Stock Analysis

- United States

- /

- Chemicals

- /

- NYSE:TROX

Steer Clear Of {avoid_company} And Explore {hold_companies_count} Better Dividend Stock Options

Reviewed by Sasha Jovanovic

When considering dividend stocks, stability and consistency in payouts are key indicators of a sound investment. However, some companies, like those that have experienced significant reductions in their dividends, may signal underlying financial troubles or an inability to sustain payouts at previous levels. Such instability can make these stocks less attractive to investors seeking reliable income from their investments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.11% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.51% | ★★★★★★ |

| Globeride (TSE:7990) | 3.75% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.70% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.91% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

Vivant (PSE:VVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vivant Corporation operates in the Philippines, focusing on generating, distributing, and retailing electric power through its subsidiaries, with a market capitalization of approximately ₱16.38 billion.

Operations: The company's operations span power generation, distribution, and retail.

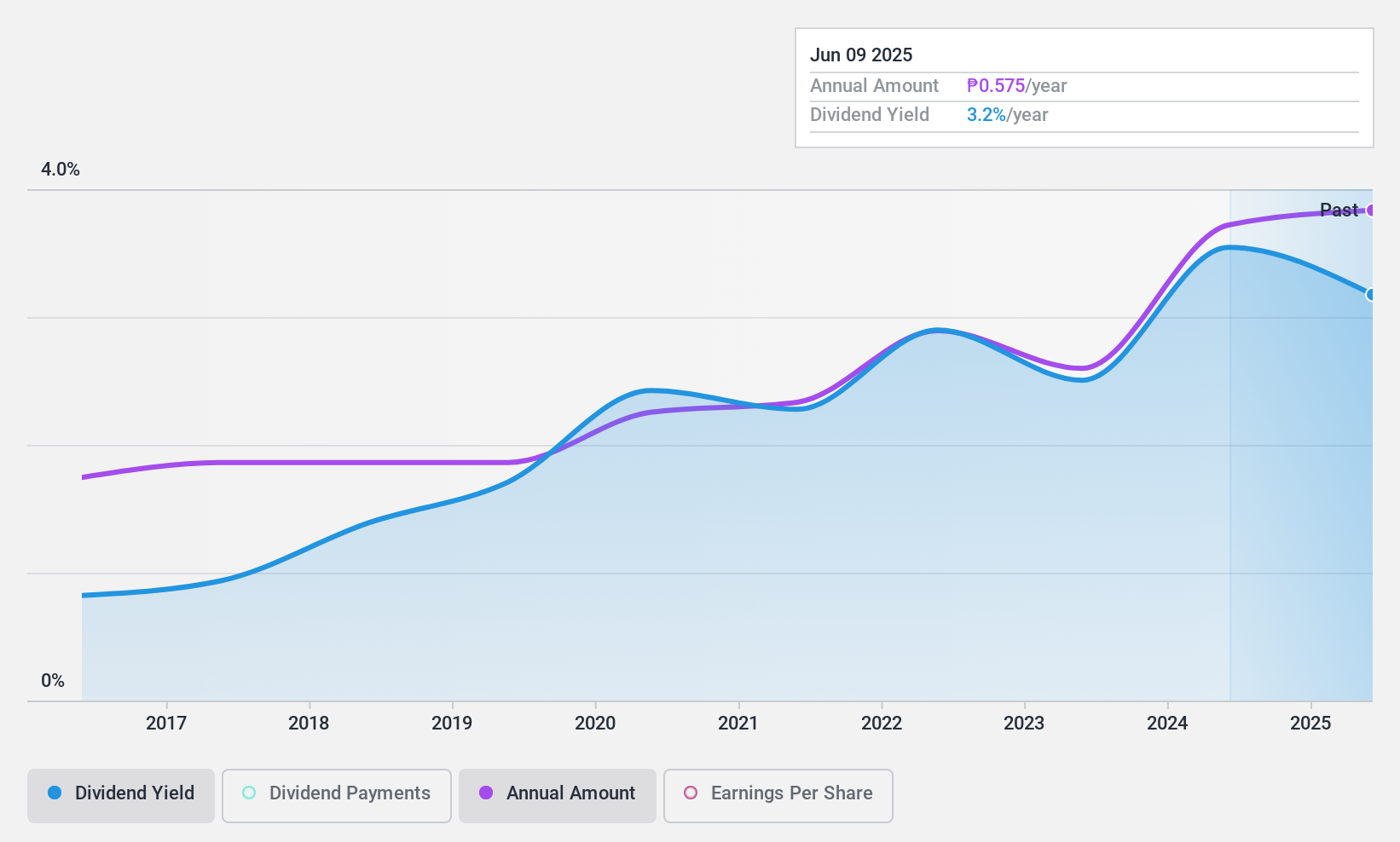

Dividend Yield: 3.5%

Vivant Corporation has consistently increased its dividend over the past decade, showcasing a stable and growing payout, with a recent declaration of PHP 0.558 per share. Despite this growth, the dividends are not well covered by cash flows, which could raise concerns about long-term sustainability. However, Vivant's low price-to-earnings ratio of 8.5x suggests it is undervalued compared to the market average of 9.1x in the Philippines, potentially offering an attractive entry point for value-focused dividend investors.

- Unlock comprehensive insights into our analysis of Vivant stock in this dividend report.

- Upon reviewing our latest valuation report, Vivant's share price might be too optimistic.

One To Reconsider

Tronox Holdings (NYSE:TROX)

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Tronox Holdings plc is a vertically integrated manufacturer of TiO2 pigment, operating across North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of approximately $2.48 billion.

Operations: The company's revenue from its Specialty Chemicals segment amounts to approximately $2.92 billion.

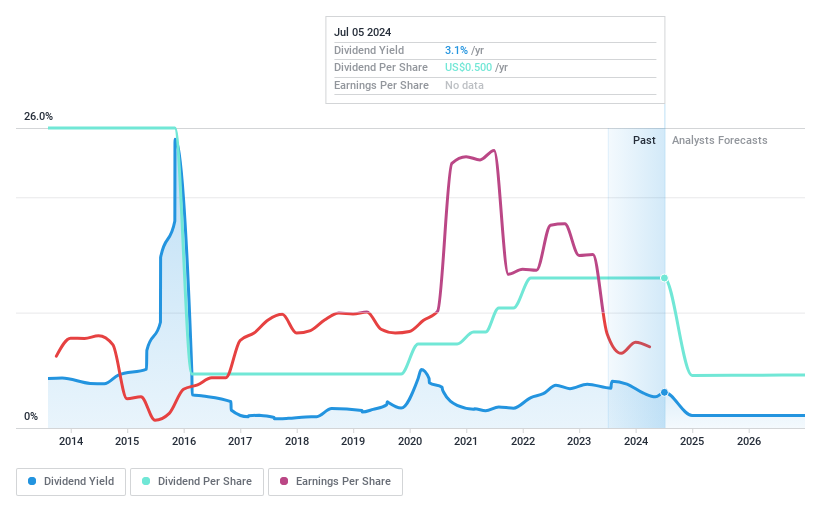

Dividend Yield: 3.2%

Tronox Holdings has demonstrated a lack of dividend reliability and stability, with significant reductions over the past decade. Its current dividend yield of 3.19% falls short compared to the top US market payers at 4.7%. Moreover, the dividends are not supported by earnings or free cash flow, indicating potential sustainability issues despite trading below its estimated fair value and a forecasted earnings growth of 83.58% annually. Recent corporate actions include board changes and a share repurchase program but these do not directly address the fundamental dividend concerns.

Summing It All Up

- Click here to access our complete index of 1959 Top Dividend Stocks.

- Are you invested in any of these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Tronox Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TROX

Tronox Holdings

Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with moderate growth potential.