- United States

- /

- Chemicals

- /

- NYSE:SMG

Scotts Miracle-Gro (SMG) One-Off $136.1M Loss Reinforces Debate Over Quality of Recent Profitability

Reviewed by Simply Wall St

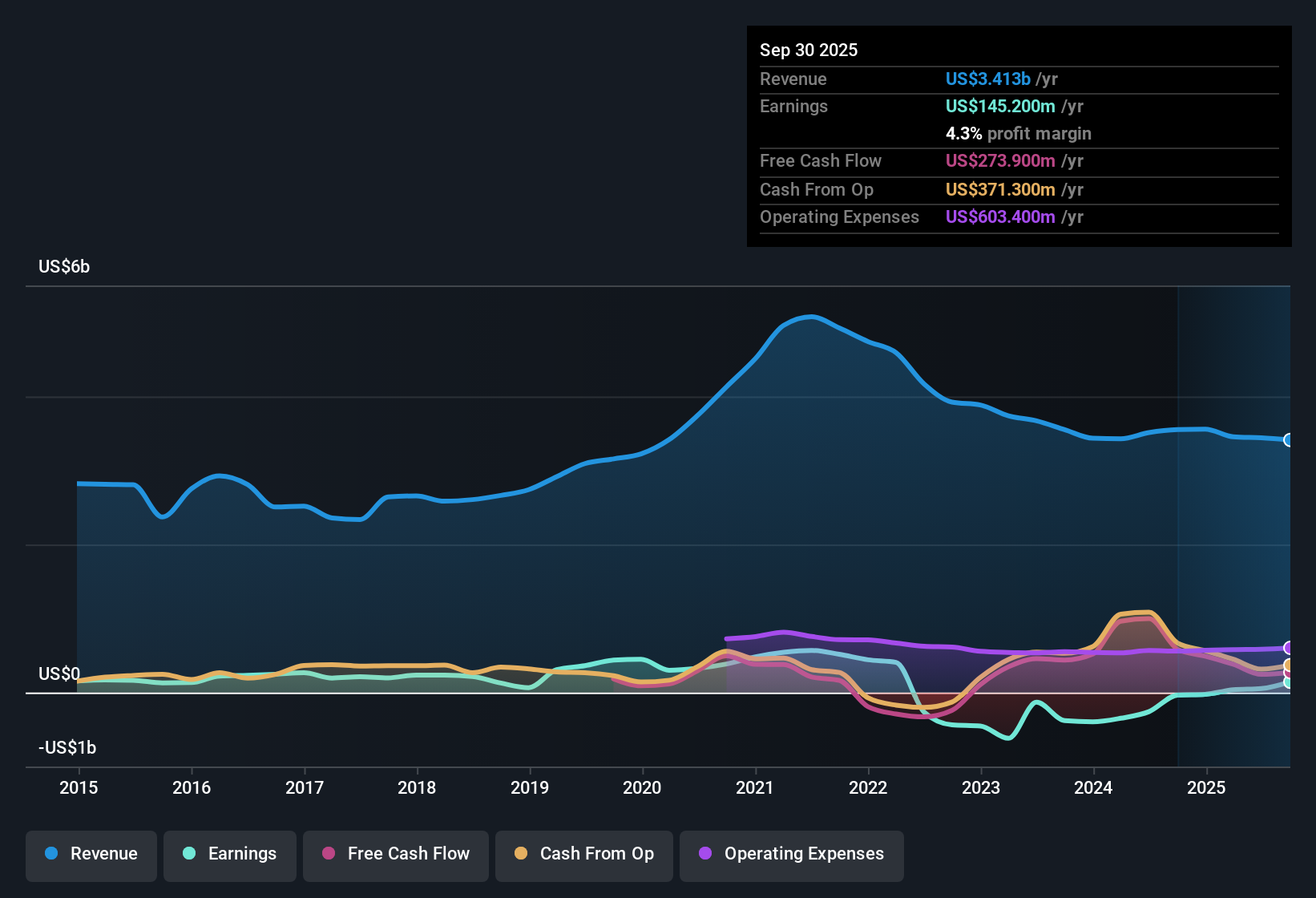

Scotts Miracle-Gro (SMG) reported earnings that finally swung into profitability over the last year, with EPS growth now forecast at 12.58% per year. Despite this turnaround, the company’s earnings have been on a tough path, declining at an average annual rate of 45.6% over the past five years. Recent results were impacted by a $136.1 million one-off loss. Revenue growth is expected to lag behind the broader market at 1.9% per year. Shares look expensive at a 60.9x price-to-earnings ratio compared to peers, but currently trade below analyst targets, sparking interest for value-focused investors with an eye on future performance.

See our full analysis for Scotts Miracle-Gro.Next, we’ll see how these headline results measure up against the most widely followed narratives and expectations for Scotts Miracle-Gro. Some stories may get reinforced, while others could face new scrutiny.

See what the community is saying about Scotts Miracle-Gro

Margins Poised for Recovery

- Analysts project profit margins will rise significantly from 1.5% today to 9.9% over the next three years, even as revenue is forecast to decrease by 0.8% annually in the same period.

- According to the analysts' consensus view, efficiency investments and process automation, expected to generate approximately $150 million in cost savings by fiscal 2027, are intended to directly boost gross margin to 35% or higher.

- This supports the notion that profitability improvements, not top-line gains, will be the main driver of better future results as commodity and input costs stabilize.

- Still, the consensus narrative notes ongoing pressure from climate variability and shifting retailer strategies could limit how much of these margin gains actually flow through to net earnings by 2028.

Consensus narrative highlights how bulls and bears will be watching closely to see if rising margins offset tepid sales and cost challenges. 📊 Read the full Scotts Miracle-Gro Consensus Narrative.

Transformation Hinges on Divestitures

- Scotts Miracle-Gro's planned sale of its Hawthorne unit (focused on hydroponics and cannabis-adjacent products) is expected to cut earnings volatility and lower company leverage, freeing up more resources for its core consumer business.

- Analysts' consensus view points out that this shift is intended to align the company with eco-friendly and higher-margin product lines, but warns that execution matters. If Hawthorne’s exit is delayed or if core lawn and garden demand weakens, the intended reduction in business risk and potential for sustainable growth could fall short.

- The consensus narrative also raises a caution that new investments in digital marketing and R&D, while critical for brand renewal, will require disciplined spending and clear returns as the company tries to capture more share among younger, eco-conscious consumers.

- Overall, the outcome is seen as a key test of the wider transformation thesis because it determines whether future growth will truly be less volatile than in Scotts’ earnings-challenged past.

Valuation Stretched vs. Fundamentals

- With shares trading at 60.9x earnings, far higher than both the peer average of 12.8x and the US chemicals industry average of 26.4x, Scotts Miracle-Gro is valued at a substantial premium, even though revenue growth lags the industry.

- Consensus narrative questions whether the current share price of $56.02, a 23.6% discount to the only allowed analyst price target of $73.29, truly offers attractive upside given the company’s modest sales forecasts, historical earnings declines, and considerable execution risks.

- The combination of high valuation multiples and ambitious profitability targets forces investors to closely evaluate whether forecasted margin recovery is likely, or if price targets may need to be revised downward if trends disappoint.

- In contrast, the market may reward even small beats if execution on project savings and portfolio moves comes through sooner than the consensus expects.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Scotts Miracle-Gro on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the data that stands out to you? Take just a few moments to shape your own narrative and see where your analysis leads. Do it your way

A great starting point for your Scotts Miracle-Gro research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Scotts Miracle-Gro faces significant valuation headwinds, with a high price-to-earnings ratio and uncertain margin recovery. These factors raise doubts about its upside potential.

If you want more compelling value for your money, check out these 836 undervalued stocks based on cash flows that are priced more attractively and may offer stronger returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMG

Scotts Miracle-Gro

Engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives