- United States

- /

- Packaging

- /

- NYSE:SW

Assessing Smurfit Westrock (NYSE:SW) Valuation After Mixed Q3 Results and Ongoing Margin Challenges

Reviewed by Simply Wall St

Smurfit Westrock (NYSE:SW) released its third-quarter results, with revenues slightly exceeding estimates and cash flow in line with projections. Adjusted earnings per share were lower, pointing to ongoing margin pressures and increased impairment charges.

See our latest analysis for Smurfit Westrock.

Even with a solid revenue beat and a new quarterly dividend just announced, Smurfit Westrock’s recent results have not eased investor concerns. Its share price has dropped 31% year-to-date, while the one-year total shareholder return stands at -26%. That said, over the past three years, the stock has still managed a total shareholder return of 22%, reflecting longer-term value for those able to stomach short-term volatility. Momentum is clearly on the back foot for now as the market weighs margin pressures against the company’s ongoing business optimizations.

If you’re looking to expand your watchlist beyond names facing near-term headwinds, this could be the perfect time to discover fast growing stocks with high insider ownership.

With shares trading at a substantial discount to analyst price targets and the company’s fundamentals sending mixed signals, investors are left to consider whether Smurfit Westrock is now a bargain opportunity or if the market is wisely pricing in uncertain growth ahead.

Most Popular Narrative: 34% Undervalued

Roughly 34% below the most popular narrative's fair value estimate, Smurfit Westrock’s current share price lags behind what analysts expect. The difference comes from a forecasting model that ties future earnings growth and margin expansion to a discounted valuation today.

Ongoing realization of at least $400 million in identified synergies, with management highlighting a similar or greater opportunity from further commercial and operational improvements, should result in sustained increases in margins and operating leverage, materially boosting future earnings.

Want to know the financial gears turning behind this discount? The key to the narrative lies buried in aggressive earnings expansion, margin transformation, and a future profit multiple that could flip industry expectations. What assumptions power this bold valuation? Take a closer look at the details that back up these forecasts.

Result: Fair Value of $55.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in core North American and European markets, or ongoing cost headwinds, could quickly undermine hopes for a smooth margin recovery.

Find out about the key risks to this Smurfit Westrock narrative.

Another View: What Do Market Ratios Suggest?

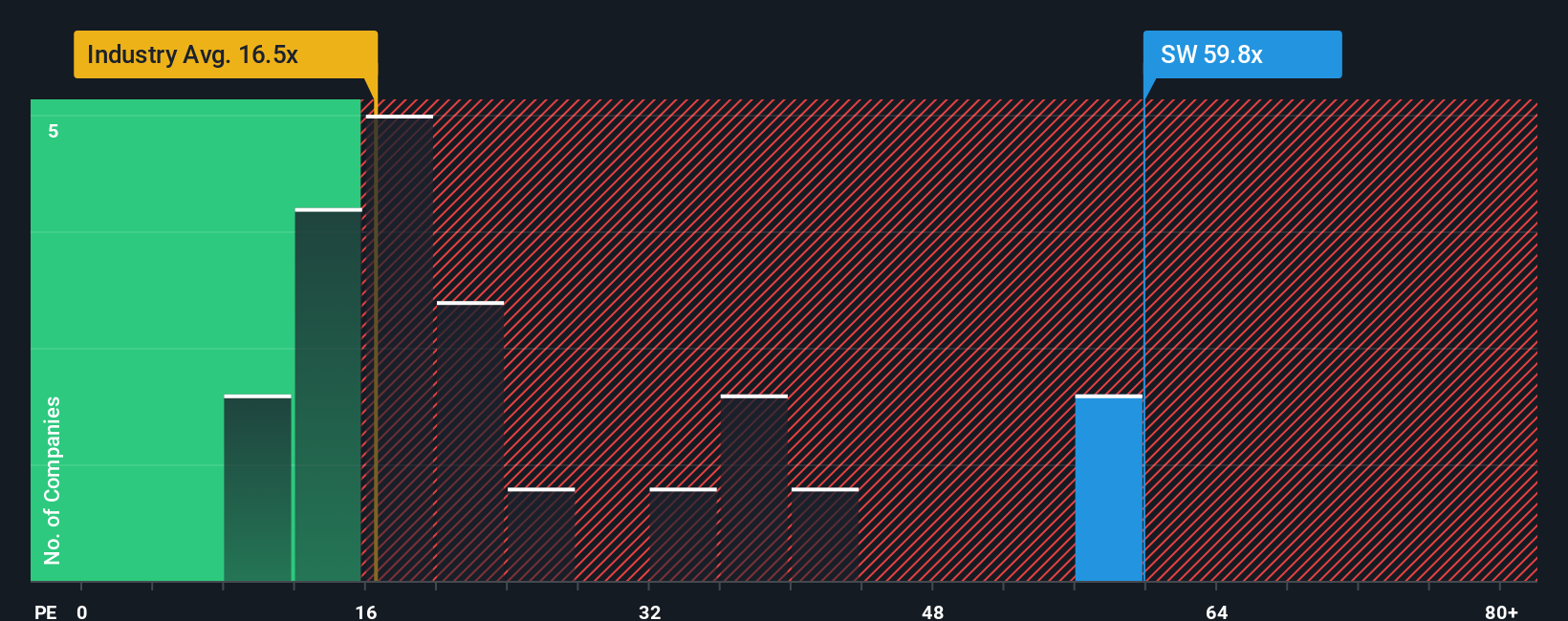

Looking at the price-to-earnings ratio for Smurfit Westrock, the stock trades at 25.7 times earnings. This is notably more expensive than both the global packaging industry average of 16.0x and the peer average of 22.8x, yet still below what our fair ratio analysis suggests as justified value at 30x. This gap highlights both risk if sentiment cools, there is room to fall, and potential upside if fundamentals catch up. Is the market too skeptical, or holding out for more evidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Smurfit Westrock Narrative

If you want a different perspective or trust your own research process, you can dive into the data and build your own narrative in just a few minutes. Do it your way

A great starting point for your Smurfit Westrock research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let the next big opportunity slip by, especially when breakthrough investments are right at your fingertips. Make a move now and be among the well-prepared.

- Seek reliable income by tapping into these 20 dividend stocks with yields > 3%, which is packed with companies offering attractive yields over 3% for your portfolio’s steady growth.

- Capture the next wave of tech innovation as you harness the potential of these 27 AI penny stocks, featuring pioneering businesses shaping tomorrow’s digital landscape.

- Supercharge your value hunt and uncover hidden bargains among these 844 undervalued stocks based on cash flows, with stocks trading below their intrinsic cash flow worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SW

Smurfit Westrock

Manufactures, distributes, and sells containerboard, corrugated containers, and other paper-based packaging products.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives