- United States

- /

- Chemicals

- /

- NYSE:SQM

Sociedad Química y Minera de Chile (NYSE:SQM): Evaluating Valuation After China Approves Codelco Lithium Joint Venture

Reviewed by Simply Wall St

China's market regulator has conditionally approved the lithium joint venture between Sociedad Química y Minera de Chile (NYSE:SQM) and Codelco, allowing this public-private initiative in the Atacama Salt Flat to advance. This move fits squarely within Chile's push for greater state involvement in lithium production and comes with commitments around supplying lithium to Chinese buyers.

See our latest analysis for Sociedad Química y Minera de Chile.

Momentum is definitely building for Sociedad Química y Minera de Chile, with the stock rallying 27.25% in the past month and a standout 43.91% share price return year-to-date. The recent jump followed news of the joint venture's approval. While enthusiasm has bolstered short-term returns, the 35.85% total shareholder return over the past year still comes after a much steeper three-year decline. Long-term investors have seen both rallies and setbacks, but the latest developments have reinvigorated hopes for growth as SQM navigates a changing global lithium landscape.

If this surge in lithium stocks piques your interest, you might want to check out the latest high-growth contenders. Discover fast growing stocks with high insider ownership.

With the stock surging on joint venture news and optimism building, the key question now becomes whether Sociedad Química y Minera de Chile is attractively valued or if the recent rally has already accounted for future growth expectations.

Most Popular Narrative: 30% Undervalued

With analysts setting a fair value at $52.03 and the last close at $51.88, the share price aligns closely with expectations. Yet the narrative points to significant potential upside based on forward earnings projections and market dynamics.

Expansion of lithium and specialty chemical production capacity positions the company for sustained revenue and margin growth, supported by strong demand and tight global supply. Operational efficiency, diverse product streams, and rising barriers to entry protect the company's competitive strength and earnings resilience against market volatility.

How has a company with exposure to market shocks won analyst confidence for future profits? The assumptions driving this valuation include bold growth in both earnings and margins. The real story behind the fair value hinges on whether SQM can deliver transformative financial results that the consensus expects. Ready to learn which levers could power the next run?

Result: Fair Value of $52.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty in Chile and volatile lithium prices could quickly shift sentiment and disrupt the positive valuation narrative for SQM.

Find out about the key risks to this Sociedad Química y Minera de Chile narrative.

Another View: Price Multiples Put a Premium on SQM

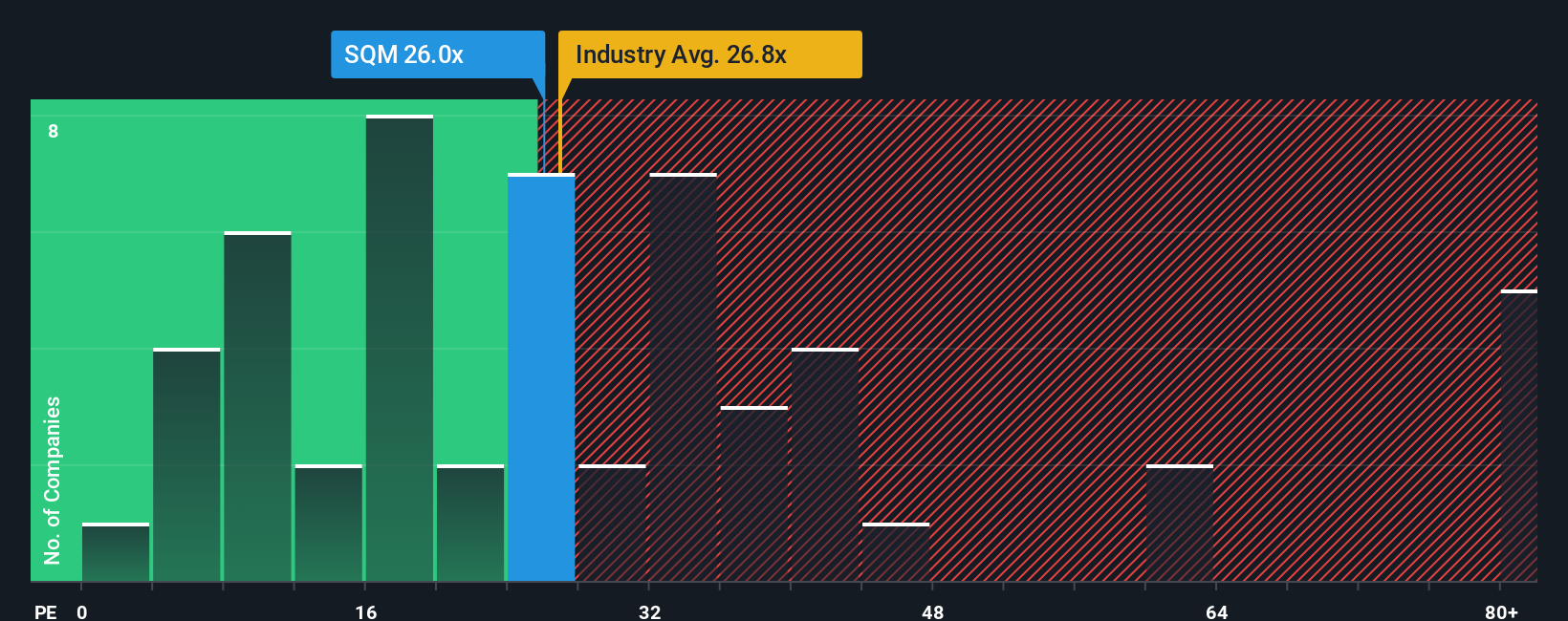

Looking through the lens of price-to-earnings, Sociedad Química y Minera de Chile trades at 31 times earnings. This is much higher than its industry peers at 23 times, and the peer group average of 17.6. The fair ratio, which the market may eventually revert to, stands at 28.1. This sizable gap suggests the stock is priced for exceptional results and leaves limited margin for error if growth expectations are missed. Could valuation concerns weigh on future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sociedad Química y Minera de Chile Narrative

If you see the numbers differently or want to dig deeper, you can shape your own perspective with just a few minutes of hands-on analysis. Do it your way.

A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart opportunities are waiting beyond SQM. Don't miss your chance to capture tomorrow's leaders before the crowd. Use the Simply Wall Street Screener to pinpoint stocks with unique growth stories now.

- Unlock steady income streams by targeting these 16 dividend stocks with yields > 3%, featuring top picks with yields above 3% and proven track records.

- Spot undiscovered potential and seize the edge before others by tracking these 874 undervalued stocks based on cash flows based on robust cash flow analysis.

- Find trailblazing pioneers in healthcare transformation by scouting these 32 healthcare AI stocks, where AI-driven innovation meets long-term medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQM

Sociedad Química y Minera de Chile

Operates as a mining company worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives