- United States

- /

- Chemicals

- /

- NYSE:WLK

Westlake (WLK): Assessing Valuation Following Q3 Loss and Debt Restructuring Moves

Reviewed by Simply Wall St

Westlake (WLK) is taking action after posting a net loss in the third quarter, weighed down by a large goodwill impairment. The company quickly launched a tender offer for its 2026 senior notes and announced new fixed-rate debt.

See our latest analysis for Westlake.

While Westlake has been busy restructuring its balance sheet after a tough quarter, investors have remained cautious. The company’s share price is now $64.95, with a sharp year-to-date decline of 42% and a hefty one-year total shareholder return loss of nearly 50%. This reflects persistent concerns about its long-term prospects and recent setbacks.

If you’re looking to broaden your investing perspective beyond the current headlines, now is a great time to explore fast growing stocks with high insider ownership.

After a year marked by significant declines and a challenging financial reset, the key question is whether Westlake’s current valuation offers a compelling entry point for long-term investors or if the market has already factored in future improvements.

Most Popular Narrative: 26.6% Undervalued

At $64.95, Westlake’s share price is well below the narrative’s fair value estimate. With a substantial gap between the two, the stage is set for a potential realignment if expectations materialize.

Demographic trends and the long-term undersupply of homes are expected to drive a recovery in residential construction. This positions Westlake’s balanced exposure to both new construction and repair/remodel markets to benefit from secular urbanization and infrastructure development, leading to sustained mid-single-digit organic HIP revenue growth and high EBITDA margins.

Why is the biggest part of this fair value hidden in the future? Big assumptions about Westlake’s revenue growth and margin power drive this narrative. Want to uncover exactly how bullish these projections are and what financial leaps analysts expect next?

Result: Fair Value of $88.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global oversupply and continued pricing pressure in Westlake’s core chemicals business could undermine recovery, despite recent balance sheet actions.

Find out about the key risks to this Westlake narrative.

Another View: Multiples Still Signal Caution

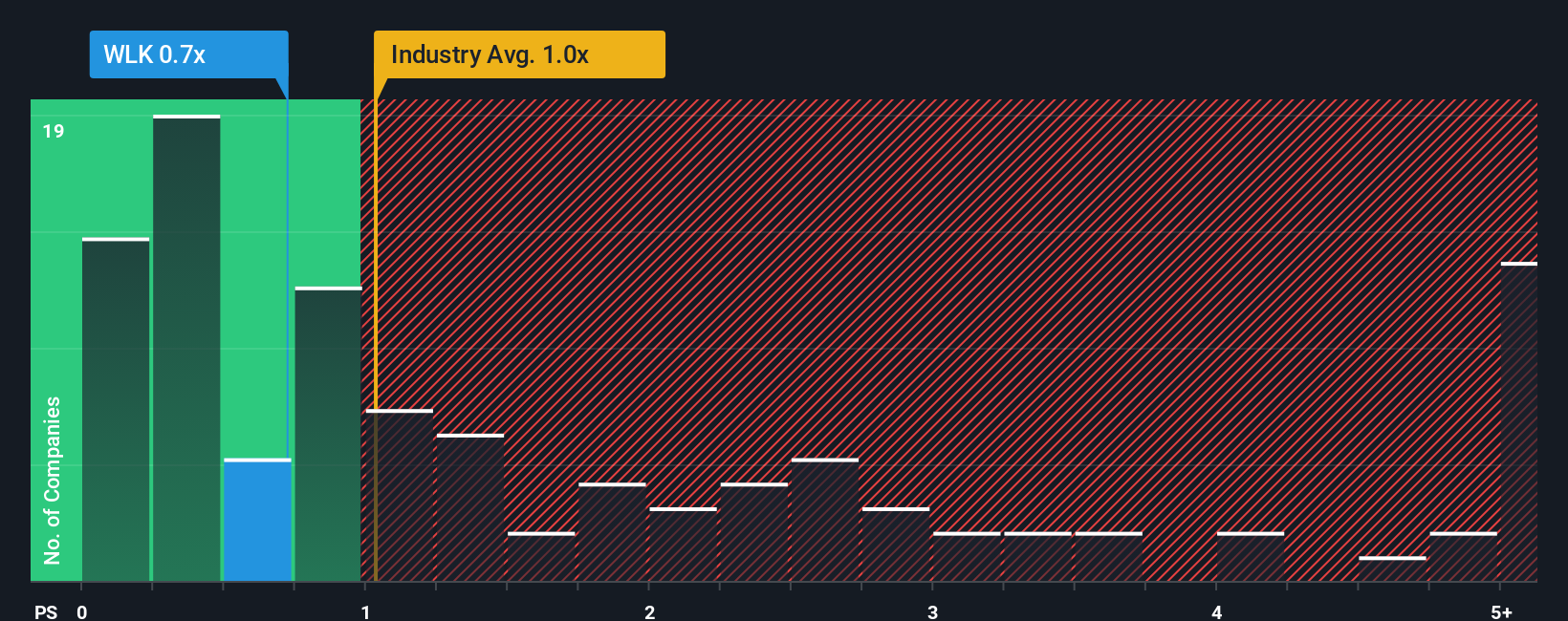

Looking at Westlake’s price-to-sales ratio of 0.7x, it is pricier than peer companies averaging only 0.5x, though slightly below the U.S. chemicals industry at 1x. Even compared to its fair ratio of 0.8x, Westlake carries valuation risk, a premium that raises questions about market optimism versus ongoing challenges. Does this multiple fully account for the company’s uncertainties, or is there room for positive surprises?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westlake Narrative

If you believe there’s another story to tell, or want to see the numbers for yourself, jump in and craft your own outlook. It takes less than 3 minutes. Do it your way

A great starting point for your Westlake research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Missed opportunities are everywhere, but you can seize your edge by seeing what else is out there. Track unique market trends and discover emerging winners today.

- Capture growth from the next wave of artificial intelligence by targeting top movers with these 24 AI penny stocks. This allows you to gain exposure to innovative technologies disrupting entire sectors.

- Secure higher yields and reliable payouts for your portfolio by handpicking leading income generators with these 16 dividend stocks with yields > 3%. This is tailored for investors seeking consistent returns.

- Capitalize on deep value by identifying companies trading below their intrinsic worth using these 870 undervalued stocks based on cash flows. This can help ensure you never overlook an undervalued opportunity again.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westlake might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLK

Westlake

Manufactures and markets performance and essential materials, and housing and infrastructure products in the United States, Canada, Germany, China, Mexico, Brazil, France, Italy, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives