- United States

- /

- Specialty Stores

- /

- NYSE:BBW

Three Undiscovered Gems in the United States to Enhance Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 1.9%. As for the longer term, the market has risen by 21% in the last year, with earnings forecast to grow by 15% annually. In this fluctuating environment, identifying stocks with strong fundamentals and growth potential can be key to enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Longduoduo | NA | 69.14% | 101.50% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc., with a market cap of approximately $1.72 billion, operates as the bank holding company for Pathward, National Association, offering a range of banking products and services in the United States.

Operations: Pathward Financial generates revenue primarily from its Consumer segment ($401.69 million) and Commercial segment ($248.43 million), with additional contributions from Corporate Services ($46.78 million).

Pathward Financial, with total assets of US$7.5 billion and equity of US$765.2 million, has a net interest margin of 6.1%. Total deposits are US$6.4 billion, while loans stand at US$4.5 billion with an appropriate bad loan allowance at 1%. Recently, the company repurchased 286,920 shares for US$14.99 million and announced a dividend of $0.05 per share for Q4 2024 payable on October 1st to shareholders as of September 10th.

- Click here and access our complete health analysis report to understand the dynamics of Pathward Financial.

Evaluate Pathward Financial's historical performance by accessing our past performance report.

Build-A-Bear Workshop (NYSE:BBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Build-A-Bear Workshop, Inc. operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally with a market cap of $451.12 million.

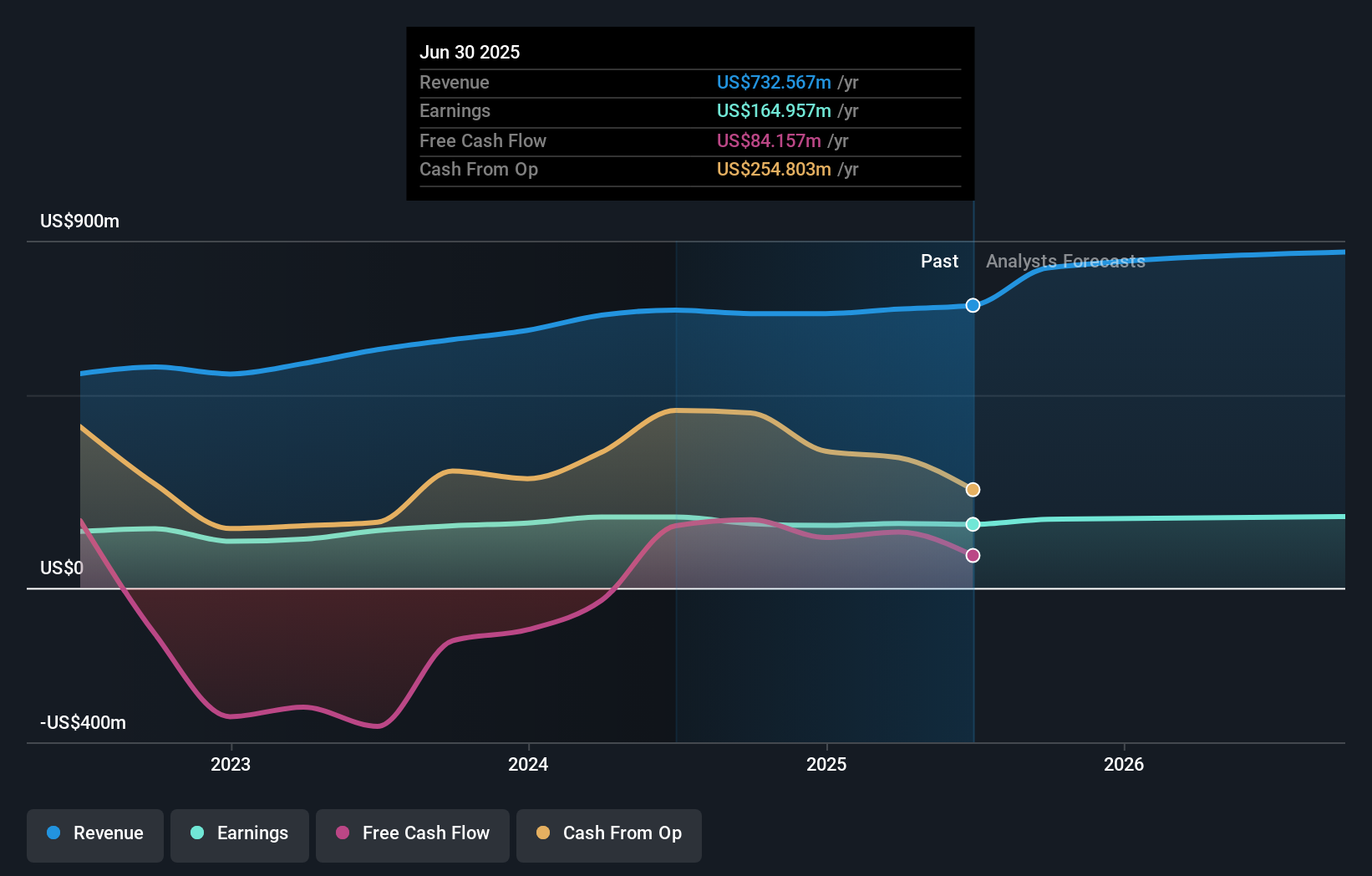

Operations: The company generates revenue primarily from net retail sales ($451.93 million), commercial activities ($27.03 million), and international franchising ($4.42 million).

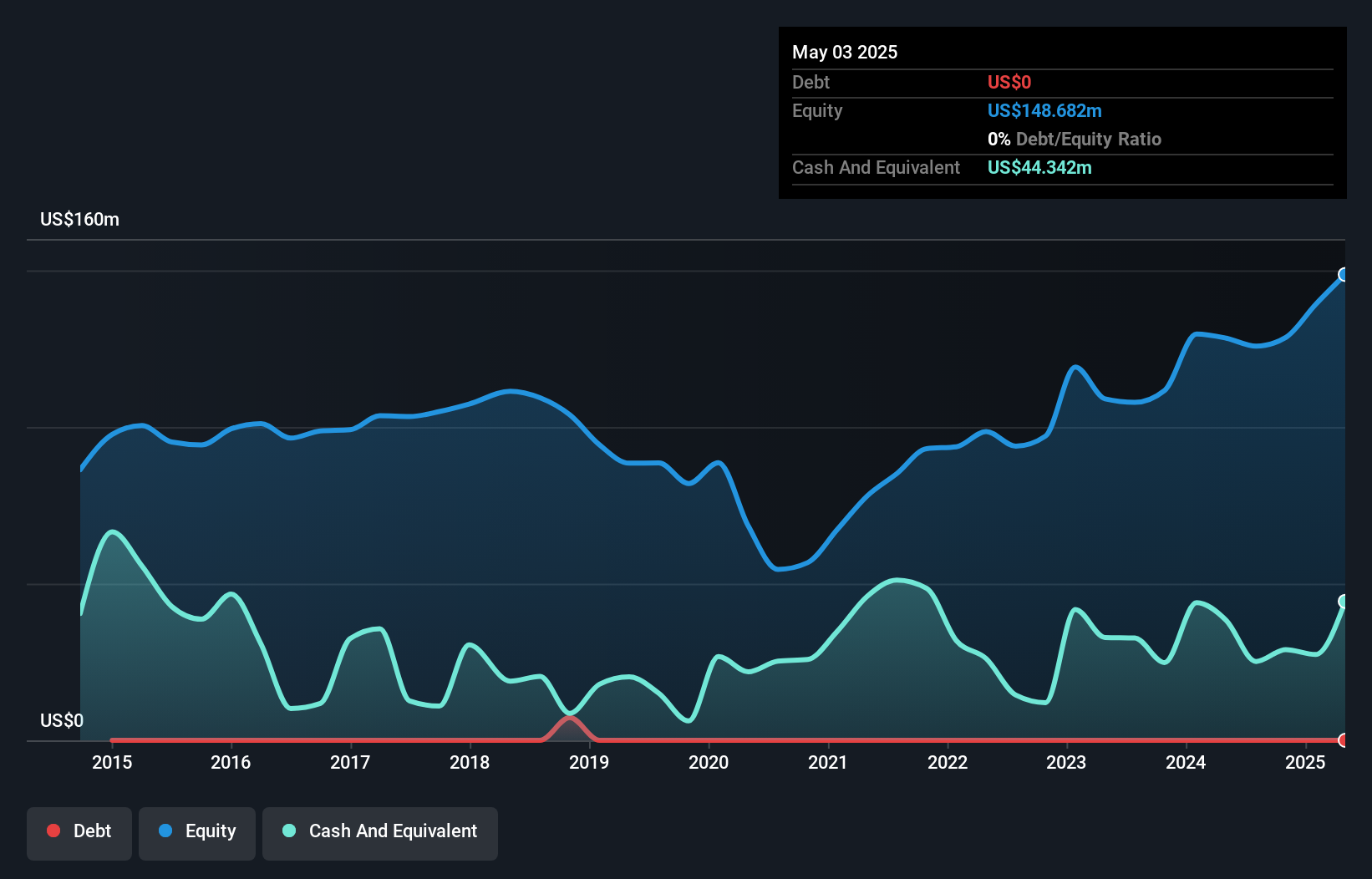

Build-A-Bear Workshop, known for its customizable plush toys, is trading at 52.8% below our fair value estimate and remains debt-free. Recent earnings results showed Q2 revenue at US$111.8 million and net income of US$8.78 million, up from US$109.23 million and US$8.34 million respectively a year ago. The company repurchased shares in 2024 and introduced an exclusive Hello Kitty plush to celebrate the brand's 50th anniversary, enhancing its appeal among collectors and fans alike.

- Navigate through the intricacies of Build-A-Bear Workshop with our comprehensive health report here.

Gain insights into Build-A-Bear Workshop's past trends and performance with our Past report.

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $826.49 million.

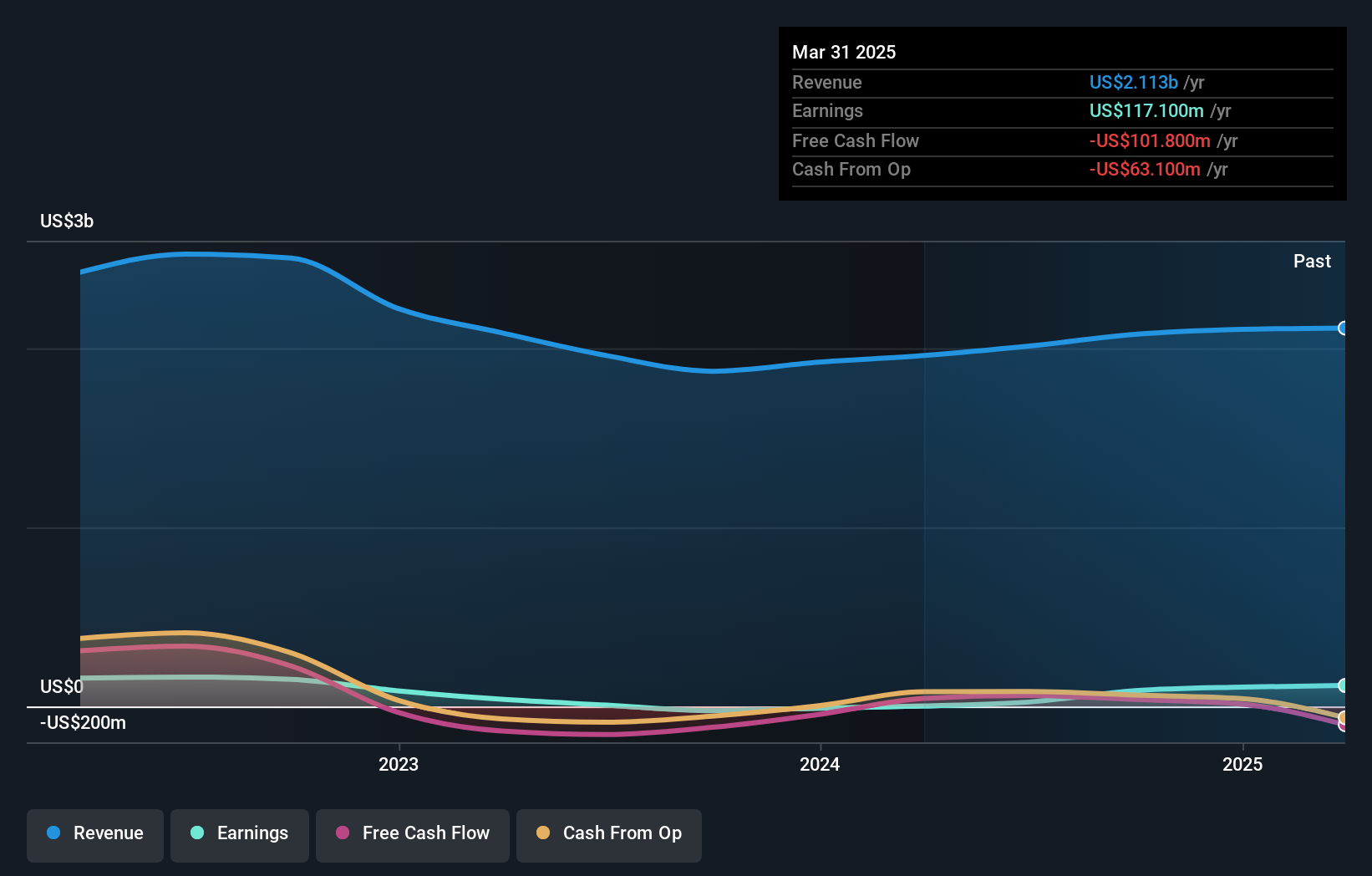

Operations: Valhi, Inc. generates revenue primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million).

Valhi's earnings have surged by 215.4% over the past year, significantly outpacing the Chemicals industry's -4.8%. The company reported a net income of US$19.9 million for Q2 2024, reversing a net loss of US$3.2 million from the previous year. Its debt to equity ratio has improved from 78% to 38.7% over five years, and interest payments are well covered with an EBIT coverage of 4.7x, indicating strong financial health and growth potential in a volatile market environment.

Taking Advantage

- Access the full spectrum of 217 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Build-A-Bear Workshop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBW

Build-A-Bear Workshop

Operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally.

Flawless balance sheet and undervalued.