- United States

- /

- Packaging

- /

- NYSE:SLGN

Why Silgan Holdings (SLGN) Trades Lower After Cutting Full-Year Outlook Despite Strong Q3 Results

Reviewed by Sasha Jovanovic

- Silgan Holdings Inc. recently reported third quarter 2025 earnings, posting US$2.01 billion in sales and US$113.3 million in net income, both up from the prior year.

- Despite recent operational gains, such as the successful integration of an acquisition and strong sales in dispensing products, management lowered its full-year 2025 outlook, citing expectations of lower volumes, higher taxes, and increased interest expenses.

- We'll examine how the reduced full-year outlook for 2025 impacts Silgan Holdings' long-term investment narrative and risk profile.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Silgan Holdings Investment Narrative Recap

At its core, investing in Silgan Holdings is about believing in consistent, underlying demand for consumer packaging, with long-term growth driven by product diversification and recurring revenue from food, personal care, and pet segments. The most recent quarterly update confirms solid results, yet the downward revision to full-year guidance is now the central short-term catalyst, specifically, how effectively Silgan can navigate softer volumes and higher costs. This lowered outlook is likely material to near-term sentiment and risk assessment.

Among recent company announcements, the successful integration of the Weener acquisition stands out as especially relevant. This move not only expands Silgan's high-value dispensing business, but also provides some offset to headwinds, such as weakened food can volumes and customer-specific challenges, demonstrating the company’s intent to adapt to changing market demands.

However, in contrast to steady earnings, investors should be mindful of the impact that higher taxes and interest expenses could have on future cash flows and...

Read the full narrative on Silgan Holdings (it's free!)

Silgan Holdings' outlook anticipates $6.8 billion in revenue and $448.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 3.1% and represents a $146.6 million increase in earnings from the current level of $302.0 million.

Uncover how Silgan Holdings' forecasts yield a $56.70 fair value, a 46% upside to its current price.

Exploring Other Perspectives

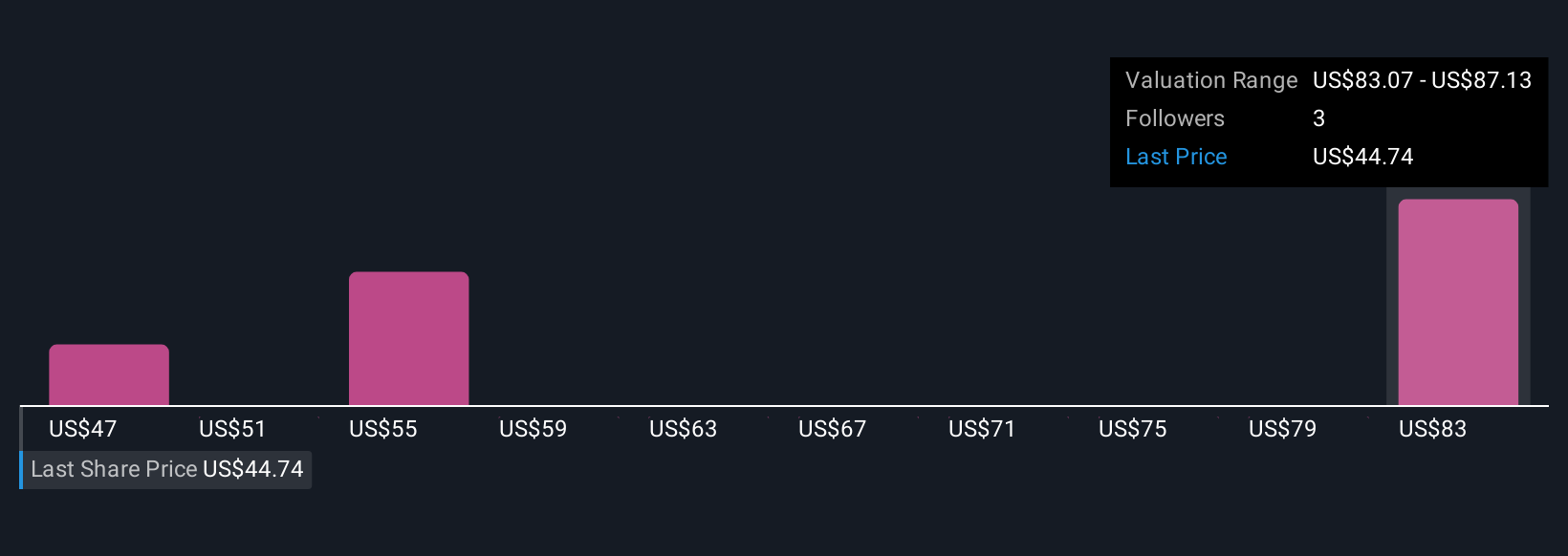

Three members of the Simply Wall St Community estimate Silgan’s fair value between US$46.51 and US$83.85 per share. Against this wide range, the recent guidance cut highlights that profit growth may now be harder to achieve, see how others are interpreting the path forward for Silgan.

Explore 3 other fair value estimates on Silgan Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Silgan Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silgan Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Silgan Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silgan Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLGN

Silgan Holdings

Manufactures and sells rigid packaging solutions for consumer goods products in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives