- United States

- /

- Chemicals

- /

- NYSE:SXT

How Investors May Respond To Sensient Technologies (SXT) Beating Earnings and Reaffirming Guidance

Reviewed by Sasha Jovanovic

- Earlier this month, Sensient Technologies Corporation reported third-quarter earnings surpassing analyst expectations, highlighted by year-over-year improvements in both sales and net income, alongside a new share purchase by Vice President and Treasurer David J. Plautz.

- The company also reaffirmed its full-year earnings guidance and emphasized a focus on acquisitions rather than share buybacks, underlining ongoing management confidence in future growth potential.

- We’ll explore how solid quarterly results and insider buying impact Sensient’s investment narrative, especially as the company prioritizes acquisitions going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sensient Technologies Investment Narrative Recap

To be a shareholder in Sensient Technologies, you need confidence in the company’s ability to capitalize on accelerating global demand for natural food colors and ingredients, especially as regulatory changes push major customers toward cleaner labels. The recent third-quarter earnings beat and executive insider buying may bolster management credibility, but these developments do not materially change the primary near-term catalyst, the U.S. regulatory-driven shift to natural colors, or ease the ongoing risk of supply chain and agricultural constraints that could limit revenue growth if not carefully managed.

Among recent announcements, Sensient’s reaffirmation of its full-year earnings guidance stands out, signaling short-term financial stability while the company stays focused on acquisitions over share buybacks. This commitment to disciplined capital allocation remains central as Sensient prepares for large-scale industry shifts and the associated operational demands.

Yet, despite these encouraging signals, the company’s exposure to volatile agricultural yields remains a risk investors should not overlook...

Read the full narrative on Sensient Technologies (it's free!)

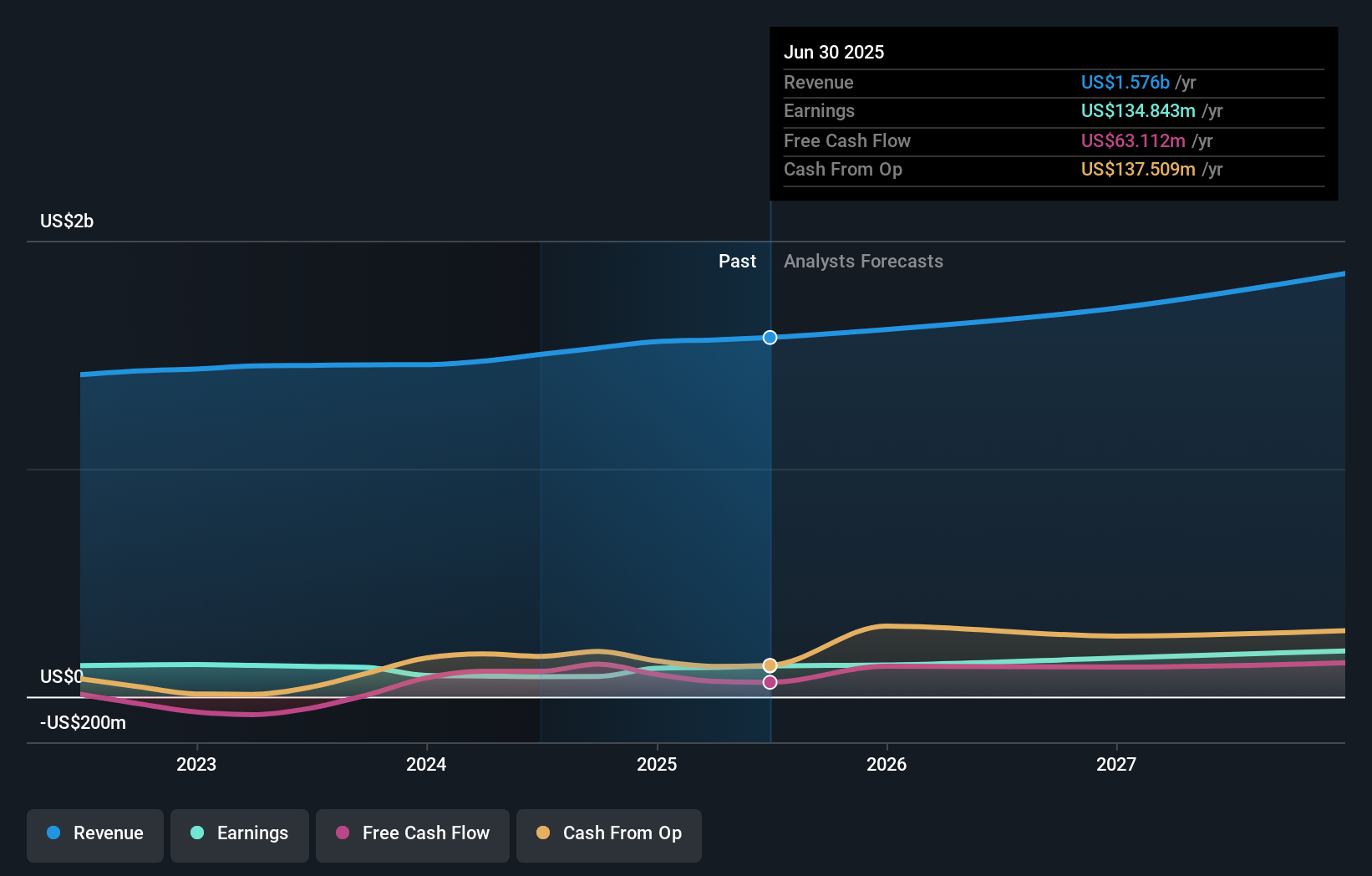

Sensient Technologies' outlook anticipates $1.9 billion in revenue and $216.5 million in earnings by 2028. Achieving this would require a 6.3% annual revenue growth rate and an $81.7 million increase in earnings from the current $134.8 million.

Uncover how Sensient Technologies' forecasts yield a $121.67 fair value, a 31% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided one fair value estimate, US$97.78 per share, reflecting a single viewpoint before recent earnings announcements. Analysts are tracking supply chain challenges as a key factor that could impact Sensient’s ability to meet rising demand for natural ingredients, underscoring why it helps to compare different expectations and seek out additional perspectives.

Explore another fair value estimate on Sensient Technologies - why the stock might be worth just $97.78!

Build Your Own Sensient Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensient Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sensient Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensient Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXT

Sensient Technologies

Manufactures and markets colors, flavors, and other specialty ingredients worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives