mean trading at a PE multiple of 62.1x, far above the US Entertainment industry norm of 38.2x, which reinforces the need for sustained profitability and strong margin expansion.

- Analysts also stress the importance of outperforming the broad US market's 10.5 percent revenue growth, given Atlanta Braves Holdings’ own projected revenue growth of only 4.6 percent per year. This makes top-line outperformance a potential swing factor.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Atlanta Braves Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do those trends suggest a different future to you? Share your take and put your spin on the numbers in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Atlanta Braves Holdings.

See What Else Is Out There

Atlanta Braves Holdings’ high debt levels, volatile earnings, and reliance on optimistic growth forecasts highlight real concerns about its financial stability under pressure.

If you want to focus on companies with stronger finances and less balance sheet risk, check out solid balance sheet and fundamentals stocks screener (1979 results) built to weather market shocks and deliver resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BATR.K

Atlanta Braves Holdings

Through its subsidiary, Braves Holdings, LLC, owns and operates the Atlanta Braves Major League Baseball Club in the United States.

Moderate growth potential with imperfect balance sheet.

Market Insights

Community Narratives